High Growth Tech Stocks And 2 More Global Picks With Promising Potential

Reviewed by Simply Wall St

The global markets have recently experienced a mix of economic signals, with U.S. consumer confidence seeing its largest drop since 2021 amid persistent inflation and policy uncertainties impacting growth stocks, particularly in the tech sector. As these dynamics unfold, investors are increasingly focused on identifying high-growth opportunities that can navigate such volatility effectively; characteristics of a promising stock often include robust innovation potential and adaptability to regulatory challenges, which are crucial in today's rapidly evolving market landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 23.58% | 40.13% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

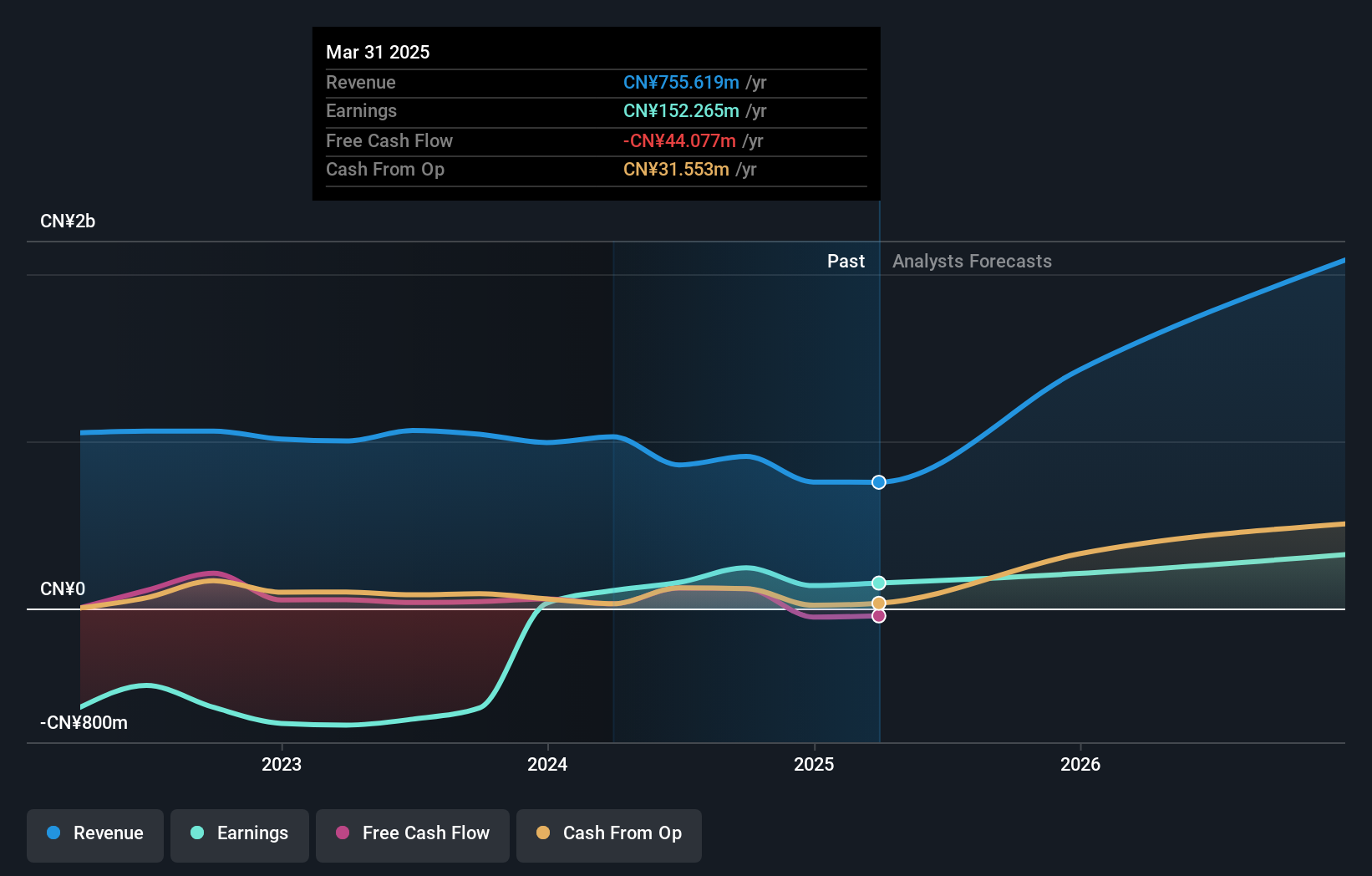

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology INC. is a company engaged in providing education and technology services, with a market cap of CN¥17.05 billion.

Operations: The company generates revenue primarily from its Information Technology Service segment, which accounts for CN¥910.10 million.

Doushen (Beijing) Education & Technology has demonstrated robust growth metrics that are particularly noteworthy in the fast-evolving tech sector. With an annual revenue increase of 38.4%, the company outpaces the average market growth rate in China, which stands at 13.3%. This significant revenue surge is complemented by an earnings expansion of approximately 23.8% per year, although slightly below the broader Chinese market's growth rate of 25.5%. The firm has transitioned to profitability this year, a testament to its effective strategy and operational efficiency. Moreover, Doushen's commitment to innovation is evident from its substantial investment in research and development, crucial for sustaining long-term competitiveness in technology-driven markets.

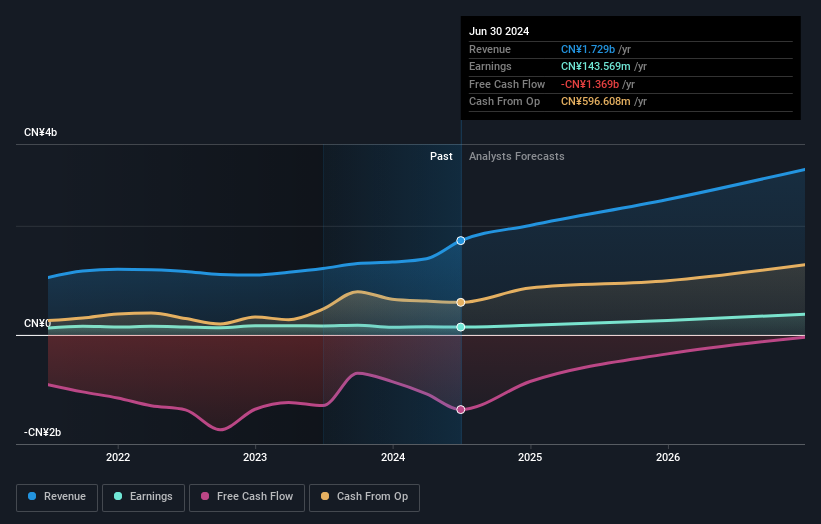

Guangdong Aofei Data Technology (SZSE:300738)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Aofei Data Technology Co., Ltd. operates in the technology sector with a focus on data services and has a market capitalization of CN¥24.42 billion.

Operations: The company generates revenue primarily through its data services operations within the technology sector. With a market capitalization of CN¥24.42 billion, it is positioned as a significant player in this industry.

Guangdong Aofei Data Technology, amidst a strategic expansion, recently announced a significant private placement aimed at bolstering its capital structure. This move underscores its aggressive growth trajectory, with revenue forecasted to climb by 23.3% annually, outpacing the broader Chinese market's 13.3% growth rate. Despite facing challenges such as a recent dip in profit margins to 6.6% from last year’s 13.5%, the company is poised for substantial earnings growth at an annual rate of 47%, well above the market average of 25.5%. This financial vigor is coupled with an innovative edge, as evidenced by their latest shareholders meeting focusing on audit enhancements and financial strategies for subsidiary support, positioning Aofei not just as a player but as a future leader in tech advancements.

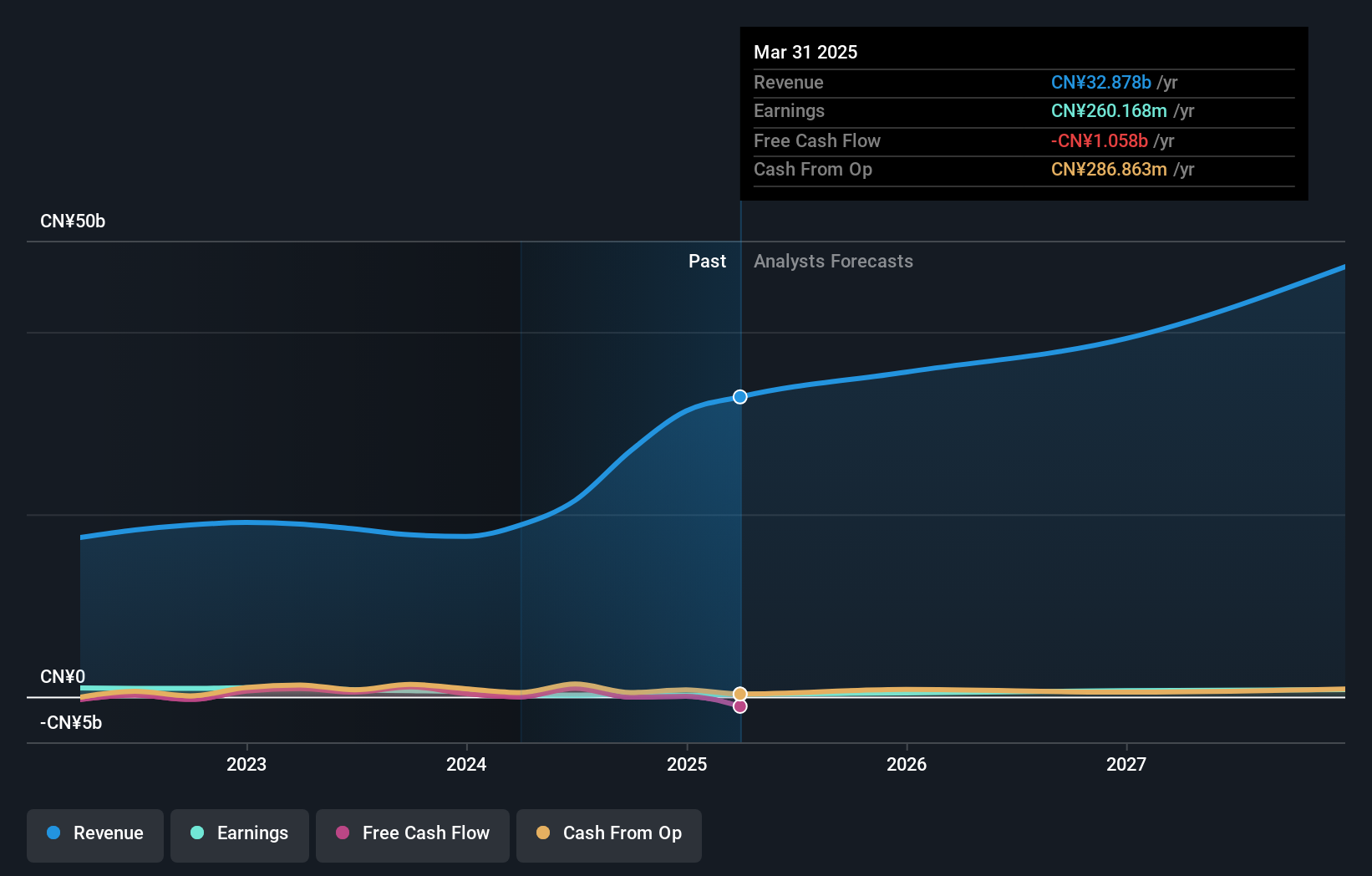

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a company with a market cap of CN¥64.02 billion, specializing in providing IT services and solutions across various industries.

Operations: iSoftStone generates revenue through its IT services and solutions, catering to diverse industries. The company focuses on leveraging technology to meet client needs, contributing significantly to its financial performance.

iSoftStone Information Technology (Group) is charting a robust path in the tech sector, evidenced by its impressive annual revenue growth of 15.5% and earnings surge at 28.3% per year. These figures notably outstrip the broader market's performance, showcasing its competitive edge. The company's commitment to innovation is further highlighted by its R&D spending, which constitutes a significant portion of its revenue, aligning with industry trends towards enhanced digital solutions and services. This strategic focus not only fuels current growth but also positions iSoftStone as a forward-thinking entity in technology advancements, ready to capitalize on future market opportunities while navigating the challenges inherent in tech evolution.

- Click here and access our complete health analysis report to understand the dynamics of iSoftStone Information Technology (Group).

Learn about iSoftStone Information Technology (Group)'s historical performance.

Make It Happen

- Gain an insight into the universe of 802 Global High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300738

Guangdong Aofei Data Technology

Guangdong Aofei Data Technology Co., Ltd.

High growth potential slight.