As global markets grapple with economic uncertainties and regulatory challenges, the Asian tech sector remains a focal point for investors seeking growth opportunities. In this environment, identifying high-growth tech stocks involves considering companies that demonstrate resilience and adaptability to evolving market conditions and geopolitical shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 35.12% | 34.05% | ★★★★★★ |

| Zhongji Innolight | 29.20% | 29.62% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Fositek | 40.35% | 52.92% | ★★★★★★ |

| Arizon RFID Technology (Cayman) | 27.55% | 28.53% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Shanghai Baosight SoftwareLtd (SHSE:600845)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China and has a market capitalization of CN¥84.74 billion.

Operations: Baosight Software focuses on providing industrial solutions in China, with a significant market presence. The company generates revenue through its software and service offerings tailored to the industrial sector.

Shanghai Baosight Software Co., Ltd, recently added to the SSE 180 Index, showcases robust financial health with a revenue growth forecast at 21.8% per year, outpacing the CN market average of 13.3%. Despite earnings projected to grow at 24.7% annually—slightly below the national rate of 25.4%—the company's earnings quality remains high and its Return on Equity is expected to reach an impressive 25.6% in three years. This performance is bolstered by significant R&D investments that fuel innovation and maintain competitive advantage in a rapidly evolving tech landscape.

Beijing Shiji Information Technology (SZSE:002153)

Simply Wall St Growth Rating: ★★★★☆☆

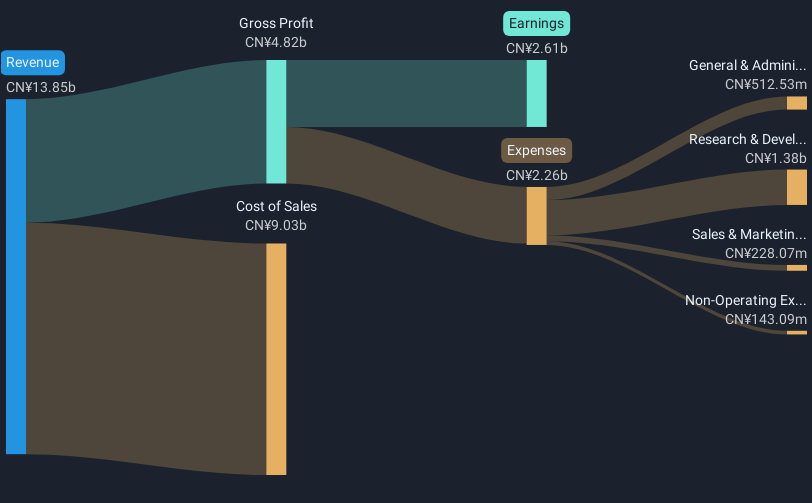

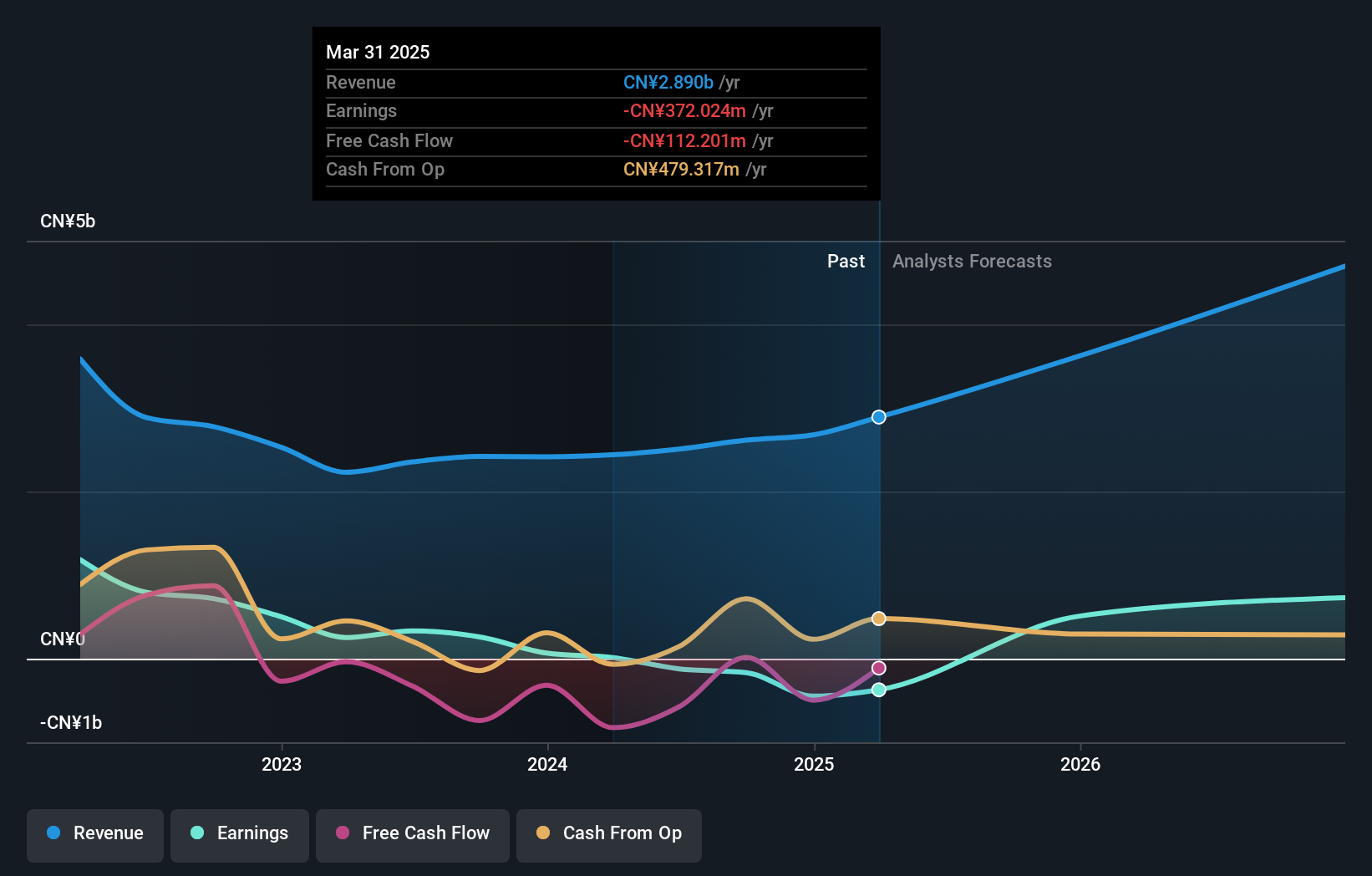

Overview: Beijing Shiji Information Technology Co., Ltd. operates as a provider of technology solutions for the hospitality, retail, and entertainment industries with a market cap of CN¥23.80 billion.

Operations: Shiji focuses on delivering technology solutions tailored for the hospitality, retail, and entertainment sectors. The company generates revenue primarily through its software and hardware offerings designed to enhance operational efficiency in these industries.

Beijing Shiji Information Technology, amid a tech landscape where software firms increasingly pivot to SaaS models, is riding the wave of high annualized revenue growth at 17%. This growth is complemented by an even more impressive earnings surge, forecasted at 113.4% annually. Investing heavily in R&D, the company allocates significant resources to stay ahead in innovation—evidence of its commitment to maintaining a competitive edge in a rapidly evolving market. These strategic moves could position Beijing Shiji well for future technological advancements and market demands.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

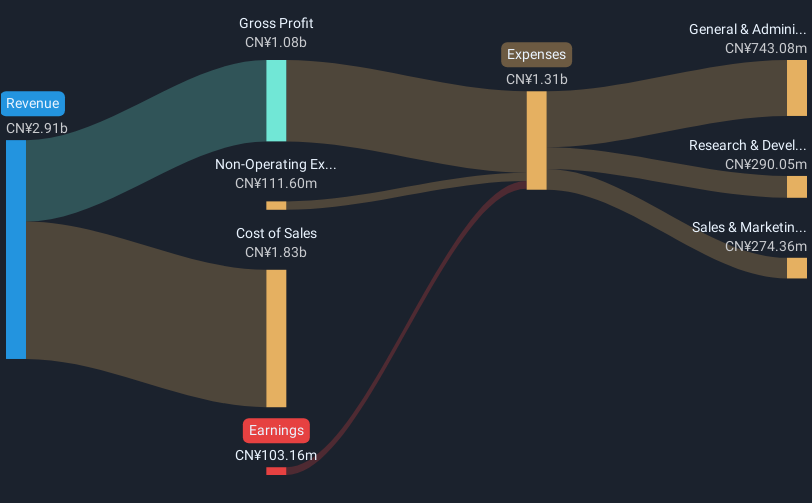

Overview: Wuhan Guide Infrared Co., Ltd. focuses on the research, development, production, and sale of infrared thermal imaging technology in Asia, with a market cap of CN¥36.05 billion.

Operations: The company specializes in infrared thermal imaging technology, generating revenue primarily through the sale of its products across Asia. It operates with a market cap of CN¥36.05 billion, indicating significant scale in its sector.

Wuhan Guide Infrared exemplifies the dynamic nature of Asia's high-growth tech sector with its robust annual revenue increase at 26.3% and an even more striking projected earnings growth of 79.1%. Positioned in a competitive market, the company is channeling substantial funds into R&D, reflecting a strategic emphasis on innovation to harness future opportunities. Despite current unprofitability, its financial trajectory suggests potential for profitability within three years, underpinned by a revenue growth forecast that surpasses the Chinese market average of 13.3%. This blend of aggressive growth targets and strategic reinvestment in technological advancements could well set Wuhan Guide Infrared on a path to becoming a significant player in its industry.

Key Takeaways

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 517 more companies for you to explore.Click here to unveil our expertly curated list of 520 Asian High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Beijing Shiji Information Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Shiji Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002153

Beijing Shiji Information Technology

Beijing Shiji Information Technology Co., Ltd.

Excellent balance sheet with reasonable growth potential.