Amid a backdrop of mixed global economic signals, Asian markets have shown resilience, particularly in the technology sector, which continues to capture investor interest despite broader market uncertainties. As we explore high-growth tech stocks in Asia with promising potential, it's crucial to consider companies that demonstrate strong innovation and adaptability to shifting market dynamics and consumer demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ASROCK Incorporation | 28.31% | 29.76% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.73% | 30.71% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Apex Software Co., LTD is a platform-based digital service provider in China with a market capitalization of CN¥8.80 billion.

Operations: Apex Software focuses on providing application software services, generating revenue of CN¥642.46 million from this segment. The company's market capitalization stands at CN¥8.80 billion, reflecting its significant presence in the digital service industry within China.

Fujian Apex SoftwareLTD's commitment to innovation is evident from its R&D spending, which has significantly impacted its product development and market position. With an annualized revenue growth of 21.2%, the company outpaces the Chinese market average of 14.1%. Despite a challenging year with earnings declining by 10%, projections are optimistic with expected earnings growth at a robust rate of 21.17% annually. The recent financials reveal resilience, as evidenced in their latest semi-annual report showing an increase in net income to CNY 52.88 million from CNY 48.78 million year-over-year, underscoring a potential turnaround and reinforcing their capacity for sustained growth amidst evolving tech landscapes.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company focused on designing, developing, and producing mask products in China with a market cap of CN¥9.42 billion.

Operations: Newway Photomask generates revenue primarily from its electronic components and parts segment, amounting to CN¥1.02 billion. The company operates within the lithography sector, emphasizing mask product innovation and production in China.

Shenzhen Newway Photomask Making has demonstrated robust growth with a notable 28.8% increase in annual revenue and a 33.9% rise in earnings, outpacing the broader Chinese electronics sector's average. This performance is anchored by significant R&D investments that fuel innovation, crucial for maintaining its competitive edge in the photomask market—a key component in semiconductor manufacturing. Recent results underscore this trajectory, with half-year revenues jumping to CNY 544.03 million from CNY 395.72 million and net income rising to CNY 106.43 million from CNY 82.42 million previously, reflecting strong operational execution and market demand. These financials, coupled with a promising outlook for continued earnings growth at an annual rate of approximately 33.94%, suggest Shenzhen Newway is well-positioned to capitalize on expanding tech demands in Asia.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

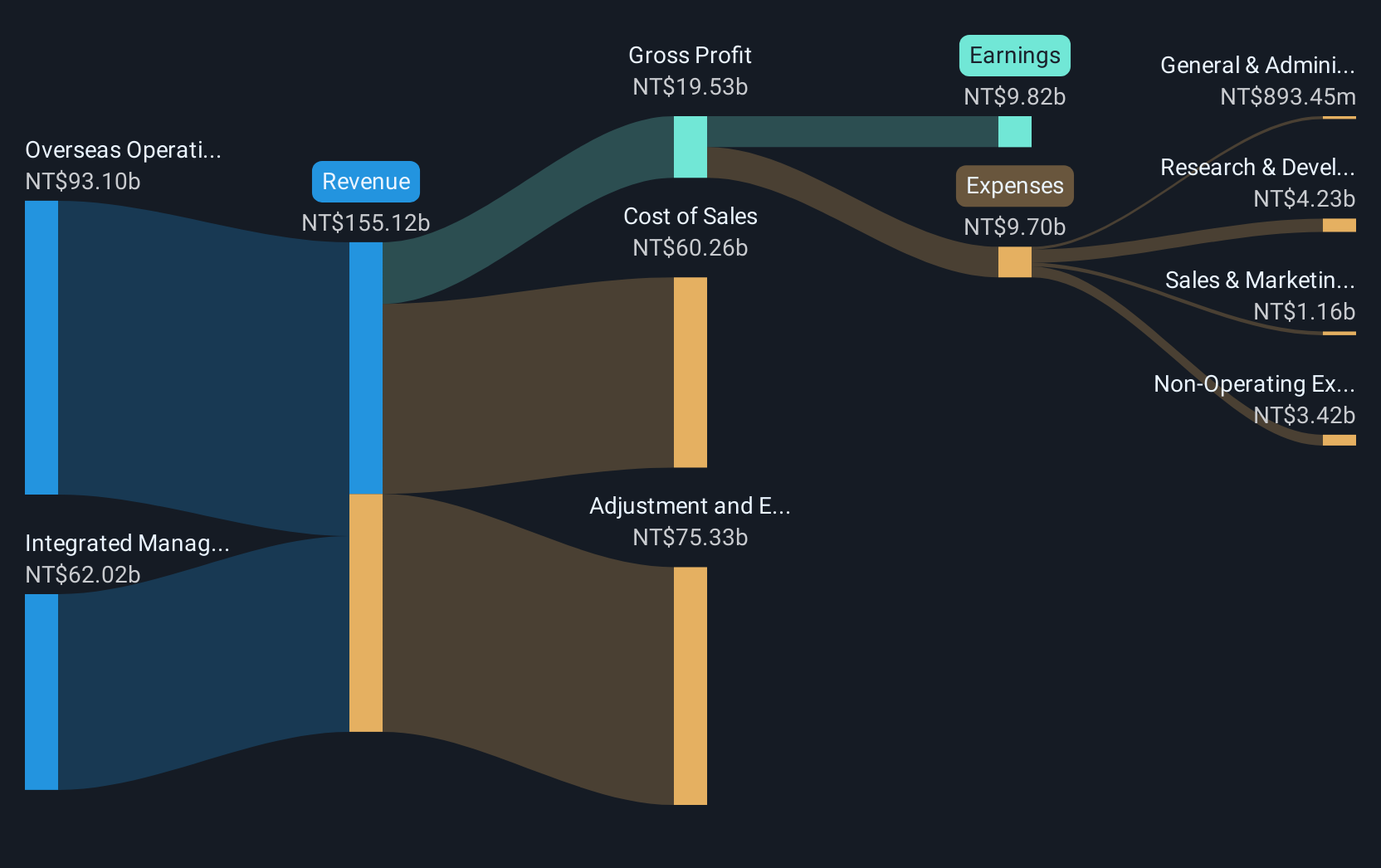

Overview: Asia Vital Components Co., Ltd. and its subsidiaries specialize in providing thermal solutions globally, with a market capitalization of approximately NT$452.21 billion.

Operations: The company's revenue is primarily driven by its Overseas Operating Department, which generated NT$106.77 billion, followed by the Integrated Management Division with NT$74.12 billion.

Asia Vital Components has showcased a remarkable financial trajectory, with its recent earnings report highlighting a surge in sales to TWD 29.59 billion, up from TWD 16.48 billion year-over-year, and net income more than doubling to TWD 3.99 billion. This robust performance is underpinned by strategic R&D investments, which are pivotal as the company strengthens its foothold in high-tech markets across Asia. Notably active at industry conferences, such as the UBS Taiwan Summit and JP Morgan Asia Tech Tour, AVC is positioning itself prominently within tech circles, signaling ongoing expansion and innovation efforts that align with its impressive 25% annual revenue growth forecast and an anticipated earnings growth of 27.3% per year—outstripping broader market expectations.

- Click here to discover the nuances of Asia Vital Components with our detailed analytical health report.

Gain insights into Asia Vital Components' past trends and performance with our Past report.

Taking Advantage

- Reveal the 185 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603383

Fujian Apex SoftwareLTD

Operates as a platform-based digital service provider company in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026