Some Hengxin Shambala Culture Co.,Ltd. (SZSE:300081) Shareholders Look For Exit As Shares Take 27% Pounding

To the annoyance of some shareholders, Hengxin Shambala Culture Co.,Ltd. (SZSE:300081) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

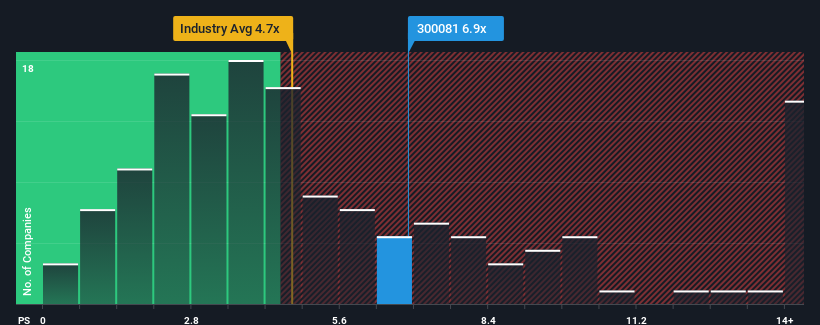

Even after such a large drop in price, Hengxin Shambala CultureLtd's price-to-sales (or "P/S") ratio of 6.9x might still make it look like a sell right now compared to the wider Software industry in China, where around half of the companies have P/S ratios below 4.7x and even P/S below 2x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Hengxin Shambala CultureLtd

How Hengxin Shambala CultureLtd Has Been Performing

For instance, Hengxin Shambala CultureLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hengxin Shambala CultureLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Hengxin Shambala CultureLtd?

Hengxin Shambala CultureLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 30% shows it's noticeably less attractive.

With this information, we find it concerning that Hengxin Shambala CultureLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Hengxin Shambala CultureLtd's P/S remain high even after its stock plunged. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Hengxin Shambala CultureLtd revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hengxin Shambala CultureLtd that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hengxin Shambala CultureLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300081

Hengxin Shambala CultureLtd

Engages in digital cultural creativity and content production services.

Adequate balance sheet with minimal risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026