- China

- /

- Semiconductors

- /

- SZSE:300301

Shenzhen Changfang Group (SZSE:300301) adds CN¥198m to market cap in the past 7 days, though investors from five years ago are still down 62%

Shenzhen Changfang Group Co., Ltd. (SZSE:300301) shareholders should be happy to see the share price up 21% in the last week. But don't envy holders -- looking back over 5 years the returns have been really bad. The share price has failed to impress anyone , down a sizable 62% during that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Shenzhen Changfang Group

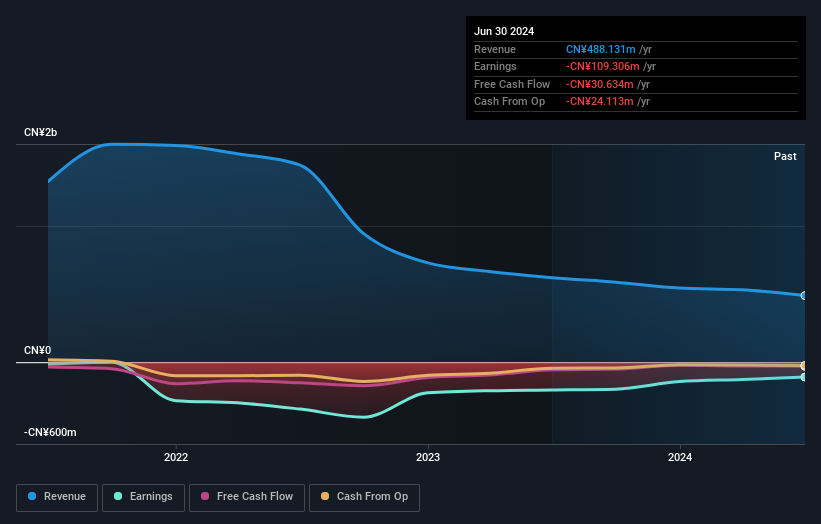

Given that Shenzhen Changfang Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Shenzhen Changfang Group reduced its trailing twelve month revenue by 21% for each year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 10% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 6.0% in the twelve months, Shenzhen Changfang Group shareholders did even worse, losing 13%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Shenzhen Changfang Group better, we need to consider many other factors. Take risks, for example - Shenzhen Changfang Group has 1 warning sign we think you should be aware of.

But note: Shenzhen Changfang Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300301

Shenzhen Changfang Group

Engages in the research and development, design, production, and sale of LED lighting source device packaging and LED lighting application products in China and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives