- China

- /

- Electronic Equipment and Components

- /

- SZSE:301106

Top High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets experience shifts with U.S. labor data influencing interest rate expectations and China's economic indicators pointing to a slowdown, the Asian tech sector remains a focal point for investors seeking growth opportunities amid broader market uncertainties. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to changing economic landscapes, which can potentially position them well in the evolving market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Giant Network Group | 31.77% | 35.00% | ★★★★★★ |

| Fositek | 33.62% | 43.81% | ★★★★★★ |

| Zhongji Innolight | 27.14% | 28.75% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.00% | 27.48% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Beijing LongRuan Technologies (SHSE:688078)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing LongRuan Technologies Inc. specializes in offering software solutions and IT services utilizing geographic information systems for the coal industry, with a market capitalization of CN¥2.27 billion.

Operations: LongRuan Technologies focuses on delivering GIS-based software and IT services tailored for the coal sector. The company leverages its expertise in geographic information systems to cater specifically to the needs of this industry, contributing to its market presence valued at CN¥2.27 billion.

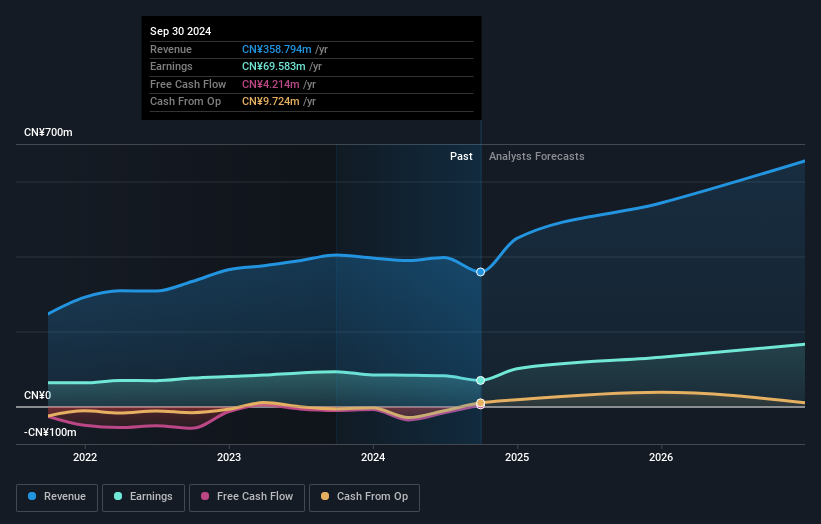

Despite a challenging year with a one-off loss of CN¥5.7M, Beijing LongRuan Technologies has demonstrated resilience with an impressive annual revenue growth rate of 51.7%, significantly outpacing the Chinese market average of 13.7%. This growth is mirrored in their earnings projections, expected to surge by 97.1% annually over the next three years, starkly contrasting with the broader market's 26.2%. However, it's crucial to note that their profit margins have dipped sharply from last year’s 20.6% to just 0.9%, reflecting some underlying challenges despite top-line growth and aggressive R&D spending aimed at innovation and maintaining competitive advantage in high-tech sectors.

- Click here to discover the nuances of Beijing LongRuan Technologies with our detailed analytical health report.

Understand Beijing LongRuan Technologies' track record by examining our Past report.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. and its subsidiaries focus on manufacturing and selling liquid crystal displays and display modules both domestically in China and internationally, with a market capitalization of CN¥3.07 billion.

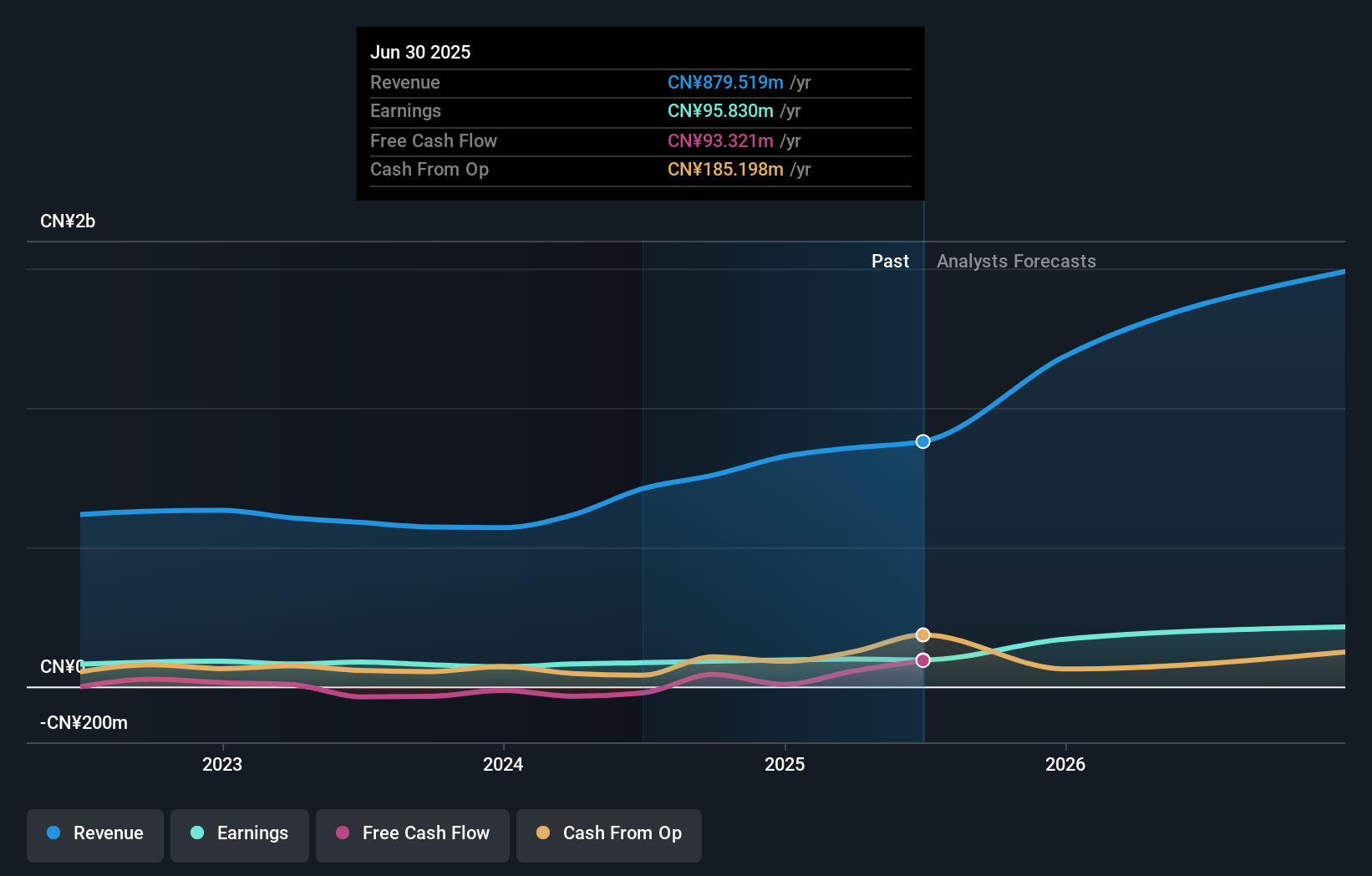

Operations: Smartwin generates revenue primarily from its electronic components and parts segment, with reported sales of CN¥879.52 million. The company operates in both domestic and international markets, focusing on liquid crystal displays and display modules.

Jiangsu Smartwin Electronics Technology Co., Ltd. has demonstrated robust financial performance, with half-year revenues climbing to CN¥461.48 million from CN¥407.04 million in the prior year, reflecting a growth of 13.3%. This growth is complemented by a slight increase in net income to CN¥54.17 million. The company's commitment to innovation is evident from its recent corporate actions aimed at refining governance structures, which could enhance operational efficiencies and market responsiveness. These strategic moves, coupled with consistent earnings growth, position Jiangsu Smartwin favorably within the competitive electronics sector in Asia.

oRo (TSE:3983)

Simply Wall St Growth Rating: ★★★★★☆

Overview: oRo Co., Ltd. is a company specializing in cloud and digital transformation solutions in Japan, with a market capitalization of ¥43.60 billion.

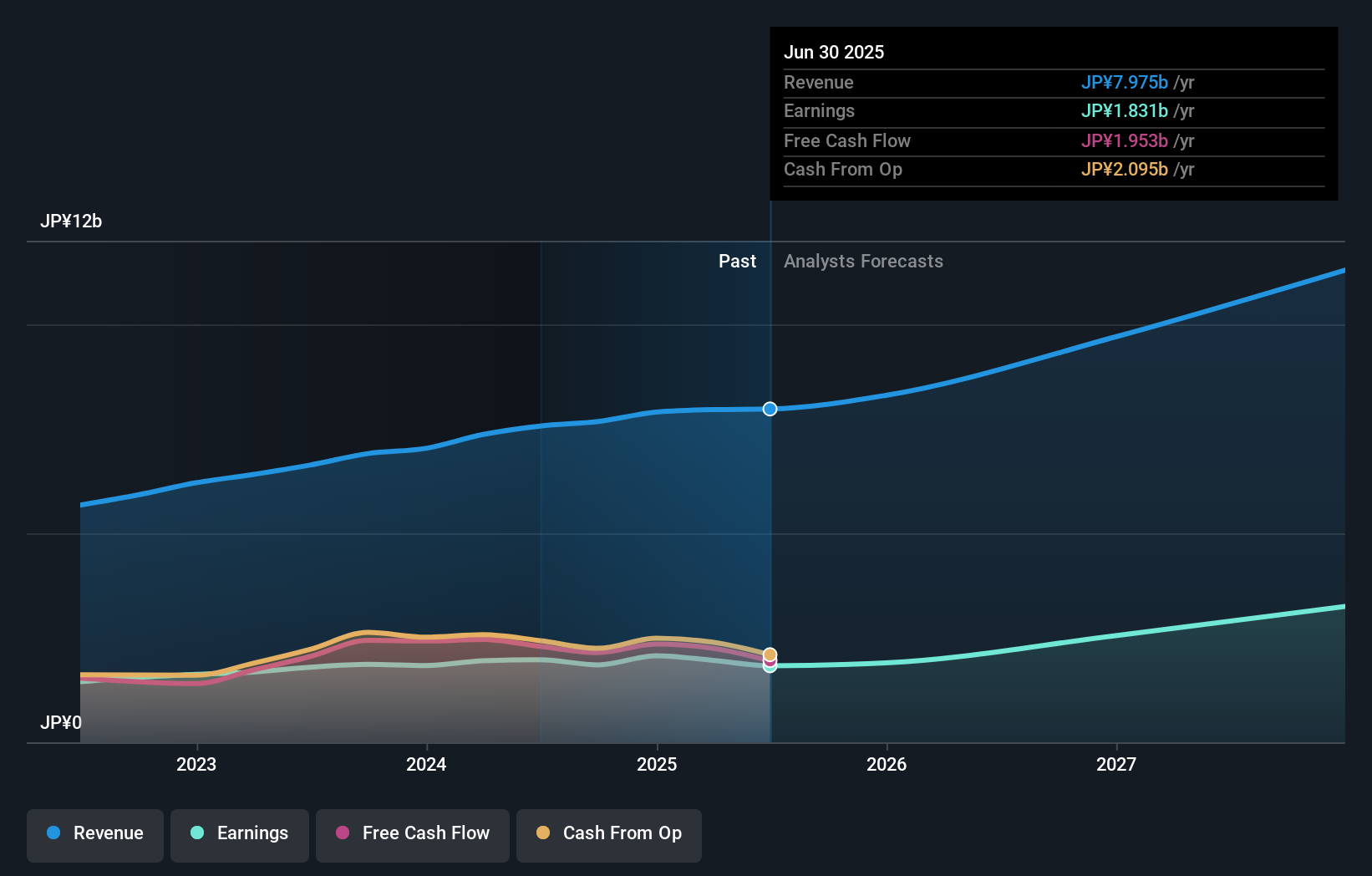

Operations: The company generates revenue primarily from its Cloud Solution Business, which contributes ¥5.29 billion, and Marketing Solutions, contributing ¥2.68 billion.

oRo Co., Ltd. is navigating the competitive tech landscape with notable strategic maneuvers and robust financial growth. In the recent quarter, the company's revenue surged by 20.1% annually, outpacing the Japanese market average of 4.3%. This growth is underpinned by a significant annual earnings increase projected at 26.3%, well above Japan's market forecast of 8.3%. The firm has also actively engaged in shareholder-friendly activities, repurchasing shares worth ¥349.56 million, enhancing shareholder value. These financial dynamics are complemented by oRo’s aggressive investment in R&D, ensuring sustained innovation and competitiveness in its sector.

- Get an in-depth perspective on oRo's performance by reading our health report here.

Review our historical performance report to gain insights into oRo's's past performance.

Next Steps

- Click through to start exploring the rest of the 182 Asian High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301106

Jiangsu Smartwin Electronics TechnologyLtd

Manufactures and sells liquid crystal display and display modules in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026