Inspur Software Co., Ltd.'s (SHSE:600756) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

Inspur Software Co., Ltd. (SHSE:600756) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 66% in the last year.

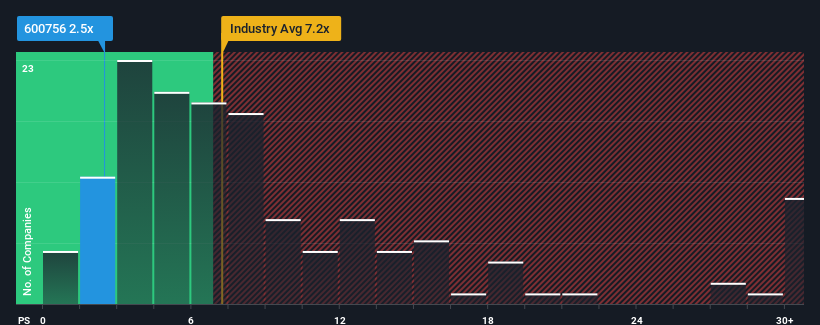

Even after such a large jump in price, Inspur Software may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.5x, considering almost half of all companies in the Software industry in China have P/S ratios greater than 7.2x and even P/S higher than 14x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Inspur Software

How Has Inspur Software Performed Recently?

We'd have to say that with no tangible growth over the last year, Inspur Software's revenue has been unimpressive. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Inspur Software's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Inspur Software would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 52% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that to the industry, which is predicted to deliver 28% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Inspur Software's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From Inspur Software's P/S?

Inspur Software's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

In line with expectations, Inspur Software maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Inspur Software that you should be aware of.

If you're unsure about the strength of Inspur Software's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600756

Inspur Software

Provides cloud computing and big data services in China and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives