- China

- /

- Semiconductors

- /

- SHSE:688416

3 Growth Companies With High Insider Ownership Growing Earnings Up To 190%

Reviewed by Simply Wall St

In a week marked by mixed performances in major global stock indexes, growth stocks have notably outpaced their value counterparts, with the S&P 500 and Nasdaq Composite reaching record highs. Amidst this backdrop of economic optimism and sector-specific gains, identifying growth companies with significant insider ownership can offer insights into potential long-term confidence within these firms. In the current market environment, such companies may present unique opportunities as insiders' stakes often align management's interests with shareholders', potentially driving strategic decisions that foster sustained earnings growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Zbit Semiconductor (SHSE:688416)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zbit Semiconductor, Inc., with a market cap of CN¥2.93 billion, is an integrated circuit design company focused on the R&D, design, and sale of memory and MCU chips in China.

Operations: The company's revenue is primarily derived from its semiconductor segment, amounting to CN¥351.52 million.

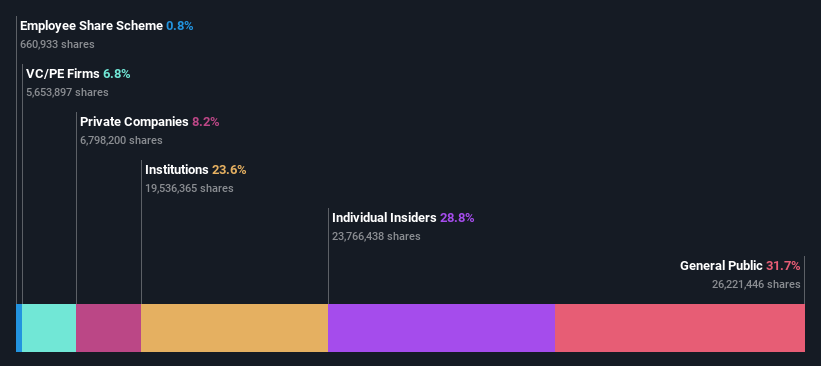

Insider Ownership: 28.8%

Earnings Growth Forecast: 190.2% p.a.

Zbit Semiconductor is poised for significant growth, with revenue expected to increase by 39.1% annually, outpacing the Chinese market's average. Despite a current net loss and volatile share price, the company plans a CNY 60 million buyback to enhance employee incentives and support long-term development. This move reflects confidence in its future profitability, anticipated within three years, aligning with substantial insider ownership that often indicates strong internal belief in the company's potential.

- Navigate through the intricacies of Zbit Semiconductor with our comprehensive analyst estimates report here.

- Our valuation report here indicates Zbit Semiconductor may be overvalued.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) in China and internationally, with a market cap of CN¥19.39 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 26.2%

Earnings Growth Forecast: 65% p.a.

Shenzhen Fastprint Circuit Tech Ltd. is navigating a challenging period with a reported net loss of CNY 31.6 million for the first nine months of 2024, contrasting last year's net income. Despite this, earnings are forecast to grow significantly at 64.98% annually, with revenue growth expected to surpass the Chinese market average at 17.5%. Insider ownership remains significant, suggesting strong internal confidence in achieving profitability within three years despite current financial hurdles.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Fastprint Circuit TechLtd.

- According our valuation report, there's an indication that Shenzhen Fastprint Circuit TechLtd's share price might be on the expensive side.

Hwa Create (SZSE:300045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hwa Create Corporation engages in the research, development, manufacturing, and sale of satellite navigation as well as radar and communication products and technologies with a market cap of CN¥16.35 billion.

Operations: Hwa Create generates revenue through its operations in satellite navigation, radar, and communication products and technologies.

Insider Ownership: 35.1%

Earnings Growth Forecast: 82.6% p.a.

Hwa Create's revenue is forecast to grow at 34.7% annually, outpacing the Chinese market average of 13.7%, with earnings expected to rise by 82.6% per year and achieve profitability within three years. Despite a volatile share price and recent net loss of CNY 28.79 million for the first nine months of 2024, substantial insider ownership suggests confidence in long-term growth prospects amid current financial challenges.

- Dive into the specifics of Hwa Create here with our thorough growth forecast report.

- The analysis detailed in our Hwa Create valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Gain an insight into the universe of 1510 Fast Growing Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zbit Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688416

Zbit Semiconductor

An integrated circuit design company, engages in the research and development, design, and sale of memory chips and MCU chips in China.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives