Investors five-year losses continue as Venustech Group (SZSE:002439) dips a further 3.6% this week, earnings continue to decline

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example, after five long years the Venustech Group Inc. (SZSE:002439) share price is a whole 63% lower. That is extremely sub-optimal, to say the least. And we doubt long term believers are the only worried holders, since the stock price has declined 54% over the last twelve months. Furthermore, it's down 31% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 12% in the same period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Venustech Group

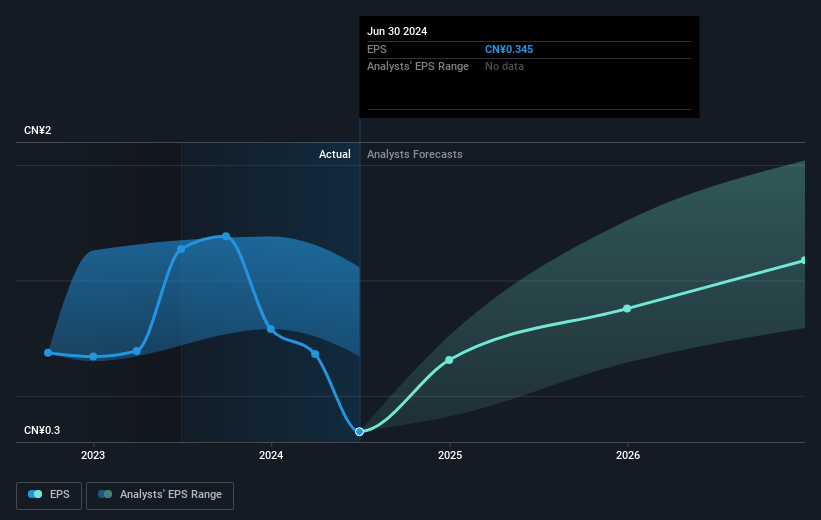

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Venustech Group's share price and EPS declined; the latter at a rate of 13% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 18% per year, over the period. This implies that the market is more cautious about the business these days.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Venustech Group's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Venustech Group shareholders are down 53% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 19%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Venustech Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Venustech Group , and understanding them should be part of your investment process.

We will like Venustech Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002439

Venustech Group

Provides network security products, trusted security management platforms, and specialized security services and solutions worldwide.

Flawless balance sheet and good value.