High Growth Tech Stocks Including Hacksaw With Potential For Expansion

Reviewed by Simply Wall St

In recent weeks, global markets have shown resilience with U.S. small-cap stocks outpacing their larger counterparts, as evidenced by the Russell 2000 Index's notable gain of 5.52% amid optimism around potential Federal Reserve rate cuts and a rebound in technology stocks. This environment highlights the importance of identifying high-growth tech companies that are well-positioned to capitalize on market opportunities, such as Hacksaw and others with robust expansion potential in an evolving economic landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 38.67% | 52.08% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Hacksaw (OM:HACK)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hacksaw AB (publ) is a B2B technology platform and game development company operating in Sweden and the Czech Republic, with a market capitalization of SEK18.35 billion.

Operations: The company generates revenue primarily from providing online casino solutions and related services to gaming operators, amounting to €186.11 million.

Hacksaw's strategic expansion into new markets, including its recent foray into the Czech Republic and the U.S., underscores its aggressive growth trajectory in the online casino sector. With a notable 32.9% annual revenue increase and a 37.5% surge in earnings, Hacksaw is outpacing industry averages significantly. The company's commitment to innovation is evident from its R&D investments, aligning with recent product launches that enhance user engagement through unique gaming experiences. These strategic moves, coupled with robust financial performance, position Hacksaw favorably within the high-growth tech landscape as it continues to expand its digital footprint globally.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Apex Software Co., LTD operates as a platform-based digital service provider company in China with a market capitalization of CN¥7.44 billion.

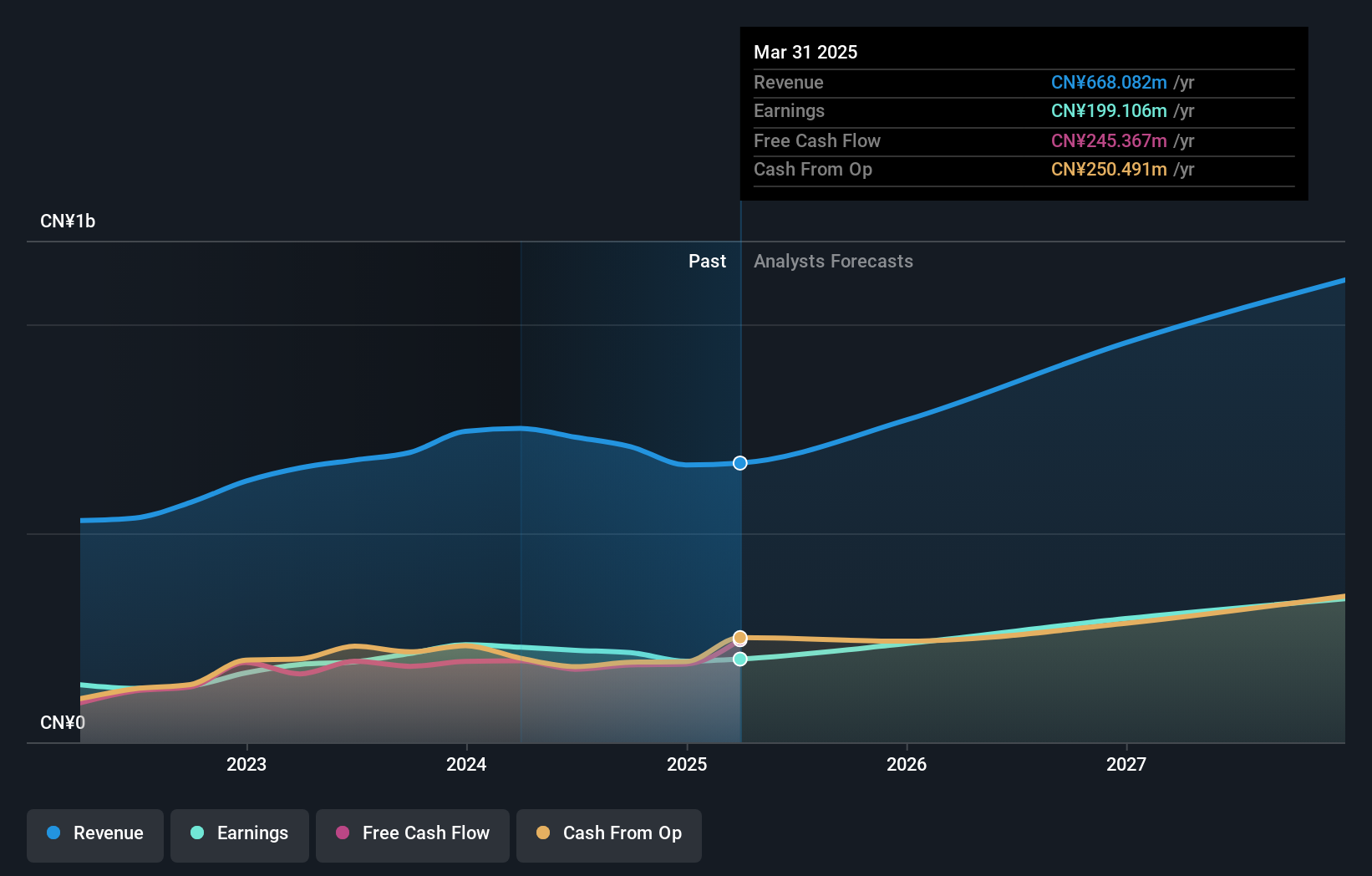

Operations: Apex Software generates revenue primarily from its Application Software Service Industry segment, amounting to CN¥627.85 million.

Fujian Apex Software Co., LTD's recent financial performance showcases a robust trajectory, with revenue growth of 23.6% annually and earnings increasing by 23.1% per year, outstripping the Chinese market average growth rates of 14.6% and 27.5%, respectively. Despite a slight dip in sales from CNY 420.63 million to CNY 384.76 million over the last nine months, net income rose to CNY 103.28 million, indicating efficient operational adjustments and cost management strategies that bolster profitability. The company's commitment to innovation is underscored by its R&D expenses which are critical in sustaining its competitive edge within the fast-evolving tech landscape, ensuring it remains at the forefront of technological advancements while continuing to expand its market presence effectively.

- Click to explore a detailed breakdown of our findings in Fujian Apex SoftwareLTD's health report.

Understand Fujian Apex SoftwareLTD's track record by examining our Past report.

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

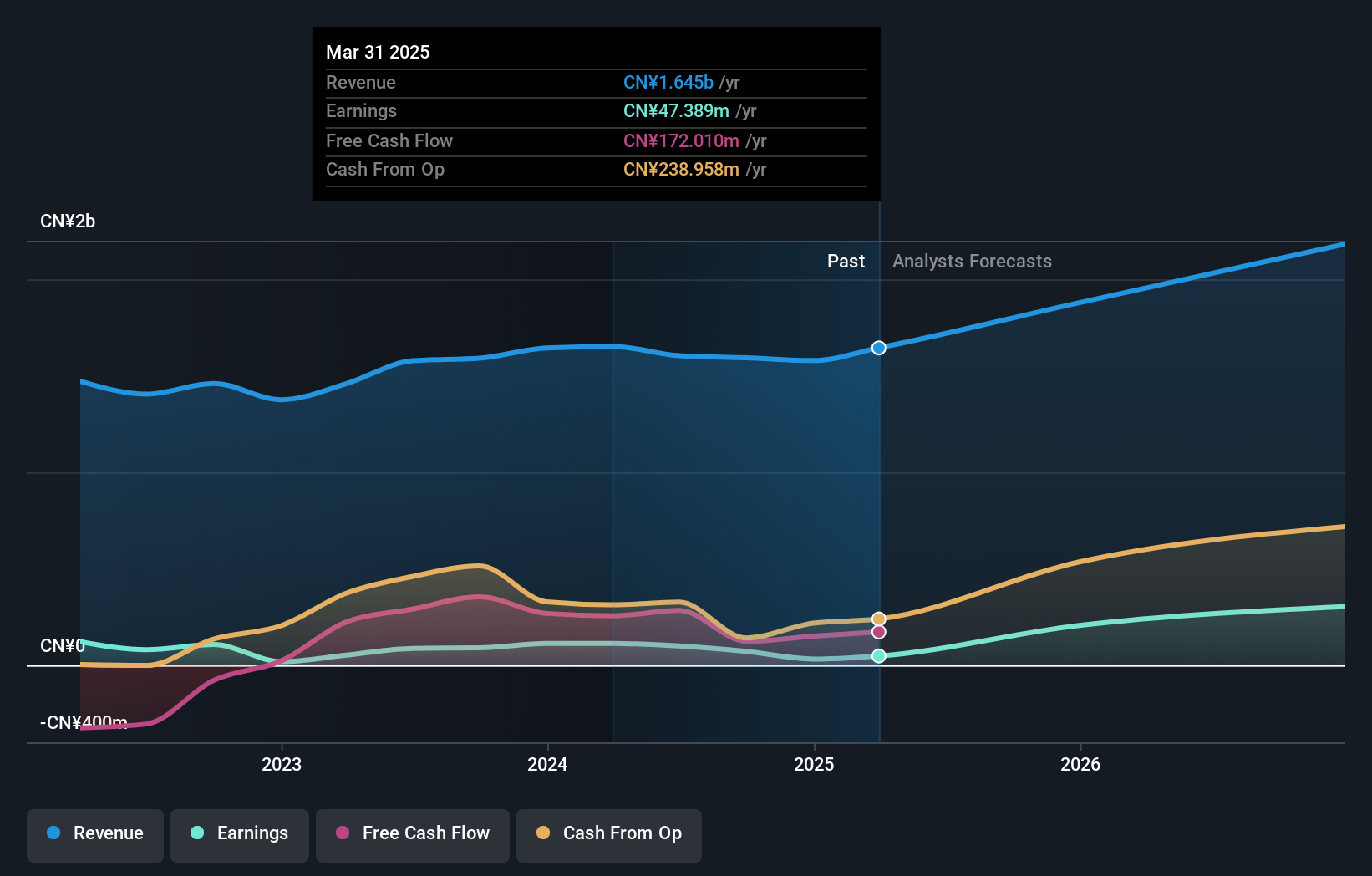

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. specializes in providing intelligent parking solutions and related technologies, with a market cap of CN¥6.04 billion.

Operations: The company generates revenue primarily through the sale of intelligent parking solutions and associated technologies. It operates within a market cap of CN¥6.04 billion, focusing on innovative systems that enhance parking efficiency and management.

Shenzhen Jieshun Science and Technology Industry Co., Ltd. has demonstrated notable growth with a revenue increase of 18.7% annually, outpacing the broader Chinese market's expansion rate of 14.6%. This growth is complemented by an impressive surge in earnings, forecasted to grow at 51.5% per year, which significantly exceeds the market average of 27.5%. The company's strategic emphasis on research and development is evident from its substantial investment in this area, ensuring it remains competitive in the fast-evolving tech landscape. Recent adjustments to its business scope and enhancements to corporate governance also suggest a proactive approach to scaling operations and improving oversight, positioning it well for sustained future growth despite some industry challenges such as fluctuating earnings in the past year.

Taking Advantage

- Discover the full array of 245 Global High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603383

Fujian Apex SoftwareLTD

Operates as a platform-based digital service provider company in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026