- China

- /

- Semiconductors

- /

- SHSE:688252

Jadard Technology Inc.'s (SHSE:688252) Shares Climb 37% But Its Business Is Yet to Catch Up

Jadard Technology Inc. (SHSE:688252) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

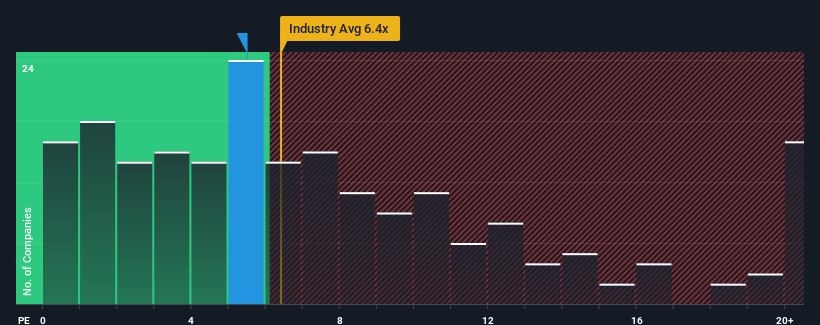

In spite of the firm bounce in price, there still wouldn't be many who think Jadard Technology's price-to-sales (or "P/S") ratio of 5.5x is worth a mention when the median P/S in China's Semiconductor industry is similar at about 6.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Jadard Technology

What Does Jadard Technology's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Jadard Technology's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Jadard Technology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Jadard Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. Even so, admirably revenue has lifted 93% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 28% over the next year. Meanwhile, the rest of the industry is forecast to expand by 37%, which is noticeably more attractive.

With this in mind, we find it intriguing that Jadard Technology's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Jadard Technology's P/S Mean For Investors?

Jadard Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Jadard Technology's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 1 warning sign for Jadard Technology that you need to take into consideration.

If these risks are making you reconsider your opinion on Jadard Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688252

Jadard Technology

Engages in the research, design, development, and sale of mobile smart terminals in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives