- China

- /

- Semiconductors

- /

- SHSE:688303

3 Global Stocks Estimated To Be Trading At Up To 27.5% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, global markets have been weighed down by concerns over AI-related valuations and mixed economic signals, leading to declines across major indices. Amidst this turbulence, investors are increasingly on the lookout for opportunities in stocks that appear undervalued relative to their intrinsic value. Identifying such stocks requires a keen understanding of market sentiment and an ability to discern potential long-term value amidst short-term volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.76 | CN¥9.38 | 49.3% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.45 | €4.88 | 49.8% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.18 | CN¥26.01 | 49.3% |

| Kitron (OB:KIT) | NOK59.25 | NOK116.55 | 49.2% |

| HMS Bergbau (XTRA:HMU) | €52.50 | €103.54 | 49.3% |

| EcoUp Oyj (HLSE:ECOUP) | €1.34 | €2.64 | 49.2% |

| China Ruyi Holdings (SEHK:136) | HK$2.42 | HK$4.81 | 49.7% |

| B&S Group (ENXTAM:BSGR) | €5.94 | €11.83 | 49.8% |

| Beijing Roborock Technology (SHSE:688169) | CN¥152.18 | CN¥300.82 | 49.4% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.03 | CN¥56.05 | 50% |

Let's take a closer look at a couple of our picks from the screened companies.

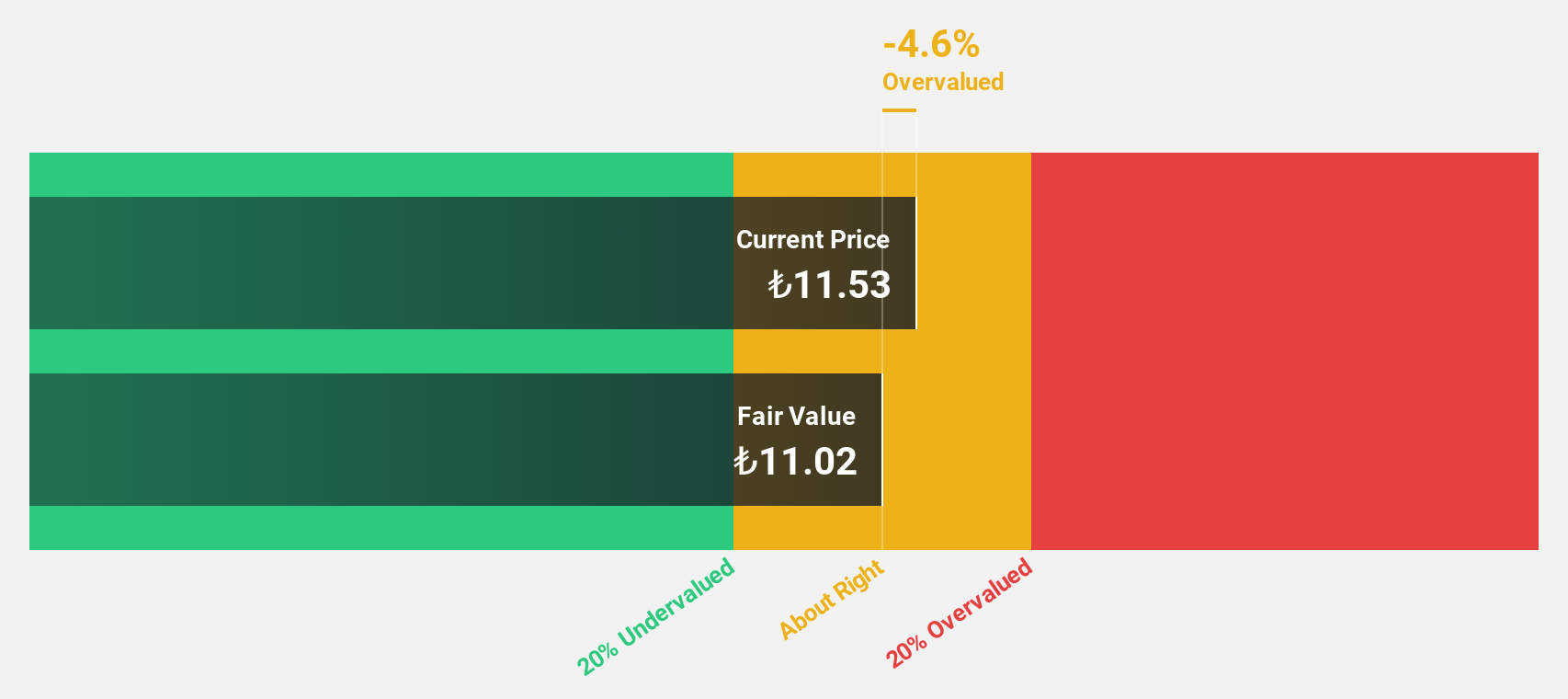

Türkiye Is Bankasi (IBSE:ISCTR)

Overview: Türkiye Is Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY381.33 billion.

Operations: Türkiye Is Bankasi's revenue is primarily derived from Corporate/Commercial Banking at TRY168.92 billion, Treasury Transactions and Investment Activities at TRY136.41 billion, and Insurance and Reinsurance Activities at TRY82.67 billion.

Estimated Discount To Fair Value: 23.9%

Türkiye Is Bankasi's recent earnings report highlights a strong increase in net income, reaching TRY 14.09 billion for Q3 2025. The stock is trading at TRY 13.34, below its estimated fair value of TRY 17.52, indicating undervaluation based on discounted cash flow analysis. Despite its high level of non-performing loans at 2.3%, the bank's earnings are expected to grow significantly over the next three years, supported by robust profit growth forecasts and a high future return on equity of 28.5%.

- The analysis detailed in our Türkiye Is Bankasi growth report hints at robust future financial performance.

- Dive into the specifics of Türkiye Is Bankasi here with our thorough financial health report.

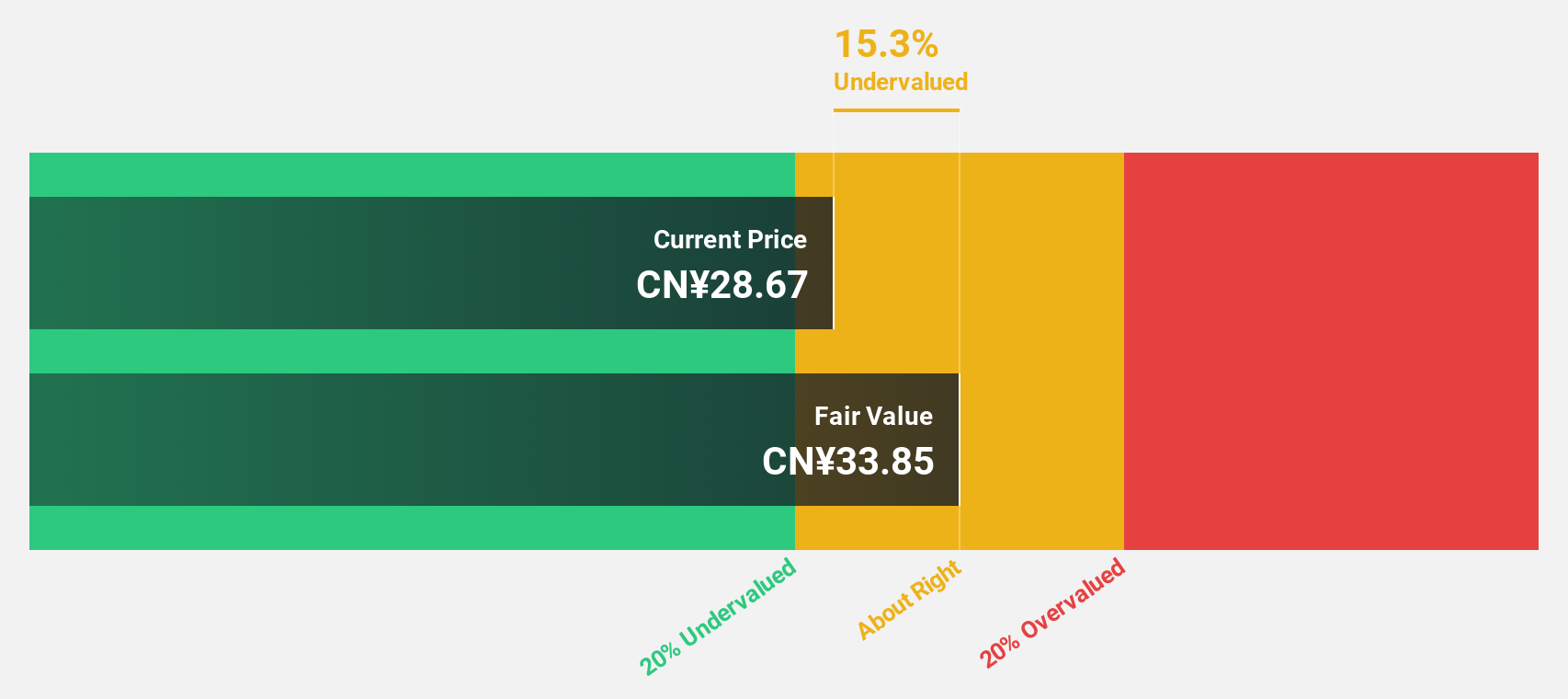

Xinjiang Daqo New EnergyLtd (SHSE:688303)

Overview: Xinjiang Daqo New Energy Ltd operates in the research, development, production, and sale of polysilicon and silicon-based materials for the photovoltaic and semiconductor industries, with a market cap of approximately CN¥59.88 billion.

Operations: The company generates revenue of CN¥4.65 billion from its manufacturing and sales of polysilicon segment.

Estimated Discount To Fair Value: 15.3%

Xinjiang Daqo New Energy Ltd. trades at CN¥28.67, below its estimated fair value of CN¥33.85, suggesting potential undervaluation based on cash flows. Revenue is projected to grow 23.7% annually, outpacing the market's 14.5%. Despite a net loss of CN¥1,073.19 million for the first nine months of 2025 and ongoing litigation issues, the company is expected to achieve profitability within three years with significant earnings growth forecasts.

- Our earnings growth report unveils the potential for significant increases in Xinjiang Daqo New EnergyLtd's future results.

- Get an in-depth perspective on Xinjiang Daqo New EnergyLtd's balance sheet by reading our health report here.

Phison Electronics (TPEX:8299)

Overview: Phison Electronics Corp., along with its subsidiaries, designs, manufactures, and sells flash memory controllers and peripheral system applications globally, with a market cap of NT$219.55 billion.

Operations: Phison Electronics generates revenue through its design, manufacturing, and sales of flash memory controllers and peripheral system applications across various international markets.

Estimated Discount To Fair Value: 27.5%

Phison Electronics, trading at NT$1,125, is undervalued with a fair value estimate of NT$1,551.25. Despite recent earnings volatility due to large one-off items and a dividend not fully covered by free cash flows, the company's revenue is forecasted to grow 22.2% annually—outpacing the Taiwanese market's 13.7%. Recent product innovations in PCIe Gen5 SSDs and aiDAPTIV+ technology enhance its competitive edge in data-intensive applications and AI infrastructure solutions for federal agencies.

- Upon reviewing our latest growth report, Phison Electronics' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Phison Electronics with our detailed financial health report.

Make It Happen

- Access the full spectrum of 509 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688303

Xinjiang Daqo New EnergyLtd

Xinjiang Daquan New Energy Co., Ltd. engages in the research, development, production, and sale of polysilicon and silicon-based materials primarily for the photovoltaic and semiconductor industries.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.