As global markets navigate through a period of economic uncertainty, with U.S. consumer confidence experiencing its steepest decline since 2021 and growth stocks underperforming amid regulatory concerns, Asia's tech sector remains a focal point for investors seeking high-growth opportunities. In this environment, identifying strong tech stocks in Asia involves looking for companies that demonstrate resilience to external pressures such as tariff impacts and inflationary challenges while maintaining robust innovation and market adaptability.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Zhongji Innolight | 29.00% | 29.86% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.12% | 34.05% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Hugel (KOSDAQ:A145020)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hugel, Inc. is a company that develops and manufactures biopharmaceuticals both in South Korea and internationally, with a market capitalization of ₩3.49 trillion.

Operations: Hugel, Inc. generates revenue primarily from its pharmaceuticals segment, with reported sales of ₩363.79 billion. The company focuses on the development and manufacturing of biopharmaceutical products for both domestic and international markets.

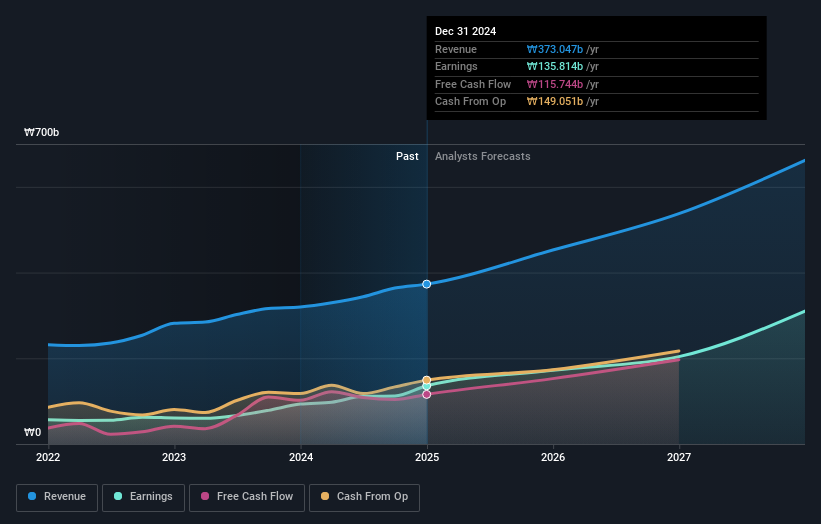

Hugel, a standout in the Asian biotech sector, demonstrates robust growth dynamics with its earnings expanding by 42.7% over the past year, outpacing the industry's 22.3%. This surge is supported by a significant commitment to R&D and strategic shareholder initiatives like the recent KRW 70 billion share repurchase program aimed at boosting stock price stability and shareholder value. With expected revenue growth of 17.8% annually—surpassing Korea's market average of 9.2%—and forecasted annual earnings increase of around 25.7%, Hugel is navigating its competitive landscape effectively, though it lags behind the high-growth benchmark of over 20% per year for tech sectors globally.

- Take a closer look at Hugel's potential here in our health report.

Explore historical data to track Hugel's performance over time in our Past section.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a company focused on the development and commercialization of innovative biopharmaceutical products, with a market cap of CN¥21.72 billion.

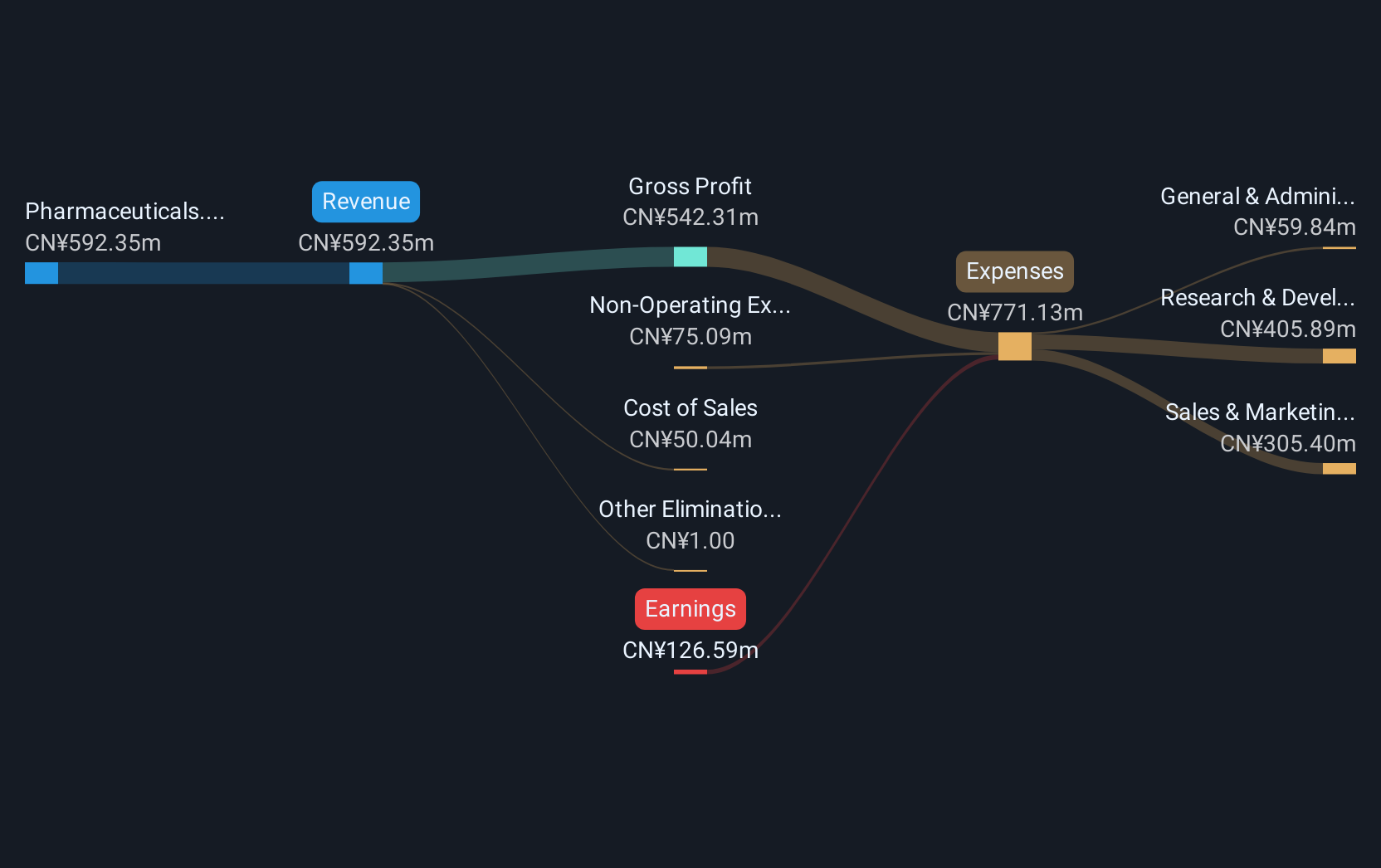

Operations: Zelgen Biopharmaceuticals specializes in the development and commercialization of biopharmaceutical products, leveraging its innovative capabilities to drive growth. The company operates within the pharmaceutical industry, focusing on advancing its product pipeline to enhance revenue streams.

Suzhou Zelgen Biopharmaceuticals has shown remarkable resilience and growth, with its annual revenue surging by 57.5%, significantly outstripping the broader Chinese market's growth of 13.3%. This performance is underpinned by a strategic focus on R&D, where the firm invested heavily, aligning with its vision to lead in innovation within biotech. The recent financial results highlight a reduction in net loss to CNY 136.22 million from CNY 278.58 million year-over-year, reflecting improved operational efficiency and market penetration despite ongoing challenges in profitability. With earnings projected to grow by an impressive 134.6% annually, Suzhou Zelgen stands poised for potential future profitability, marking it as a notable contender in Asia's high-growth tech landscape.

Shenzhen Intellifusion Technologies (SHSE:688343)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Intellifusion Technologies Co., Ltd. focuses on developing and providing artificial intelligence solutions, with a market cap of CN¥25.79 billion.

Operations: Intellifusion generates revenue primarily through its artificial intelligence solutions, leveraging advanced technology to cater to various industries. The company emphasizes innovation in AI applications, contributing significantly to its financial performance.

Shenzhen Intellifusion Technologies, amidst a challenging financial landscape, has demonstrated robust revenue growth of 81.7% year-over-year, reaching CNY 917.99 million in 2024 from CNY 506.01 million the previous year. This surge is notably aligned with its strategic emphasis on innovative technologies in the AI sector, despite a shift from net income to a loss over the same period. The company's commitment to R&D is evident as it adapts to market demands and technological advancements while maintaining an aggressive stance on share repurchases with a total expenditure of CNY 39.45 million for buying back shares. With forecasts indicating potential profitability and an annual earnings growth rate of 105%, Shenzhen Intellifusion is poised for significant transformations within Asia's tech industry.

Turning Ideas Into Actions

- Take a closer look at our Asian High Growth Tech and AI Stocks list of 530 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688343

Shenzhen Intellifusion Technologies

Shenzhen Intellifusion Technologies Co., Ltd.

Excellent balance sheet with concerning outlook.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)