- China

- /

- Semiconductors

- /

- SHSE:688313

Some Shareholders Feeling Restless Over Henan Shijia Photons Technology Co., Ltd.'s (SHSE:688313) P/S Ratio

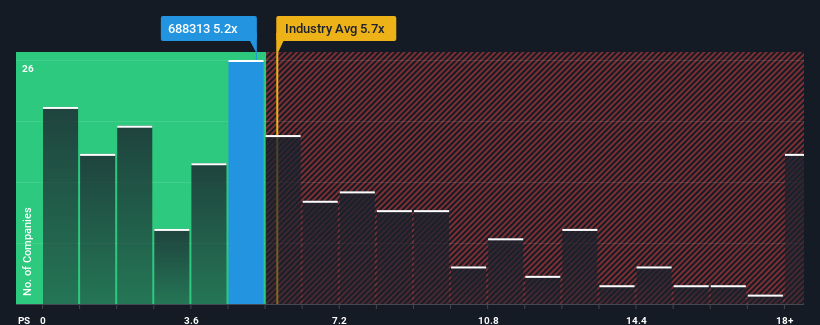

It's not a stretch to say that Henan Shijia Photons Technology Co., Ltd.'s (SHSE:688313) price-to-sales (or "P/S") ratio of 5.2x right now seems quite "middle-of-the-road" for companies in the Semiconductor industry in China, where the median P/S ratio is around 5.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Henan Shijia Photons Technology

What Does Henan Shijia Photons Technology's P/S Mean For Shareholders?

Henan Shijia Photons Technology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Henan Shijia Photons Technology.Do Revenue Forecasts Match The P/S Ratio?

Henan Shijia Photons Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 6.2% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 26% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 35%, which is noticeably more attractive.

With this information, we find it interesting that Henan Shijia Photons Technology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Henan Shijia Photons Technology's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Henan Shijia Photons Technology's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Henan Shijia Photons Technology you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Henan Shijia Photons Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688313

Henan Shijia Photons Technology

Henan Shijia Photons Technology Co., Ltd.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives