- China

- /

- Semiconductors

- /

- SHSE:688256

Chinese Growth Stocks With High Insider Ownership For October 2024

Reviewed by Simply Wall St

In the midst of a volatile global landscape, Chinese markets have shown resilience, with significant gains in major indices driven by optimism around Beijing's supportive measures. As investors navigate these turbulent times, identifying growth companies with high insider ownership can offer insights into potential stability and confidence within the market.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.6% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Here we highlight a subset of our preferred stocks from the screener.

Cambricon Technologies (SHSE:688256)

Simply Wall St Growth Rating: ★★★★★☆

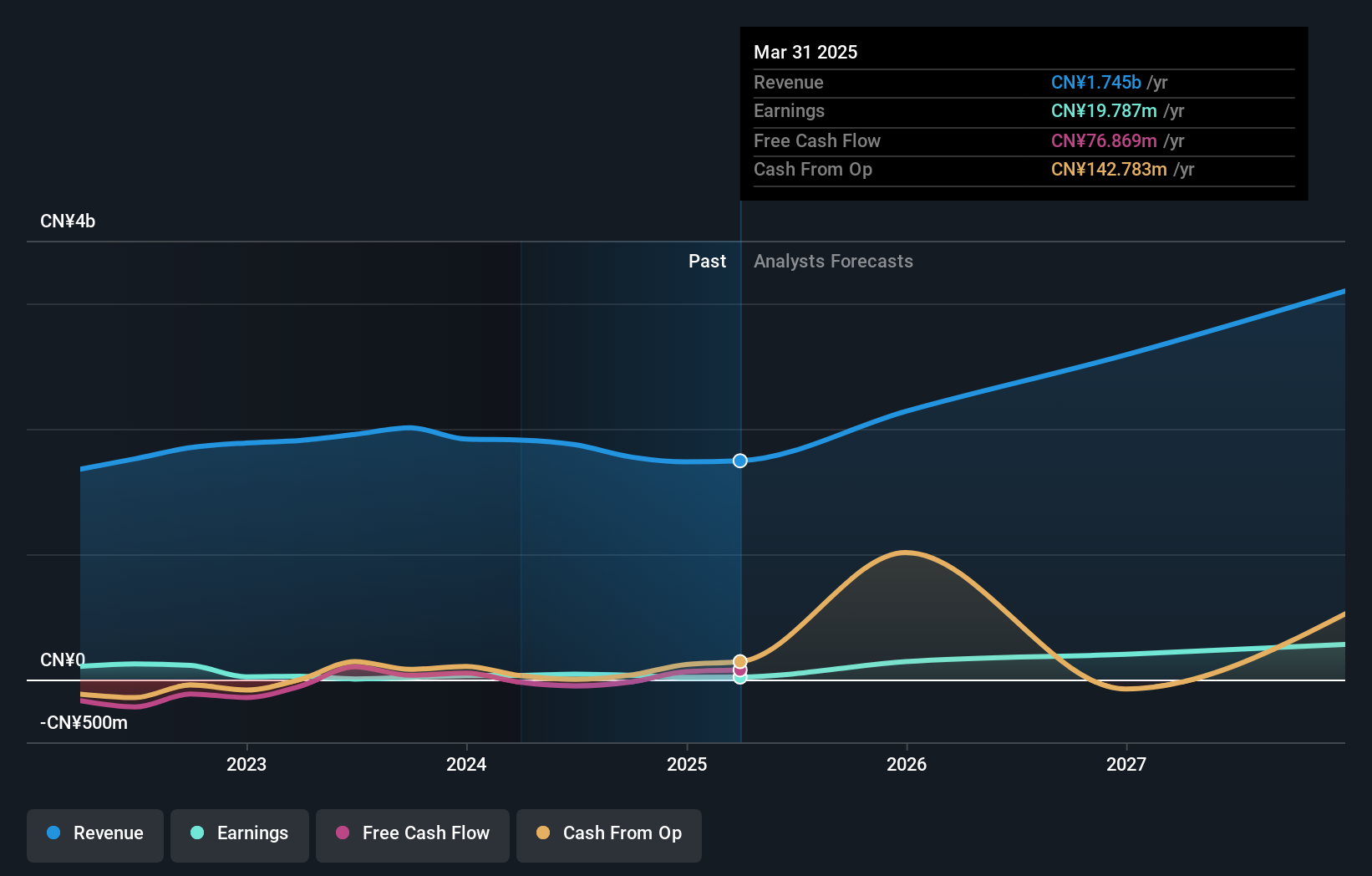

Overview: Cambricon Technologies Corporation Limited focuses on researching, developing, designing, and selling core chips for cloud servers, edge computing, and terminal equipment in China with a market cap of CN¥144.41 billion.

Operations: Cambricon Technologies generates revenue from its core chip offerings across cloud server, edge computing, and terminal equipment sectors in China.

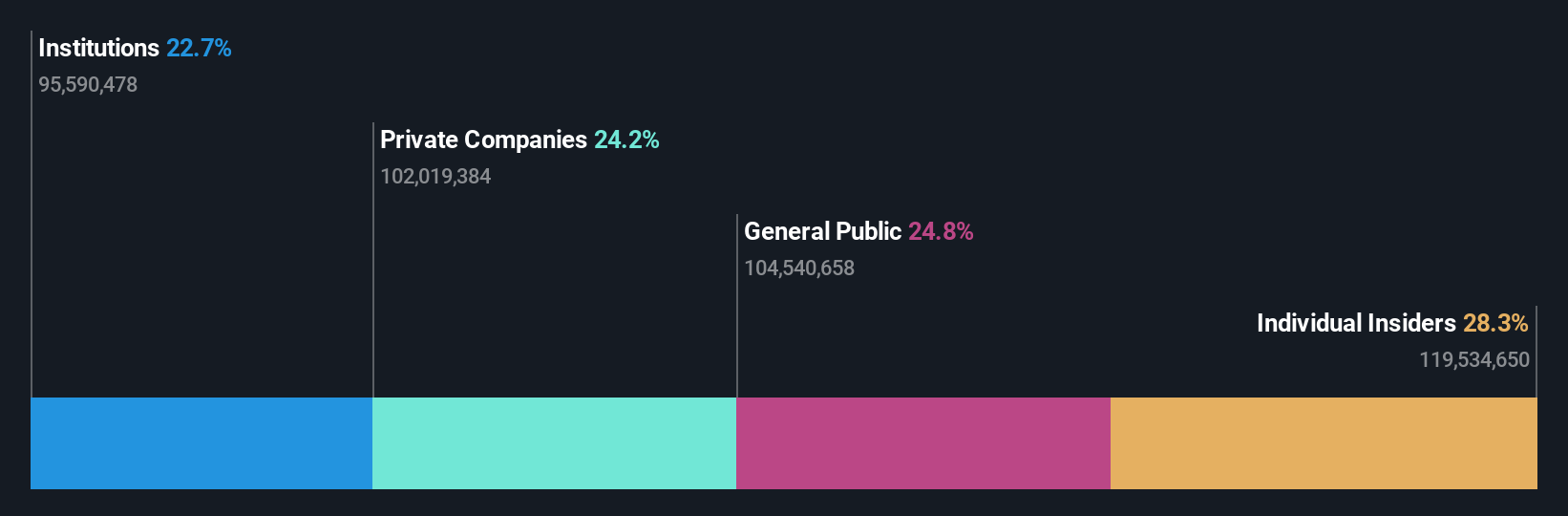

Insider Ownership: 28.8%

Earnings Growth Forecast: 60.3% p.a.

Cambricon Technologies is experiencing significant revenue growth, forecasted at 42.7% annually, outpacing the broader Chinese market. Despite this, recent earnings reports show a decline in sales to CNY 64.77 million and a net loss of CNY 530.11 million for H1 2024. The company has announced a share buyback program up to CNY 40 million but has yet to repurchase any shares, indicating potential caution or strategic reassessment amidst high volatility and insider ownership considerations.

- Dive into the specifics of Cambricon Technologies here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Cambricon Technologies is priced higher than what may be justified by its financials.

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. (SHSE:688498) operates in the semiconductor industry and has a market cap of approximately CN¥12.19 billion.

Operations: I'm sorry, but it seems there is no specific revenue segment information provided in the text you shared. If you have more detailed data on revenue segments, feel free to share it for a more accurate summary.

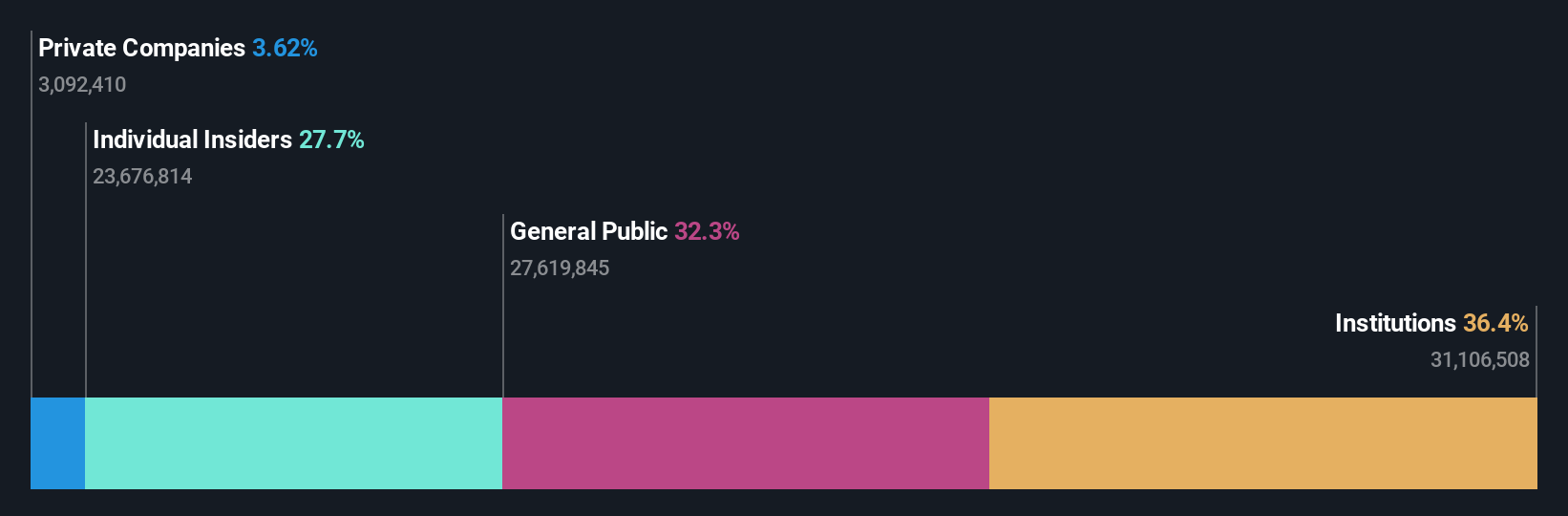

Insider Ownership: 27.7%

Earnings Growth Forecast: 73.1% p.a.

Yuanjie Semiconductor Technology is poised for substantial growth, with revenue projected to increase by 41.1% annually, surpassing the Chinese market's average. Despite a decline in net income to CNY 10.75 million for H1 2024, the company remains committed to enhancing shareholder value through its completed share buyback of CNY 55.41 million. Recent inclusion in the S&P Global BMI Index underscores its rising prominence, although highly volatile share prices may pose challenges ahead.

- Navigate through the intricacies of Yuanjie Semiconductor Technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Yuanjie Semiconductor Technology implies its share price may be too high.

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. offers banking software and technology services to the global banking and finance sector, with a market cap of CN¥10.79 billion.

Operations: Shenzhen Sunline Tech Co., Ltd.'s revenue primarily stems from providing software and technology services to the banking and finance industry worldwide.

Insider Ownership: 21.8%

Earnings Growth Forecast: 37% p.a.

Shenzhen Sunline Tech is experiencing significant earnings growth, projected at 37% annually, outpacing the Chinese market's average. Despite a slight revenue decline to CNY 704.24 million for H1 2024, net income improved to CNY 1.84 million from a loss last year. The company recently amended its bylaws and registered capital, indicating strategic shifts amidst high insider ownership but faces challenges with past shareholder dilution and share price volatility.

- Click to explore a detailed breakdown of our findings in Shenzhen Sunline Tech's earnings growth report.

- The valuation report we've compiled suggests that Shenzhen Sunline Tech's current price could be inflated.

Seize The Opportunity

- Embark on your investment journey to our 377 Fast Growing Chinese Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688256

Cambricon Technologies

Research, develops, design, and sells core chips in cloud server, edge computing, and terminal equipment in China.

Flawless balance sheet with high growth potential.