- China

- /

- Electronic Equipment and Components

- /

- SZSE:002281

Asian Value Stocks Estimated Below Intrinsic Worth In October 2025

Reviewed by Simply Wall St

As of October 2025, Asian markets have shown resilience with notable gains in major indices such as Japan's Nikkei and China's CSI 300, amid a backdrop of mixed economic signals including strong business activity in Japan and technology sector strength in China. In this environment, identifying stocks that are potentially undervalued relative to their intrinsic worth can be an effective strategy for investors seeking opportunities amidst ongoing market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.79 | CN¥74.69 | 49.4% |

| Nippon Chemi-Con (TSE:6997) | ¥1630.00 | ¥3218.06 | 49.3% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.37 | CN¥26.40 | 49.4% |

| Lotes (TWSE:3533) | NT$1425.00 | NT$2830.44 | 49.7% |

| Kinsus Interconnect Technology (TWSE:3189) | NT$145.00 | NT$284.52 | 49% |

| Insource (TSE:6200) | ¥911.00 | ¥1806.40 | 49.6% |

| COVER (TSE:5253) | ¥1872.00 | ¥3693.77 | 49.3% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥47.65 | CN¥95.09 | 49.9% |

| Andes Technology (TWSE:6533) | NT$270.50 | NT$531.74 | 49.1% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.55 | CN¥54.29 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Autel Intelligent Technology (SHSE:688208)

Overview: Autel Intelligent Technology Corp., Ltd. specializes in the research, development, production, sale, and servicing of automotive intelligent diagnostics equipment and systems with a market cap of CN¥25 billion.

Operations: Autel Intelligent Technology Corp., Ltd. generates revenue through its automotive intelligent diagnostics equipment, detection and analysis systems, and automotive electronic components.

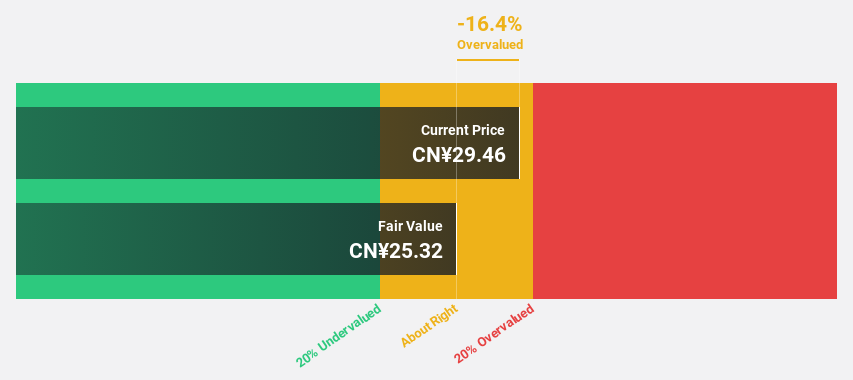

Estimated Discount To Fair Value: 13.2%

Autel Intelligent Technology is trading at CN¥37.87, below its estimated fair value of CN¥43.65, suggesting undervaluation based on cash flows. Despite a dividend not well-covered by free cash flow, the company shows strong revenue growth potential at 21.2% annually, surpassing market expectations. Recent earnings reported sales of CN¥3.50 billion and net income of CN¥733 million for nine months ending September 2025, reflecting robust financial performance with growing earnings per share from continuing operations.

- In light of our recent growth report, it seems possible that Autel Intelligent Technology's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Autel Intelligent Technology.

Shanghai V-Test Semiconductor Tech (SHSE:688372)

Overview: Shanghai V-Test Semiconductor Tech Co., Ltd. operates in the semiconductor industry and has a market cap of CN¥13.20 billion.

Operations: Shanghai V-Test Semiconductor Tech Co., Ltd. generates its revenue primarily from operations within the semiconductor industry.

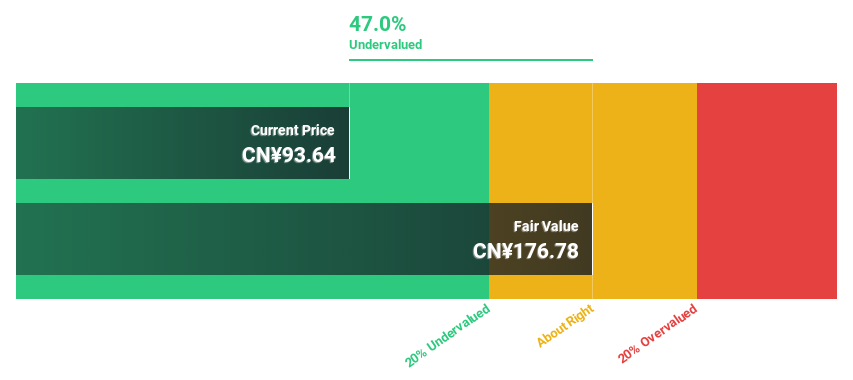

Estimated Discount To Fair Value: 46.7%

Shanghai V-Test Semiconductor Tech is trading at CN¥88.61, significantly below its estimated fair value of CN¥166.14, highlighting its undervaluation based on cash flows. The company reported strong financial performance with sales of CN¥1.08 billion and net income of CN¥202.43 million for the nine months ending September 2025, showing substantial growth from the previous year. Despite high volatility in share price and a high level of debt, revenue growth is expected to outpace market averages significantly.

- Upon reviewing our latest growth report, Shanghai V-Test Semiconductor Tech's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Shanghai V-Test Semiconductor Tech.

Accelink Technologies CoLtd (SZSE:002281)

Overview: Accelink Technologies Co., Ltd. is involved in the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥51.02 billion.

Operations: Accelink Technologies Co., Ltd.'s revenue is derived from its activities in research, development, manufacturing, sales, and technical services related to optoelectronic chips, devices, modules, and subsystem products.

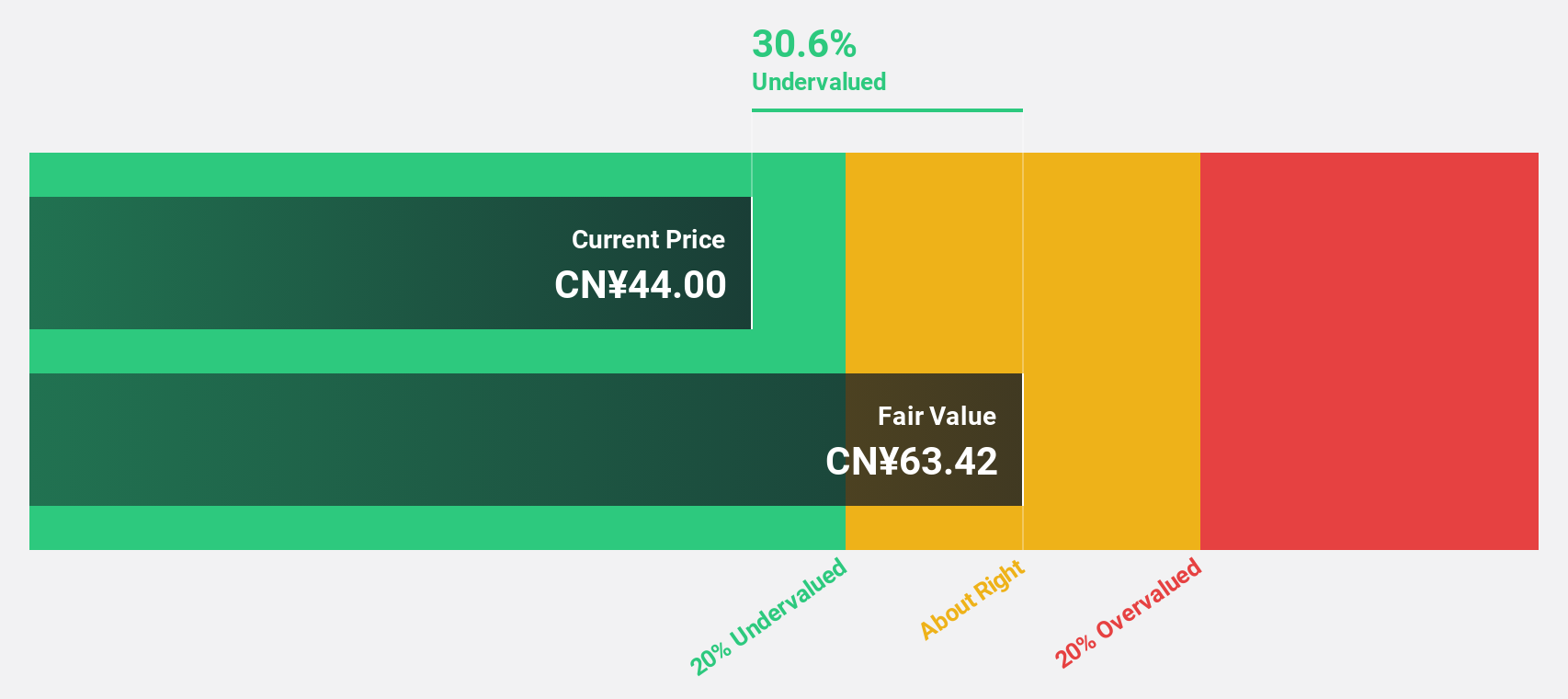

Estimated Discount To Fair Value: 34.8%

Accelink Technologies Co., Ltd. is trading at CN¥63.23, well below its fair value estimate of CN¥97.01, indicating significant undervaluation based on cash flows. The company reported robust financial results for the nine months ending September 2025, with sales reaching CNY 8.53 billion and net income of CNY 718.97 million, marking strong growth from the previous year. Despite high share price volatility, Accelink's earnings and revenue are forecast to grow faster than the market average in China.

- The analysis detailed in our Accelink Technologies CoLtd growth report hints at robust future financial performance.

- Click here to discover the nuances of Accelink Technologies CoLtd with our detailed financial health report.

Seize The Opportunity

- Get an in-depth perspective on all 271 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002281

Accelink Technologies CoLtd

Researches, develops, manufactures, sells, and technical services for optoelectronic chips, devices, modules, and subsystem products primarily in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)