- South Korea

- /

- Chemicals

- /

- KOSE:A010060

Top Growth Companies With Insider Ownership In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by accelerating U.S. inflation and climbing stock indexes, growth stocks have notably outperformed their value counterparts, capturing investor interest. In this environment, companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business operations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 118.5% |

We'll examine a selection from our screener results.

OCI Holdings (KOSE:A010060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OCI Holdings Company Ltd., along with its subsidiaries, offers a range of chemical products and energy solutions across South Korea, the United States, China, other parts of Asia, Europe, and globally; it has a market cap of ₩1.43 trillion.

Operations: The company's revenue is primarily derived from its Basic Chemicals segment, which accounts for ₩2.26 trillion, followed by the Urban Development Business Sector at ₩567.84 million and Energy Solutions at ₩490.19 million.

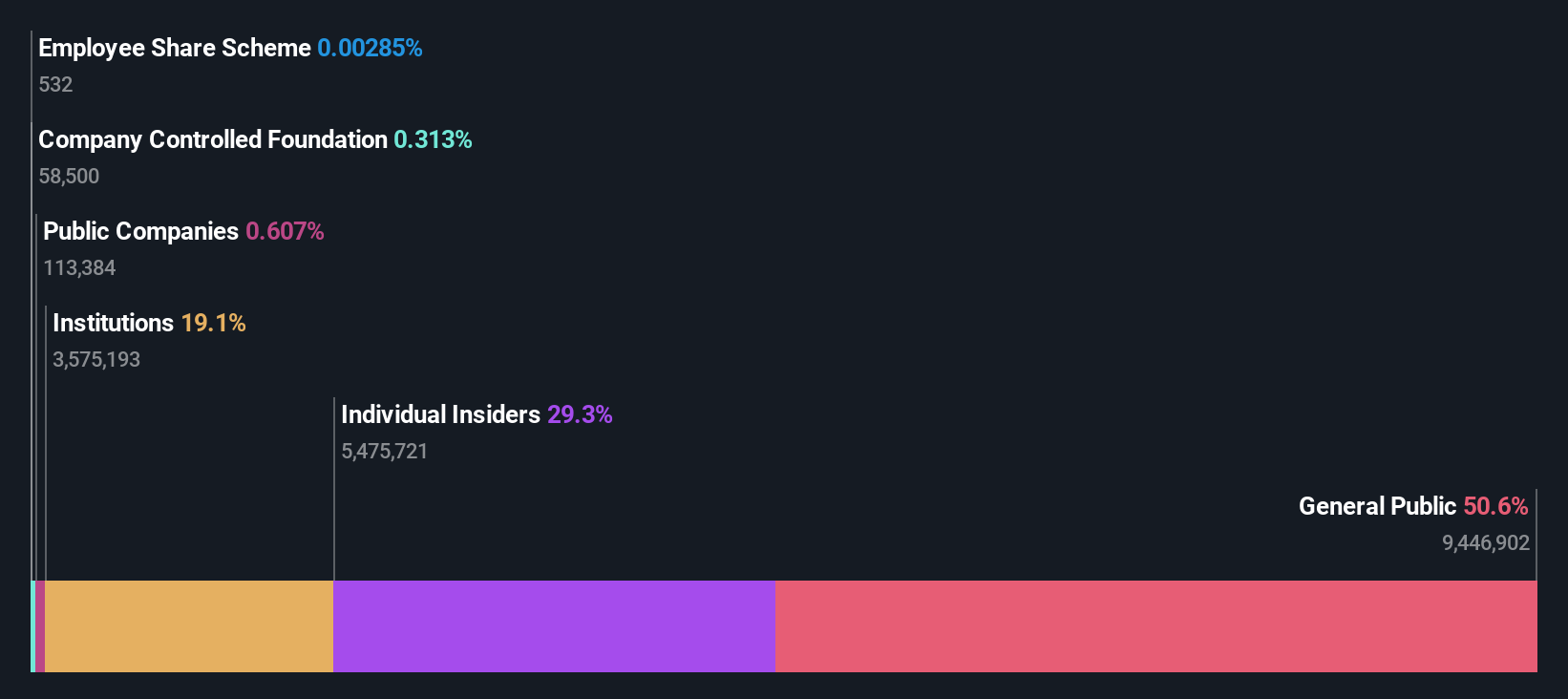

Insider Ownership: 29.1%

OCI Holdings exhibits promising growth potential, with earnings expected to grow significantly at 52.8% annually, outpacing the KR market's 26%. The company trades at a favorable price-to-earnings ratio of 9.3x compared to the market's 12.2x, suggesting good value. Despite lower profit margins and a dividend not fully covered by free cash flows, OCI has engaged in share buybacks totaling KRW 19.99 billion recently to enhance shareholder value and stabilize stock prices.

- Get an in-depth perspective on OCI Holdings' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that OCI Holdings' share price might be on the cheaper side.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$53.72 billion.

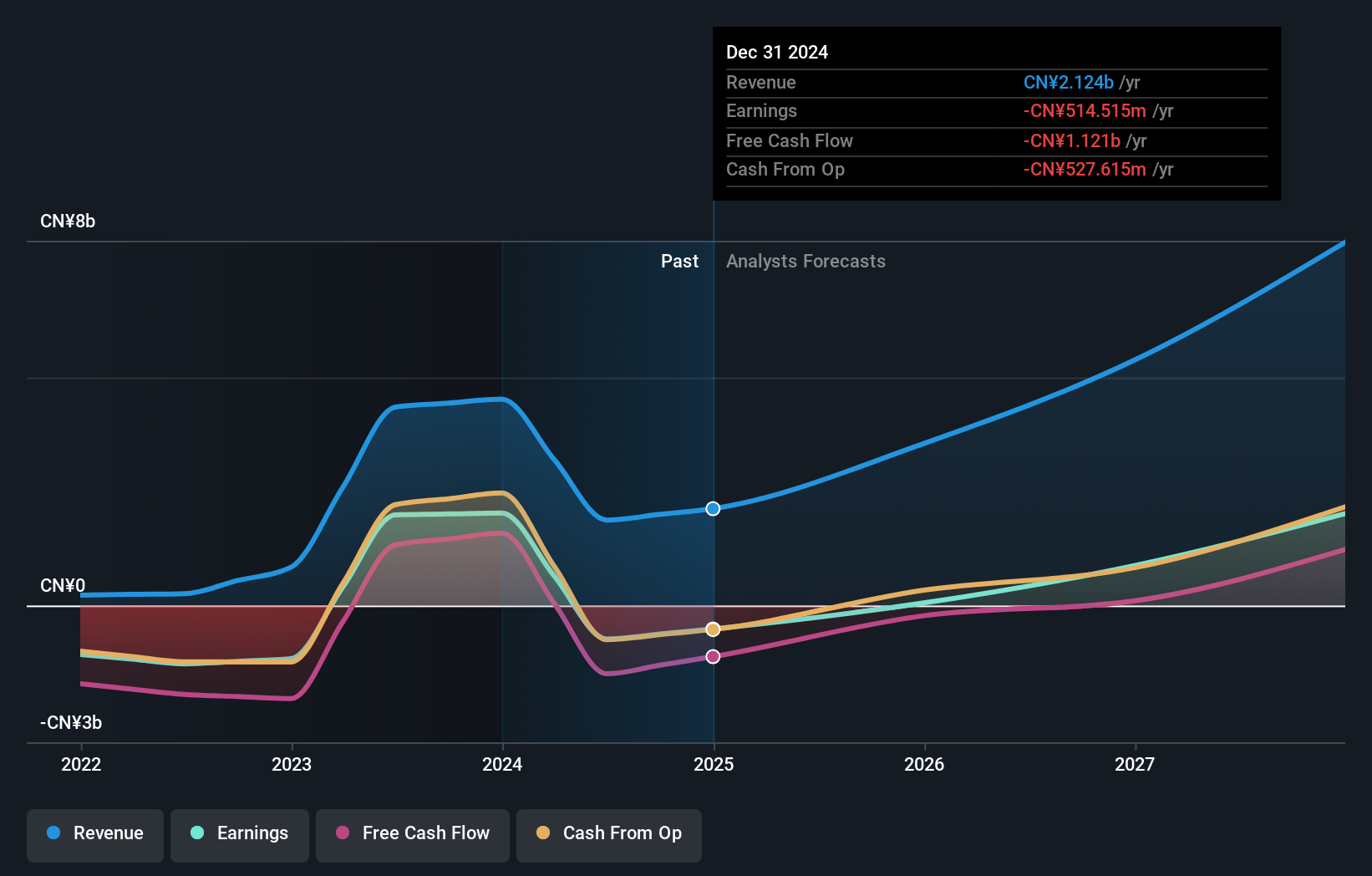

Operations: The company's revenue is primarily derived from the research, development, production, and sale of biopharmaceutical products, totaling CN¥1.87 billion.

Insider Ownership: 19%

Akeso is poised for significant growth, with earnings projected to rise 43.85% annually and revenue expected to grow at 30.1% per year, surpassing the Hong Kong market average. Despite substantial insider selling recently, Akeso's innovative drug pipeline remains robust. The recent acceptance of AK139's IND application and ongoing clinical trials for cadonilimab highlight its strategic focus on expanding therapeutic options in oncology and autoimmune diseases, reinforcing its competitive position in these high-growth sectors.

- Unlock comprehensive insights into our analysis of Akeso stock in this growth report.

- Upon reviewing our latest valuation report, Akeso's share price might be too optimistic.

BIWIN Storage Technology (SHSE:688525)

Simply Wall St Growth Rating: ★★★★★★

Overview: BIWIN Storage Technology Co., Ltd. engages in the research, development, design, packaging, testing, production, and sale of semiconductor memories with a market capitalization of approximately CN¥26.52 billion.

Operations: The company's revenue from its semiconductor segment amounts to approximately CN¥6.49 billion.

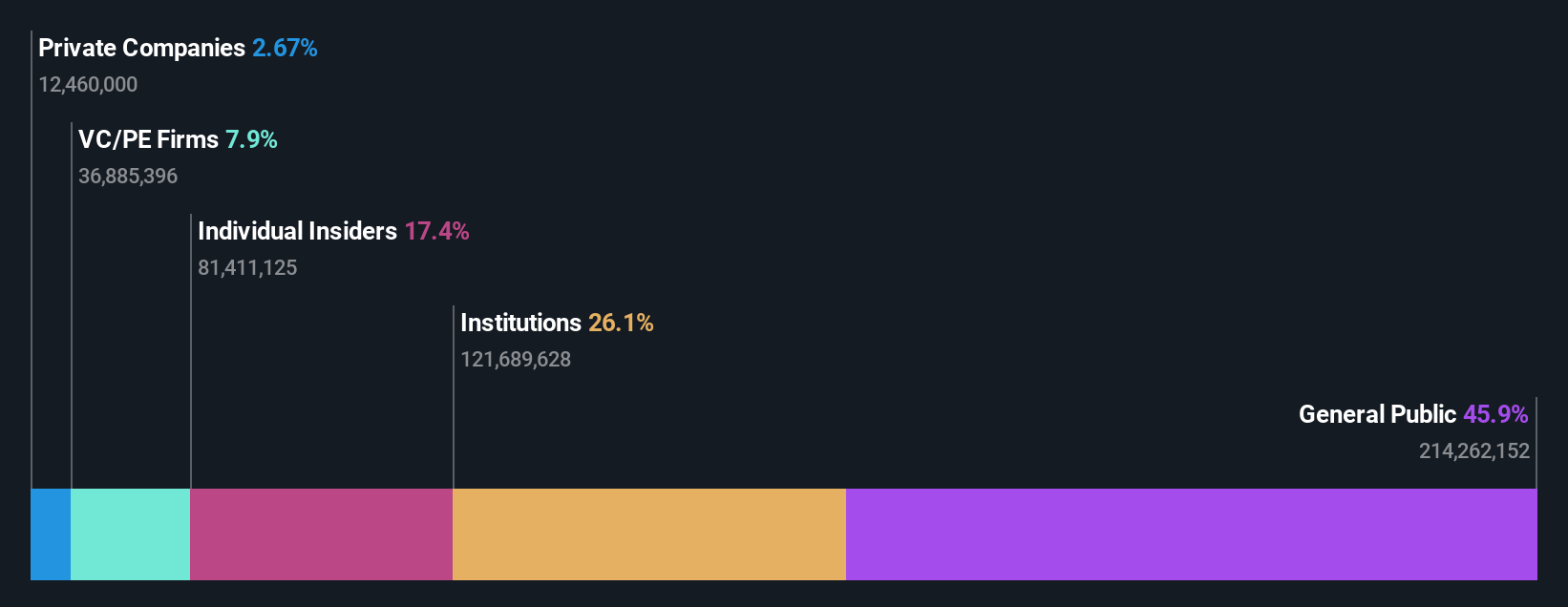

Insider Ownership: 18.9%

BIWIN Storage Technology is set for substantial growth, with earnings projected to increase by a very large margin annually, outpacing the CN market. Revenue is also expected to grow faster than 20% per year. Despite becoming profitable this year, concerns exist over interest payments not being well covered by earnings. The upcoming shareholder meeting could provide insights into strategic decisions influencing its trajectory in the competitive storage technology sector.

- Click to explore a detailed breakdown of our findings in BIWIN Storage Technology's earnings growth report.

- Our valuation report unveils the possibility BIWIN Storage Technology's shares may be trading at a premium.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1464 companies within our Fast Growing Companies With High Insider Ownership screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade OCI Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A010060

OCI Holdings

Provides various chemical products and energy solutions in South Korea, the United States, China, rest of Asia, Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives