Optimistic Investors Push YGSOFT Inc. (SZSE:002063) Shares Up 41% But Growth Is Lacking

YGSOFT Inc. (SZSE:002063) shares have had a really impressive month, gaining 41% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 3.7% isn't as attractive.

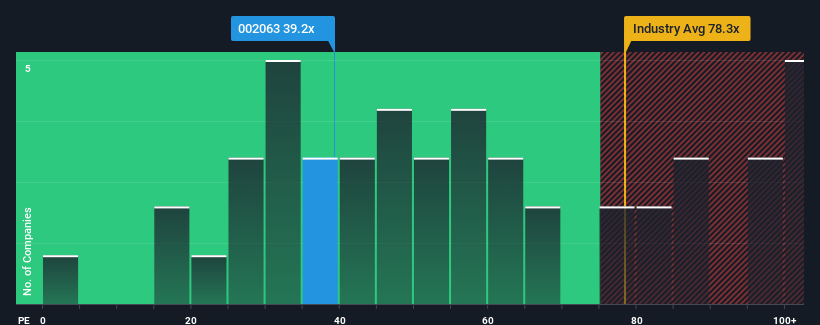

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 33x, you may consider YGSOFT as a stock to potentially avoid with its 39.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With earnings that are retreating more than the market's of late, YGSOFT has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for YGSOFT

Does Growth Match The High P/E?

YGSOFT's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 5.0%. Regardless, EPS has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 20% during the coming year according to the lone analyst following the company. That's shaping up to be materially lower than the 37% growth forecast for the broader market.

With this information, we find it concerning that YGSOFT is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From YGSOFT's P/E?

The large bounce in YGSOFT's shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that YGSOFT currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for YGSOFT with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than YGSOFT. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002063

YGSOFT

Provides enterprise management, energy interconnection, and social service information technology products and services to the energy and power industry in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives