- China

- /

- Metals and Mining

- /

- SHSE:600399

Undiscovered Gems Featuring 3 Top Small Cap Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets show resilience with U.S. indices nearing record highs and smaller-cap indexes outperforming large-caps, investors are increasingly turning their attention to the potential opportunities within the small-cap sector. In this environment, identifying promising small-cap stocks can be crucial for those looking to capitalize on broad-based gains, as these companies often offer unique growth prospects driven by innovative business models and niche market positions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 40.67% | 12.22% | 22.08% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Fushun Special SteelLTD (SHSE:600399)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fushun Special Steel Co., LTD. is a company that manufactures and sells steel products both in China and internationally, with a market capitalization of CN¥12.86 billion.

Operations: Fushun Special Steel generates revenue primarily through the sale of steel products domestically and internationally. The company's net profit margin is a key financial metric to consider when assessing its profitability.

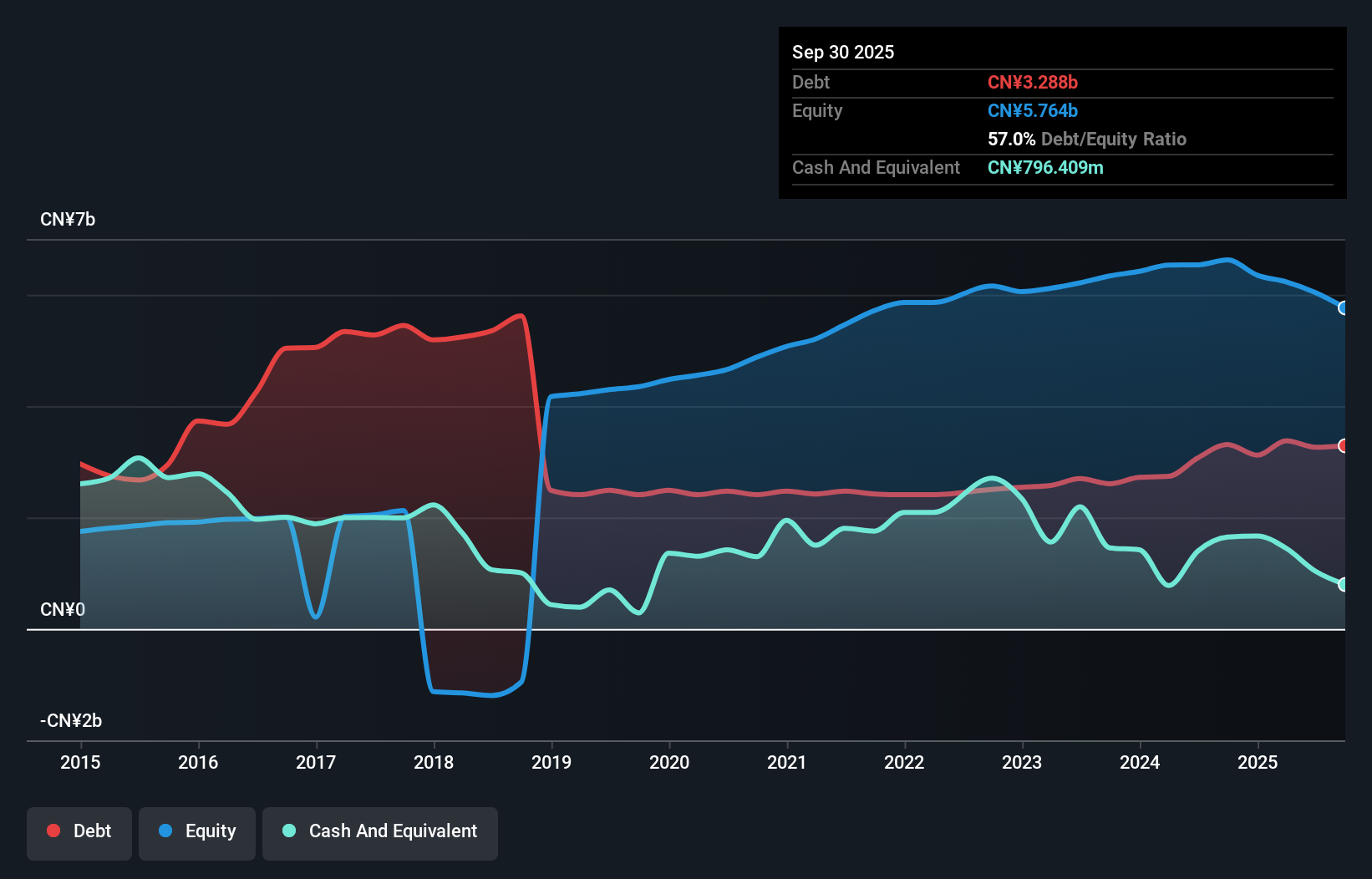

Fushun Special Steel, a notable player in the steel industry, showcases impressive financial metrics. Its earnings growth of 120% over the past year outpaces the broader Metals and Mining sector's -2.7%, highlighting robust performance. The company's net debt to equity ratio stands at a satisfactory 25%, reflecting prudent financial management over five years as it dropped from 55%. With earnings per share rising from CNY 0.143 to CNY 0.160, profitability is evident despite negative free cash flow trends recently observed. A recent buyback of shares worth CNY 70 million further indicates strategic capital allocation efforts aimed at enhancing shareholder value.

- Delve into the full analysis health report here for a deeper understanding of Fushun Special SteelLTD.

Evaluate Fushun Special SteelLTD's historical performance by accessing our past performance report.

Jadard Technology (SHSE:688252)

Simply Wall St Value Rating: ★★★★★★

Overview: Jadard Technology Inc. specializes in the manufacturing and sale of mobile terminal ICs, electronic price tag solutions, and IoT equipment ICs, with a market cap of CN¥9.31 billion.

Operations: Jadard Technology generates revenue primarily from its electronic components and parts segment, amounting to CN¥1.87 billion.

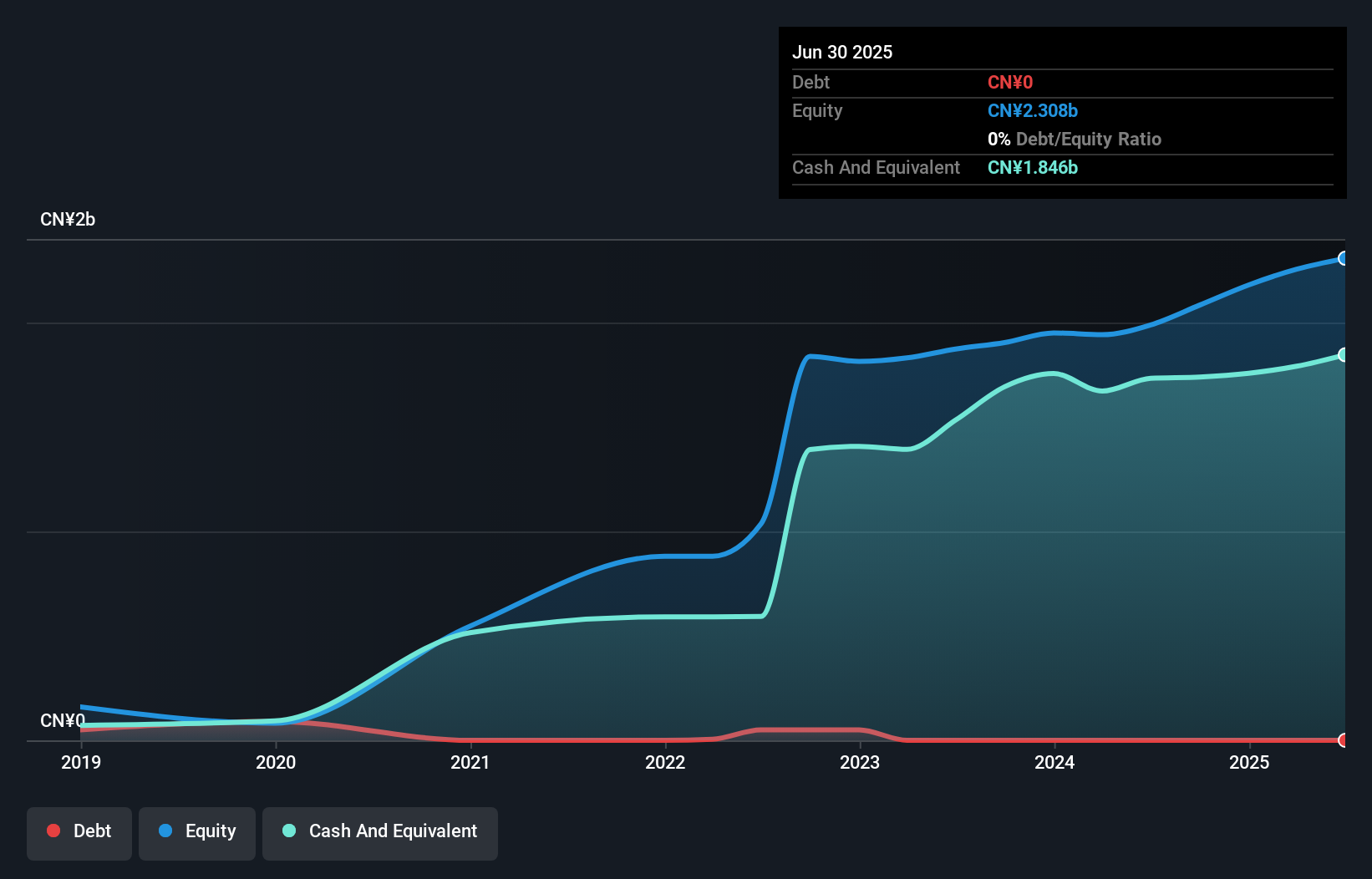

Jadard Technology, a nimble player in the semiconductor space, stands out with its debt-free status and impressive earnings growth of 377.7% over the past year, far surpassing the industry average of 12.1%. Its Price-To-Earnings ratio at 40.5x is notably lower than the sector's average of 62.2x, suggesting it trades at a favorable value compared to peers. Despite recent share price volatility, Jadard's financial health seems robust with high-quality non-cash earnings and free cash flow positivity. Recent earnings reports show net income climbing to CNY 191.99 million from CNY 74.83 million last year, signaling strong performance momentum.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou DPtech Technologies Co., Ltd. focuses on the research, development, production, and sale of network security and application delivery products both in China and internationally, with a market cap of CN¥11.94 billion.

Operations: DPtech generates revenue primarily from the sale of network security and application delivery products. The company's net profit margin was recorded at 12.5% in the most recent financial period, reflecting its ability to manage costs effectively relative to its sales.

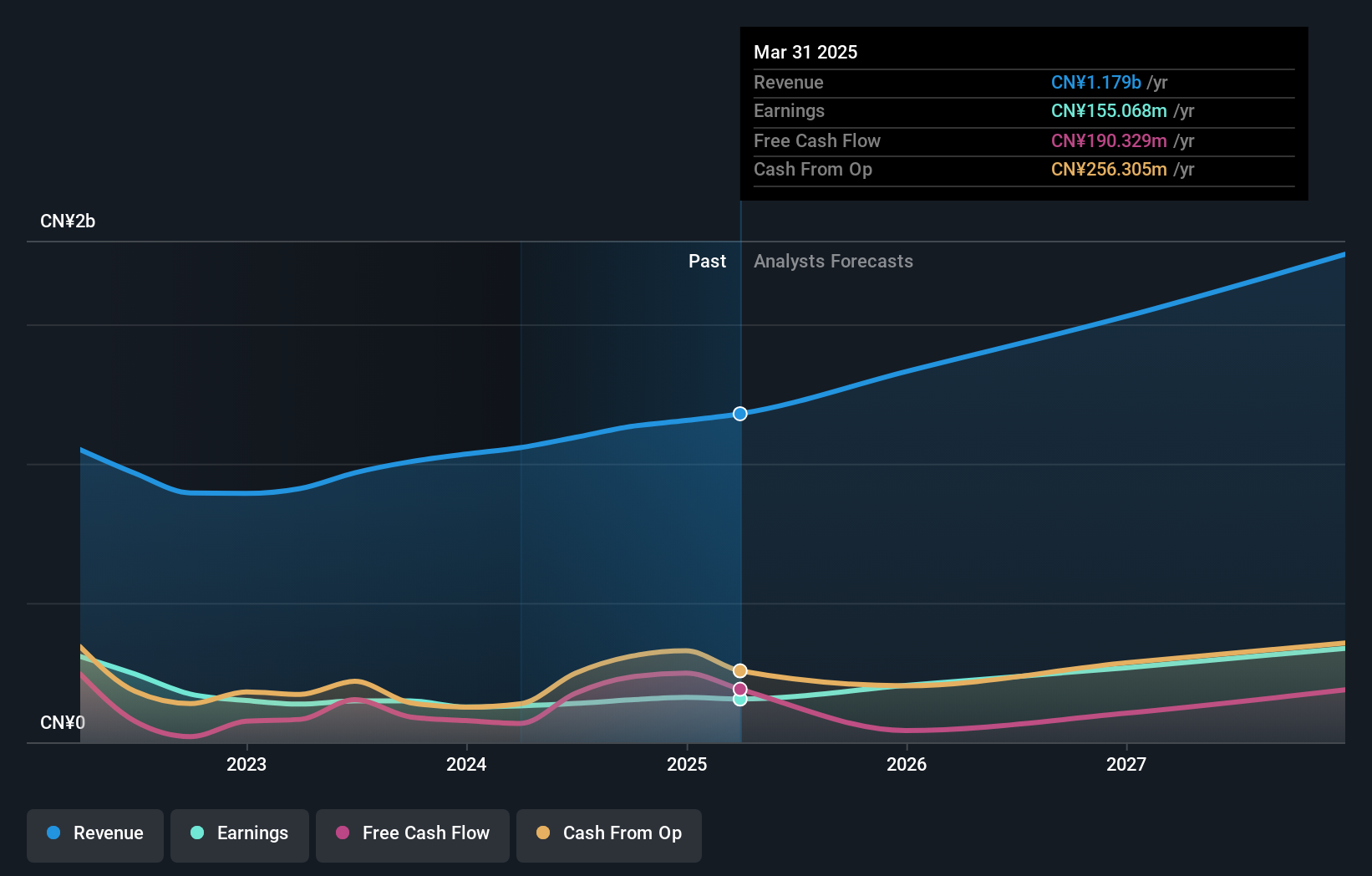

Hangzhou DPtech Technologies, a nimble player in the tech arena, is debt-free and showcases high-quality earnings. Over the past year, its earnings rose by 2.2%, outpacing the software industry's -11.2% performance dip. The company's shares trade at a discount of 11.6% below estimated fair value, hinting at potential upside for investors seeking value plays in smaller firms. Despite recent volatility in its share price, DPtech's financial health appears robust with positive free cash flow and no debt concerns over five years. Future growth looks promising with earnings expected to climb by 23.67% annually, providing an optimistic outlook for stakeholders.

Key Takeaways

- Access the full spectrum of 4615 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600399

Fushun Special SteelLTD

Manufactures and sells steel products in China and internationally.

Excellent balance sheet with proven track record.