- China

- /

- Tech Hardware

- /

- SHSE:688583

Undiscovered Gems In Global Markets To Watch This March 2025

Reviewed by Simply Wall St

As global markets grapple with ongoing trade policy uncertainties and recession fears, small-cap stocks have been particularly impacted, with key indices like the S&P 600 experiencing notable declines. However, amidst this challenging environment, investors may find opportunities in lesser-known stocks that demonstrate resilience through strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.60% | 4.56% | 15.25% | ★★★★★★ |

| GakkyushaLtd | 18.84% | 4.73% | 16.81% | ★★★★★★ |

| Kanda HoldingsLtd | 27.19% | 4.45% | 15.53% | ★★★★★★ |

| Ad-Sol Nissin | NA | 7.54% | 9.63% | ★★★★★★ |

| AlpenLtd | 9.98% | 3.10% | -0.77% | ★★★★★★ |

| Kondotec | 11.26% | 7.01% | 7.06% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| GENOVA | 0.46% | 25.48% | 27.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

Overview: Rasan Information Technology Company is a financial technology firm offering insurance and financial services in the Kingdom of Saudi Arabia, with a market capitalization of SAR6.03 billion.

Operations: The company's primary revenue streams include leasing and the Tameeni platforms, with Tameeni - Motors generating SAR187.93 million and leasing contributing SAR77.92 million.

Rasan Information Technology, a small cap player, has been making waves with its impressive earnings growth of 84% over the past year, outpacing the insurance industry's -15%. The company is debt-free and boasts high-quality earnings. Despite recent share price volatility, Rasan's financial health seems robust with positive free cash flow reaching US$86.18 million as of March 2025. Notably added to major indices like S&P Pan Arab Composite and S&P Global BMI Index in December 2024, Rasan’s future prospects appear promising with revenue growth forecasted at 31% annually.

Giantec Semiconductor (SHSE:688123)

Simply Wall St Value Rating: ★★★★★☆

Overview: Giantec Semiconductor Corporation specializes in the manufacturing and sale of integrated circuits both within China and globally, with a market capitalization of CN¥12.85 billion.

Operations: Giantec Semiconductor generates revenue primarily from the integrated circuit design industry, amounting to CN¥1.03 billion. The company's market capitalization stands at CN¥12.85 billion.

Giantec Semiconductor stands out with impressive earnings growth of 188.5%, far surpassing the industry's 14.6% rise, and forecasts suggest a further 37% annual increase. The company reported net income of CNY 289.56 million for the past year, up from CNY 100.36 million, reflecting high-quality earnings and strong profitability with a price-to-earnings ratio of 45.8x, which is favorable compared to the industry average of 67.5x. Despite its volatile share price recently, Giantec's financial health appears robust with more cash than total debt and positive free cash flow indicating potential for continued growth in its niche market segment.

- Click here and access our complete health analysis report to understand the dynamics of Giantec Semiconductor.

Explore historical data to track Giantec Semiconductor's performance over time in our Past section.

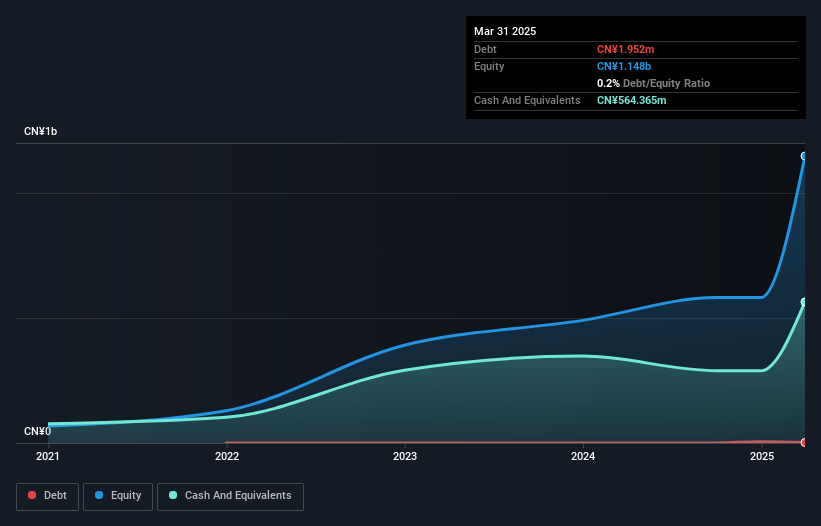

Scantech (HANGZHOU) (SHSE:688583)

Simply Wall St Value Rating: ★★★★★☆

Overview: Scantech (HANGZHOU) Co., Ltd. focuses on the research, development, production, and sale of 3D vision digital products in China and has a market capitalization of CN¥7.31 billion.

Operations: Scantech generates revenue primarily from the sale of 3D vision digital products. The company's net profit margin is 18.5%, reflecting its ability to convert a significant portion of revenue into profit.

Scantech (HANGZHOU) has recently made waves with its IPO, raising CNY 568.82 million, suggesting strong market interest. The company reported a sales increase to CNY 334.54 million from CNY 271.71 million the previous year, while net income rose to CNY 121.28 million from CNY 114.26 million, reflecting a steady growth trajectory with earnings per share at CNY 2.38 compared to last year's CNY 2.24. Despite a volatile share price in recent months, Scantech's earnings growth of 6% outpaces the tech industry's average decline of -0.7%, and it maintains more cash than total debt, indicating financial stability amidst expansion efforts.

- Click here to discover the nuances of Scantech (HANGZHOU) with our detailed analytical health report.

Gain insights into Scantech (HANGZHOU)'s past trends and performance with our Past report.

Seize The Opportunity

- Click here to access our complete index of 3232 Global Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688583

Scantech (HANGZHOU)

Engages in research, development, production, and sale of 3D vision digital products in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives