HAND Enterprise Solutions' (SZSE:300170) earnings growth rate lags the 167% return delivered to shareholders

The HAND Enterprise Solutions Co., Ltd. (SZSE:300170) share price has had a bad week, falling 10%. Despite this, the stock is a strong performer over the last year, no doubt about that. We're very pleased to report the share price shot up 167% in that time. So it is important to view the recent reduction in price through that lense. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Although HAND Enterprise Solutions has shed CN¥2.1b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for HAND Enterprise Solutions

While HAND Enterprise Solutions made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

HAND Enterprise Solutions grew its revenue by 1.7% last year. That's not a very high growth rate considering it doesn't make profits. In contrast, the share price took off during the year, gaining 167%. The business will need a lot more growth to justify that increase. We're not so sure that revenue growth is driving the market optimism about the stock.

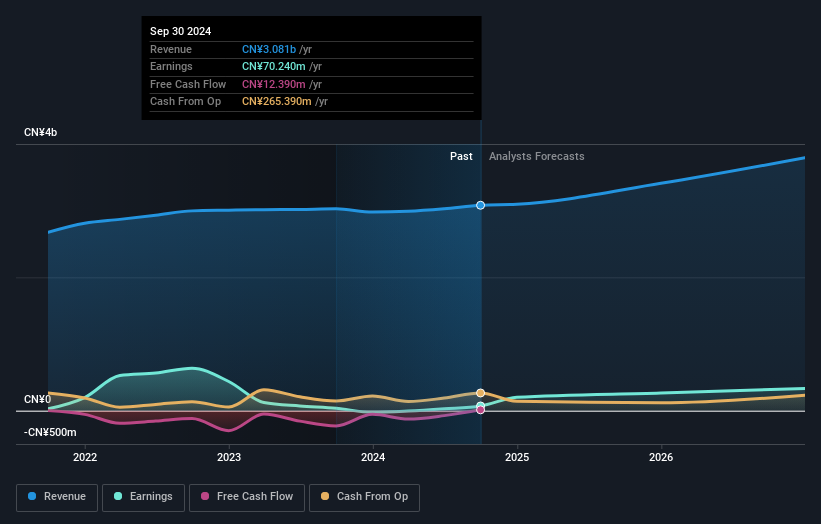

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for HAND Enterprise Solutions in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that HAND Enterprise Solutions shareholders have received a total shareholder return of 167% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with HAND Enterprise Solutions (including 1 which shouldn't be ignored) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HAND Enterprise Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300170

HAND Enterprise Solutions

Provides ERP implementation consulting services in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives