High Growth Tech Stocks In China Including China National Software & Service

Reviewed by Simply Wall St

The Chinese stock market has recently experienced a dip, influenced by underwhelming corporate earnings and a sluggish property sector, with the Shanghai Composite Index losing 0.43% and the blue-chip CSI 300 falling 0.17%. Despite these challenges, high-growth tech stocks in China remain an area of interest for investors seeking opportunities in sectors with strong potential for innovation and expansion. When evaluating high-growth tech stocks like China National Software & Service, it's crucial to consider factors such as market position, revenue growth potential, and resilience to economic fluctuations.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 33.26% | 32.13% | ★★★★★★ |

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Zhongji Innolight | 31.57% | 30.49% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.35% | 29.89% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 28.05% | 28.35% | ★★★★★★ |

| Imeik Technology DevelopmentLtd | 25.24% | 23.27% | ★★★★★★ |

| Eoptolink Technology | 39.30% | 34.10% | ★★★★★★ |

| Bio-Thera Solutions | 25.99% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 38.54% | 99.87% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China National Software & Service Company Limited operates as a software company in China with a market cap of CN¥26.19 billion.

Operations: The company's primary revenue stream comes from its Software Service Business, generating CN¥6.17 billion.

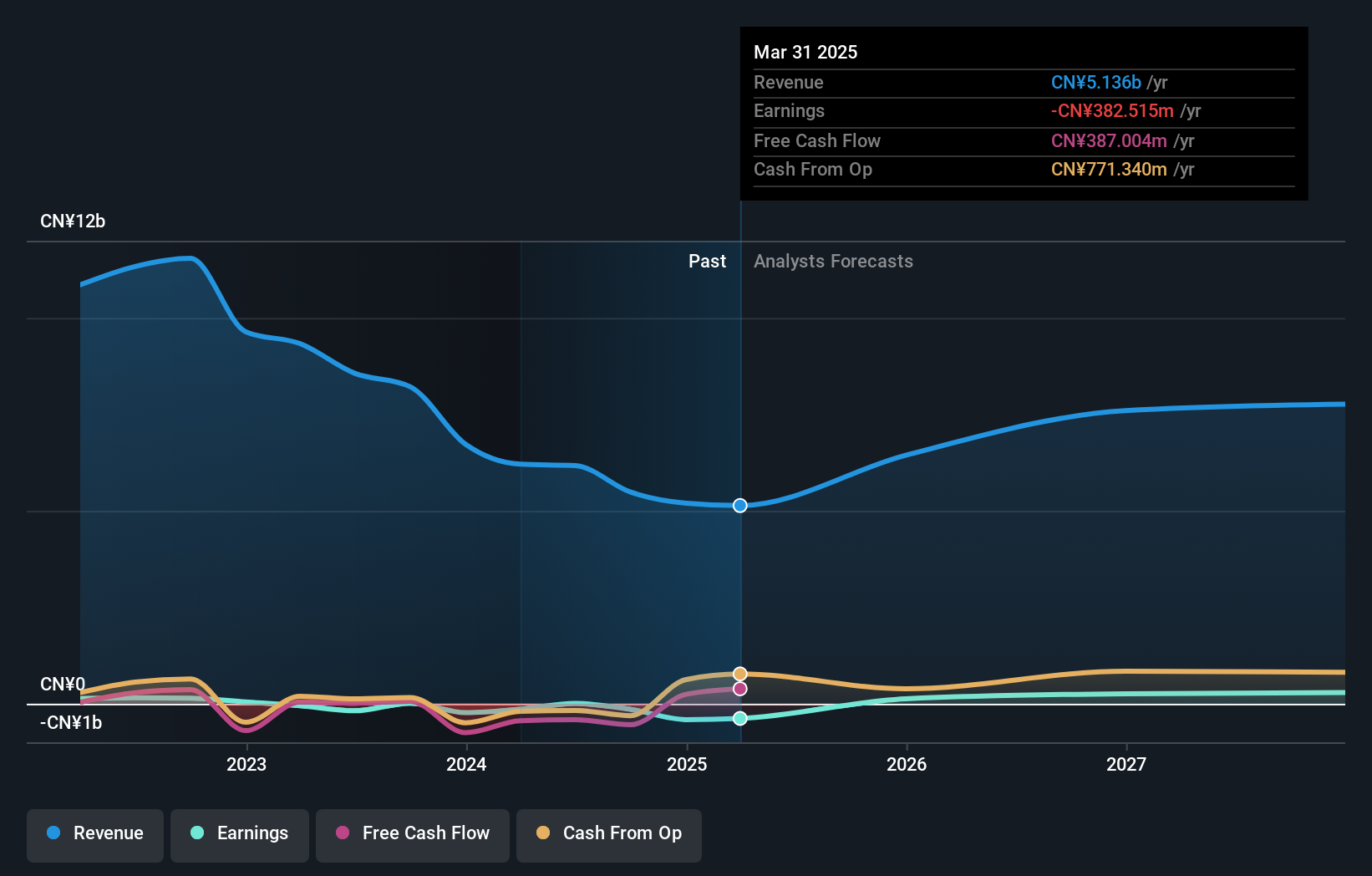

China National Software & Service reported a net loss of ¥272.65 million for the half-year ending June 2024, an improvement from the ¥515.34 million loss a year prior. Despite this, earnings are projected to grow at 69.7% annually, significantly outpacing the Chinese market's 23.2%. The company’s revenue is expected to increase by 19.6% annually, driven by its robust R&D investments {ankey_string}, which totaled ¥1 billion last year, underscoring its commitment to innovation in software and AI sectors.

Yonyou Network TechnologyLtd (SHSE:600588)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yonyou Network Technology Co., Ltd. provides digital intelligence platforms and services for enterprises and public organizations in China and internationally, with a market cap of CN¥29.78 billion.

Operations: The company's primary revenue stream comes from its Cloud Service and Software Business, generating CN¥10.23 billion. Its market cap stands at CN¥29.78 billion.

Yonyou Network Technology Ltd. reported a revenue increase to ¥3.81 billion for the first half of 2024, up from ¥3.37 billion a year ago, highlighting its growth trajectory despite a net loss of ¥793.94 million. The company’s R&D expenses reflect significant investment in innovation, totaling ¥1 billion last year, which aligns with its forecasted annual earnings growth rate of 44.61%. Additionally, Yonyou repurchased 39 million shares for ¥716.4 million under its recent buyback plan, indicating confidence in its future prospects within the software and AI sectors.

- Unlock comprehensive insights into our analysis of Yonyou Network TechnologyLtd stock in this health report.

Learn about Yonyou Network TechnologyLtd's historical performance.

Imeik Technology DevelopmentLtd (SZSE:300896)

Simply Wall St Growth Rating: ★★★★★★

Overview: Imeik Technology Development Co., Ltd. specializes in the research, development, production, and transformation of biomedical soft tissue repair materials in China with a market cap of CN¥43.67 billion.

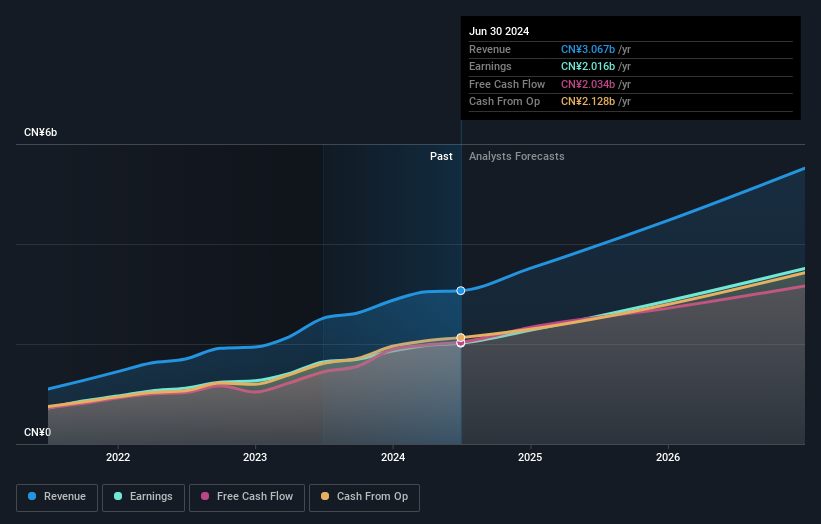

Operations: Imeik Technology Development Co., Ltd. generates its revenue primarily from the Surgical & Medical Equipment segment, amounting to CN¥3.07 billion. The company focuses on biomedical soft tissue repair materials within China.

Imeik Technology Development Ltd. reported a 13.5% increase in revenue to ¥1,656.91 million for the first half of 2024, with net income rising to ¥1,120.91 million from ¥963.4 million last year. The company's earnings are expected to grow at an impressive annual rate of 23.3%, outpacing the broader Chinese market's forecasted growth of 23.2%. With R&D expenses reflecting a strong commitment to innovation and product development, Imeik's strategic focus on high-growth segments promises robust future prospects in China's tech landscape.

Seize The Opportunity

- Take a closer look at our Chinese High Growth Tech and AI Stocks list of 247 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300896

Imeik Technology DevelopmentLtd

Engages in the research and development, production, and transformation of biomedical soft tissue repair materials in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives