- China

- /

- Semiconductors

- /

- SHSE:688332

3 Growth Companies Insiders Back With Up To 71% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic indicators, such as the contracting Chicago PMI and revised GDP forecasts, investors are keenly observing growth opportunities amid a backdrop of cautious optimism. In this environment, companies with strong insider ownership can signal confidence in their potential for robust earnings growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

We're going to check out a few of the best picks from our screener tool.

Intercos (BIT:ICOS)

Simply Wall St Growth Rating: ★★★★☆☆

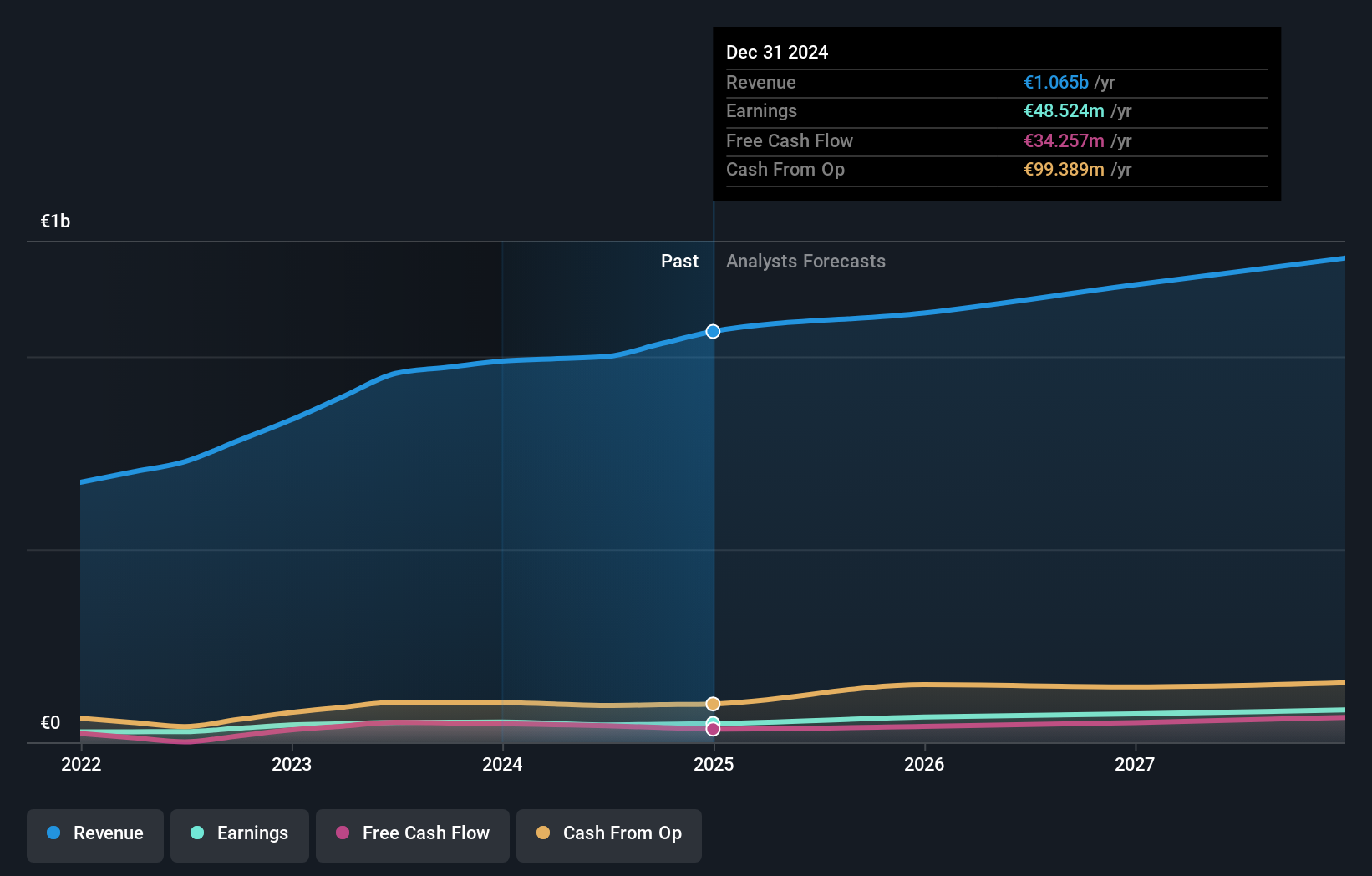

Overview: Intercos S.p.A., along with its subsidiaries, is engaged in the creation, production, and marketing of cosmetics and skincare products globally, with a market cap of €1.36 billion.

Operations: The company's revenue is derived from three main segments: Make up Line (€578.55 million), Skin Care Line (€168.48 million), and Hair & Body Line (€252.73 million).

Insider Ownership: 32.2%

Earnings Growth Forecast: 21.9% p.a.

Intercos is poised for growth with earnings expected to increase significantly at 21.87% annually, outpacing the Italian market's 6.9%. Revenue growth is projected at 7.7% per year, surpassing the local market's 4%, though not reaching high-growth thresholds. Analysts anticipate a stock price rise of 26.3%. Despite no recent insider trading data, substantial insider ownership suggests alignment with shareholder interests and potential confidence in the company's future performance.

- Delve into the full analysis future growth report here for a deeper understanding of Intercos.

- The analysis detailed in our Intercos valuation report hints at an inflated share price compared to its estimated value.

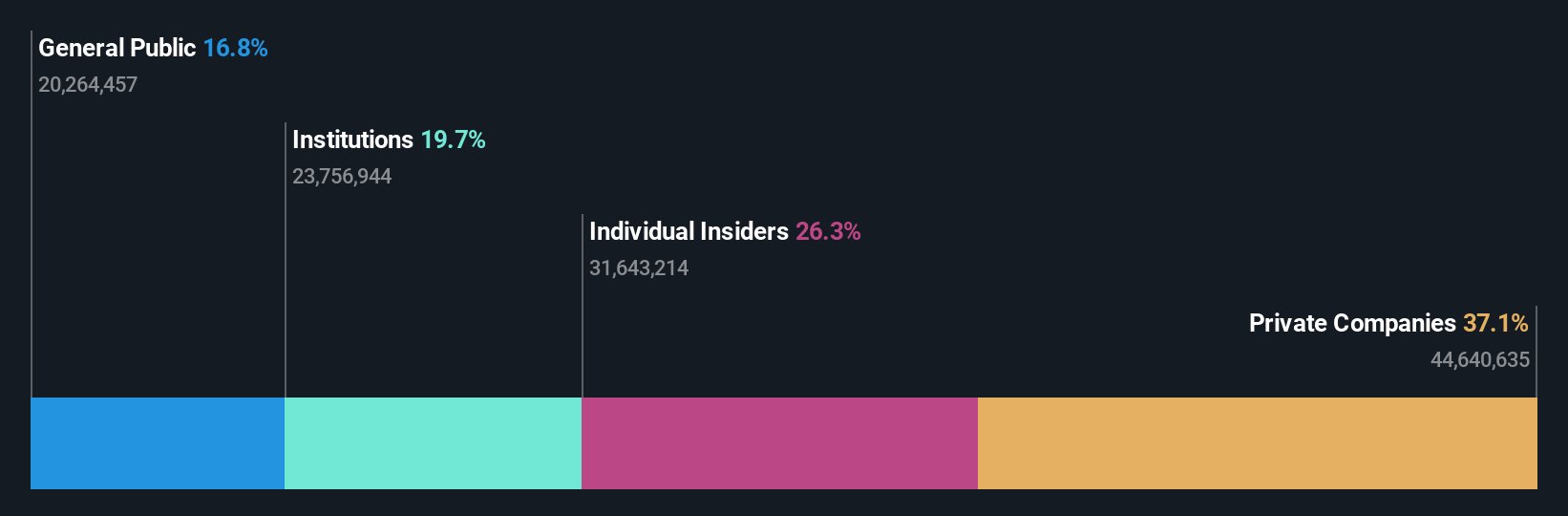

Shenzhen Bluetrum Technology (SHSE:688332)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bluetrum Technology Co., Ltd. specializes in the research, development, design, and sale of wireless audio SOC chips and has a market cap of CN¥15.90 billion.

Operations: The company's revenue primarily comes from its activities in the research, development, design, and sale of wireless audio SOC chips.

Insider Ownership: 26.3%

Earnings Growth Forecast: 25.8% p.a.

Shenzhen Bluetrum Technology's earnings are projected to grow significantly at 25.8% annually, outpacing the Chinese market's 25.1%. Revenue is expected to rise by 24.2% per year, surpassing the market average of 13.6%. Recent reports show sales increased to CNY 1.25 billion from CNY 1.05 billion year-on-year, with net income slightly up at CNY 206.71 million from CNY 197.25 million, indicating robust growth potential despite high share price volatility and low future return on equity forecasts.

- Dive into the specifics of Shenzhen Bluetrum Technology here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Shenzhen Bluetrum Technology's current price could be inflated.

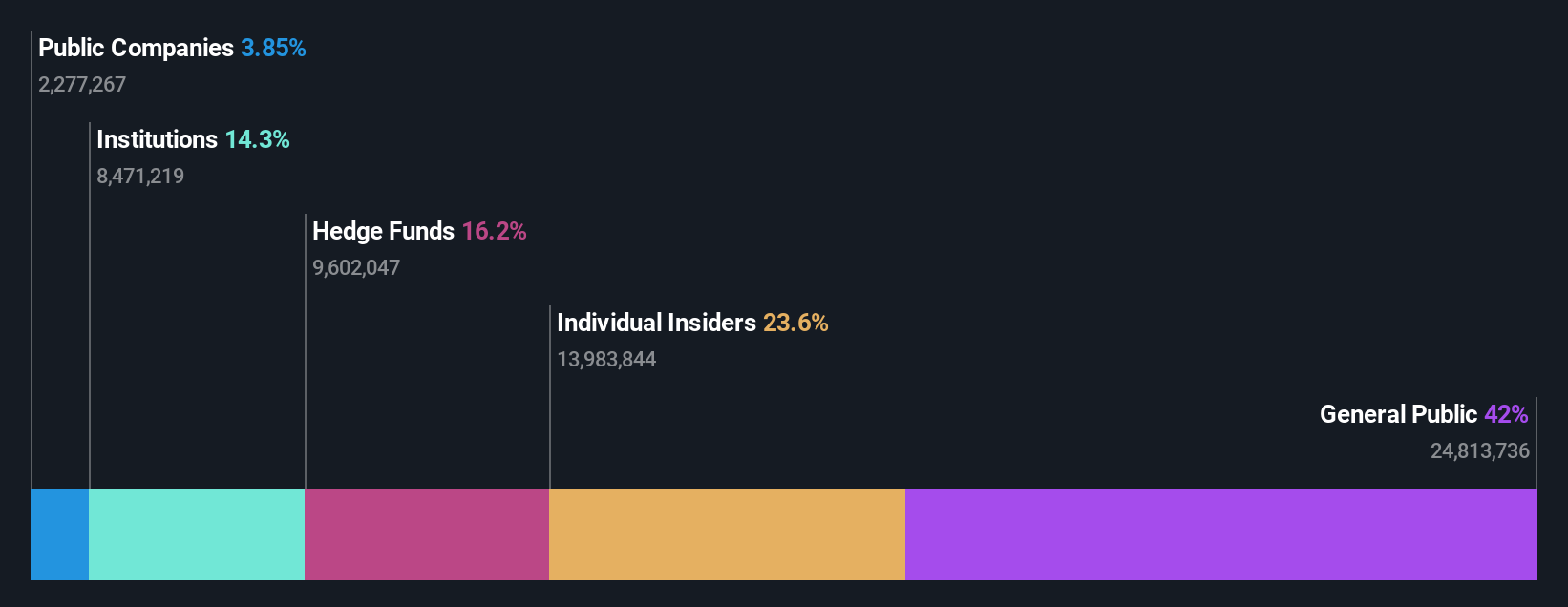

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market capitalization of ¥185.07 billion.

Operations: The company's revenue primarily comes from its Platform Business, generating ¥27.09 billion.

Insider Ownership: 23.8%

Earnings Growth Forecast: 71.4% p.a.

freee K.K. is forecast to achieve significant earnings growth of 71.35% annually, surpassing the Japanese market's average, and is expected to become profitable within three years. Despite high share price volatility, it trades at a substantial discount to its estimated fair value. Recent board discussions about issuing new restricted shares could impact insider ownership dynamics, although no substantial insider trading activity has been reported over the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of freee K.K.

- Our expertly prepared valuation report freee K.K implies its share price may be lower than expected.

Turning Ideas Into Actions

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1484 more companies for you to explore.Click here to unveil our expertly curated list of 1487 Fast Growing Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688332

Shenzhen Bluetrum Technology

Engages in the research and development, design, and sale of wireless audio SOC chips in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives