- China

- /

- Semiconductors

- /

- SZSE:300812

Further weakness as Shenzhen Etmade Automatic Equipment (SZSE:300812) drops 12% this week, taking one-year losses to 41%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. For example, the Shenzhen Etmade Automatic Equipment Co., Ltd. (SZSE:300812) share price is down 42% in the last year. That's disappointing when you consider the market returned 6.1%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 9.6% in three years. Unfortunately the share price momentum is still quite negative, with prices down 17% in thirty days. We do note, however, that the broader market is down 7.7% in that period, and this may have weighed on the share price.

If the past week is anything to go by, investor sentiment for Shenzhen Etmade Automatic Equipment isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Shenzhen Etmade Automatic Equipment

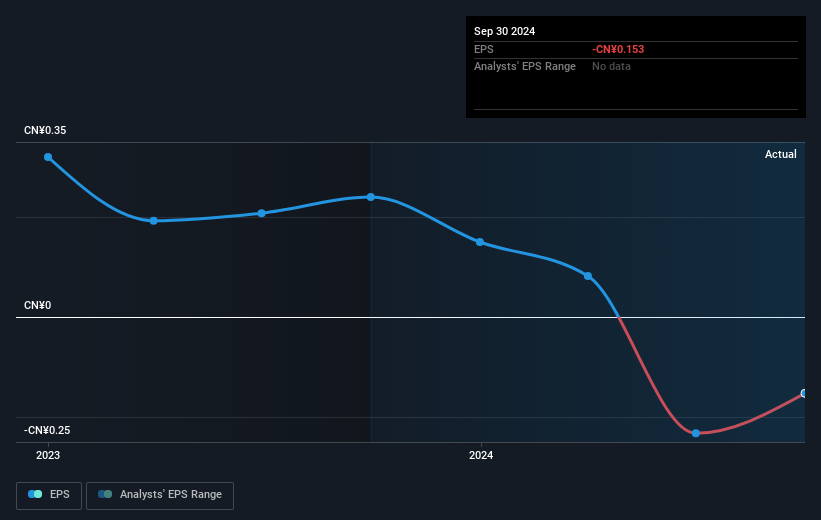

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Shenzhen Etmade Automatic Equipment saw its earnings per share drop below zero. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. We hope for shareholders' sake that the company becomes profitable again soon.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Shenzhen Etmade Automatic Equipment's key metrics by checking this interactive graph of Shenzhen Etmade Automatic Equipment's earnings, revenue and cash flow.

A Different Perspective

Shenzhen Etmade Automatic Equipment shareholders are down 41% for the year (even including dividends), but the market itself is up 6.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Shenzhen Etmade Automatic Equipment you should be aware of, and 1 of them is significant.

Of course Shenzhen Etmade Automatic Equipment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Shenzhen Etmade Automatic Equipment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300812

Shenzhen Etmade Automatic Equipment

Shenzhen Etmade Automatic Equipment Co., Ltd.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives