High Insider Ownership In These 3 Prominent Growth Companies

Reviewed by Simply Wall St

In the midst of fluctuating global markets, characterized by policy uncertainties and sector-specific volatility, investors are keenly observing how these dynamics impact corporate earnings and market sentiment. Amidst this backdrop, companies with high insider ownership often stand out as potentially promising growth opportunities due to the alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

We're going to check out a few of the best picks from our screener tool.

Farsoon Technologies (SHSE:688433)

Simply Wall St Growth Rating: ★★★★★☆

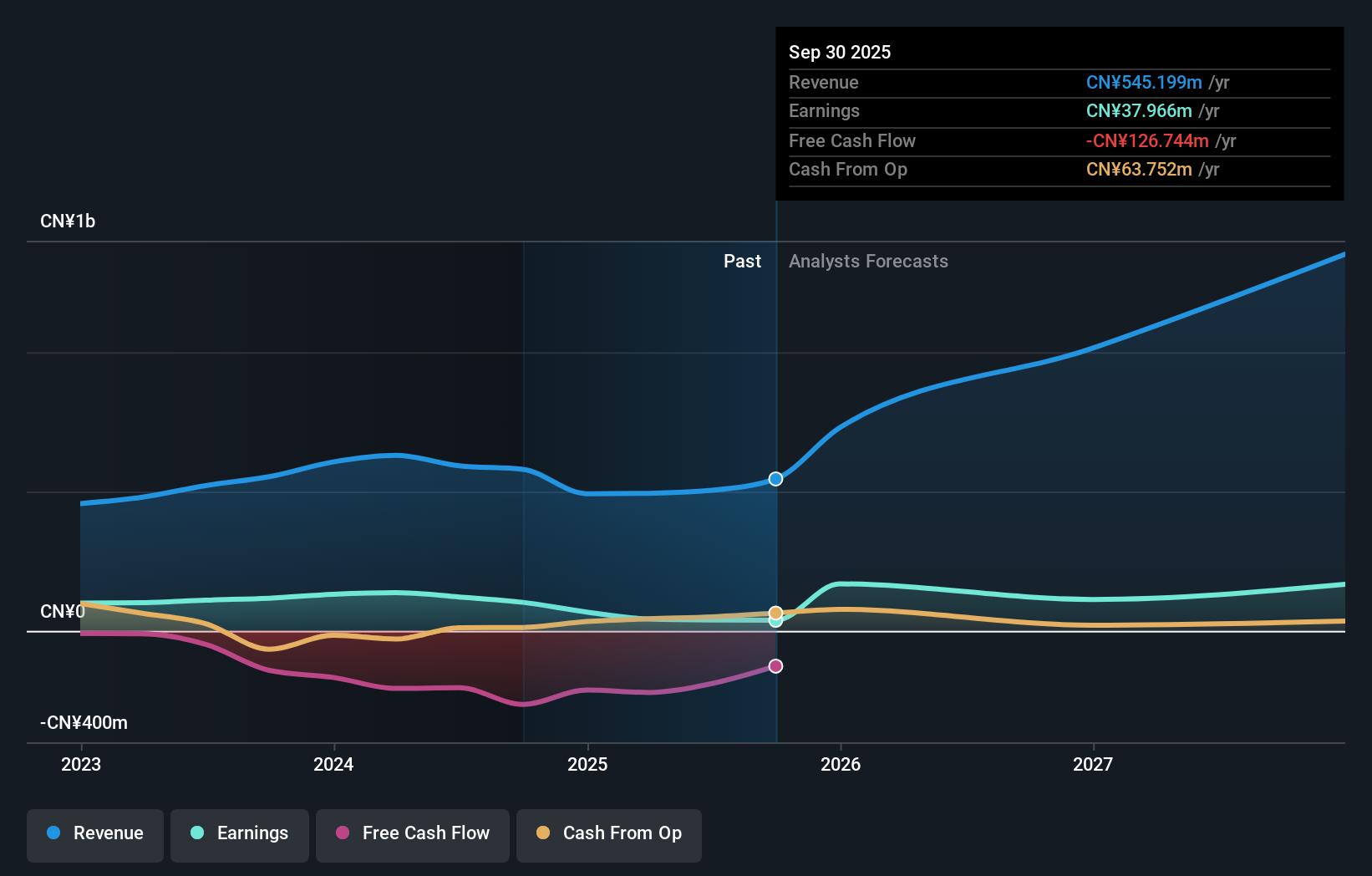

Overview: Farsoon Technologies supplies industrial plastic laser sintering and metal laser melting systems across China, North America, and Europe with a market cap of CN¥8.04 billion.

Operations: The company's revenue segment consists of Machinery & Industrial Equipment, generating CN¥579.72 million.

Insider Ownership: 11.5%

Earnings Growth Forecast: 68.4% p.a.

Farsoon Technologies exhibits strong growth potential with forecasted revenue and earnings growth rates of 52.3% and 68.4% per year, respectively, outpacing the Chinese market averages. Despite this promising outlook, recent financial results show a decline in sales and net income for the nine months ending September 2024 compared to the previous year. The company's stock has experienced high volatility recently, but there is no significant insider trading activity reported over the past three months.

- Navigate through the intricacies of Farsoon Technologies with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Farsoon Technologies shares in the market.

Maxic Technology (SHSE:688458)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maxic Technology, Inc. designs and sells analog and digital-analog hybrid integrated circuits in China and internationally, with a market cap of CN¥3.93 billion.

Operations: Maxic Technology generates revenue through the design and sale of analog and digital-analog hybrid integrated circuits both domestically in China and internationally.

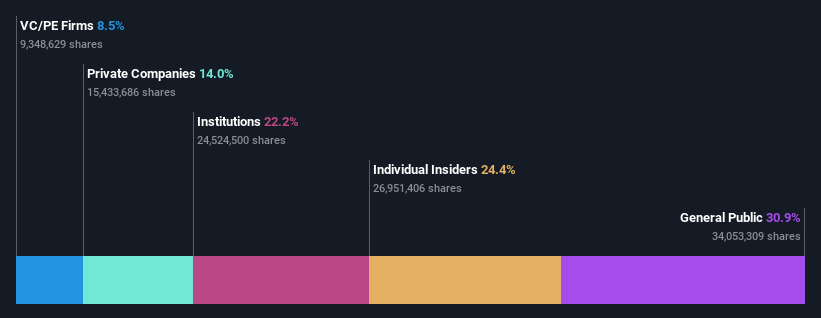

Insider Ownership: 25%

Earnings Growth Forecast: 79.4% p.a.

Maxic Technology is poised for significant growth with forecasted annual revenue and earnings increases of 33.5% and 79.37%, respectively, surpassing market averages. However, recent financial results reveal a decline in sales to CNY 287.83 million and a net loss of CNY 32.25 million for the nine months ending September 2024 compared to the previous year. The company completed a share buyback worth CNY 59.83 million, while its stock remains highly volatile without notable insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of Maxic Technology.

- Our valuation report here indicates Maxic Technology may be overvalued.

Lontium Semiconductor (SHSE:688486)

Simply Wall St Growth Rating: ★★★★★☆

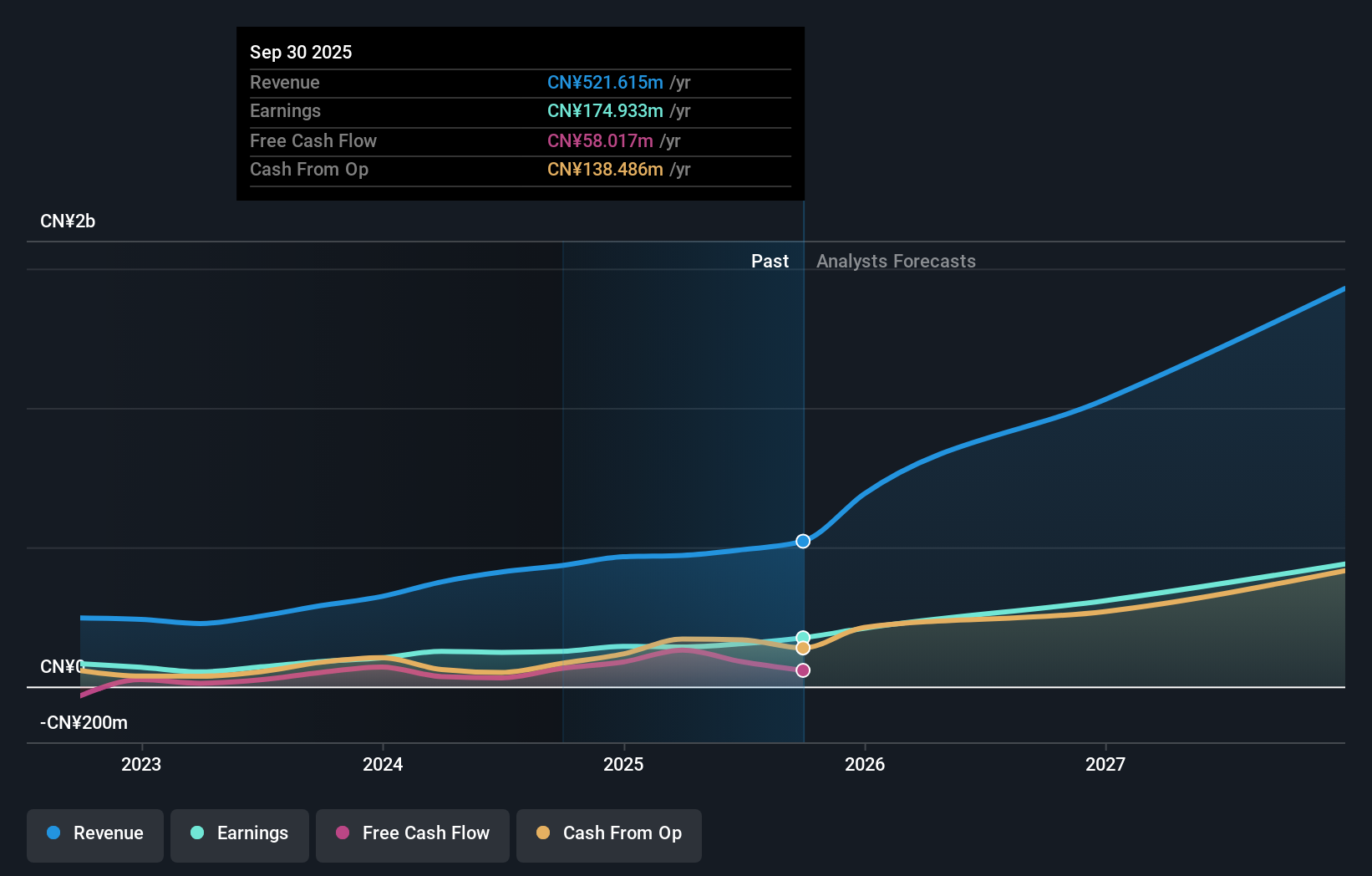

Overview: Lontium Semiconductor Corporation designs, manufactures, and sells semiconductor products in China with a market cap of CN¥6.05 billion.

Operations: Lontium Semiconductor Corporation generates revenue from designing, manufacturing, and selling semiconductor products in China.

Insider Ownership: 38.5%

Earnings Growth Forecast: 39.8% p.a.

Lontium Semiconductor shows promising growth potential, with earnings and revenue forecasted to grow annually by 39.8% and 39.4%, respectively, outpacing the broader CN market. Recent financials highlight a rise in sales to CNY 333.59 million and net income of CNY 93.99 million for the nine months ending September 2024 compared to the prior year. Despite high volatility in its share price, insider trading has been minimal recently, while a buyback program was completed at CNY 59.2 million.

- Get an in-depth perspective on Lontium Semiconductor's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Lontium Semiconductor's current price could be inflated.

Where To Now?

- Unlock our comprehensive list of 1538 Fast Growing Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688433

Farsoon Technologies

Farsoon Technologies supplies industrial plastic laser sintering and metal laser melting systems in China, North America, and Europe.

Flawless balance sheet with high growth potential.