As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are keenly observing shifts in major indices like the S&P 500 and Nasdaq Composite. In this environment, identifying undervalued stocks can be crucial for those looking to capitalize on market inefficiencies, especially when large-cap and growth stocks show resilience amidst broader declines.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trimegah Bangun Persada (IDX:NCKL) | IDR890.00 | IDR1777.58 | 49.9% |

| Provident Financial Services (NYSE:PFS) | US$19.03 | US$37.92 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.27 | US$168.24 | 49.9% |

| California Resources (NYSE:CRC) | US$52.32 | US$104.35 | 49.9% |

| Geovis TechnologyLtd (SHSE:688568) | CN¥40.77 | CN¥81.16 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Enento Group Oyj (HLSE:ENENTO) | €18.40 | €36.57 | 49.7% |

| ChromaDex (NasdaqCM:CDXC) | US$3.58 | US$7.15 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Türkiye Is Bankasi (IBSE:ISCTR)

Overview: Türkiye Is Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY354.87 billion.

Operations: The company's revenue is primarily derived from Corporate/Commercial Banking (TRY142.67 billion), Treasury Transaction/Investment Activities (TRY104.34 billion), and Insurance and Reinsurance Activities (TRY48.37 billion).

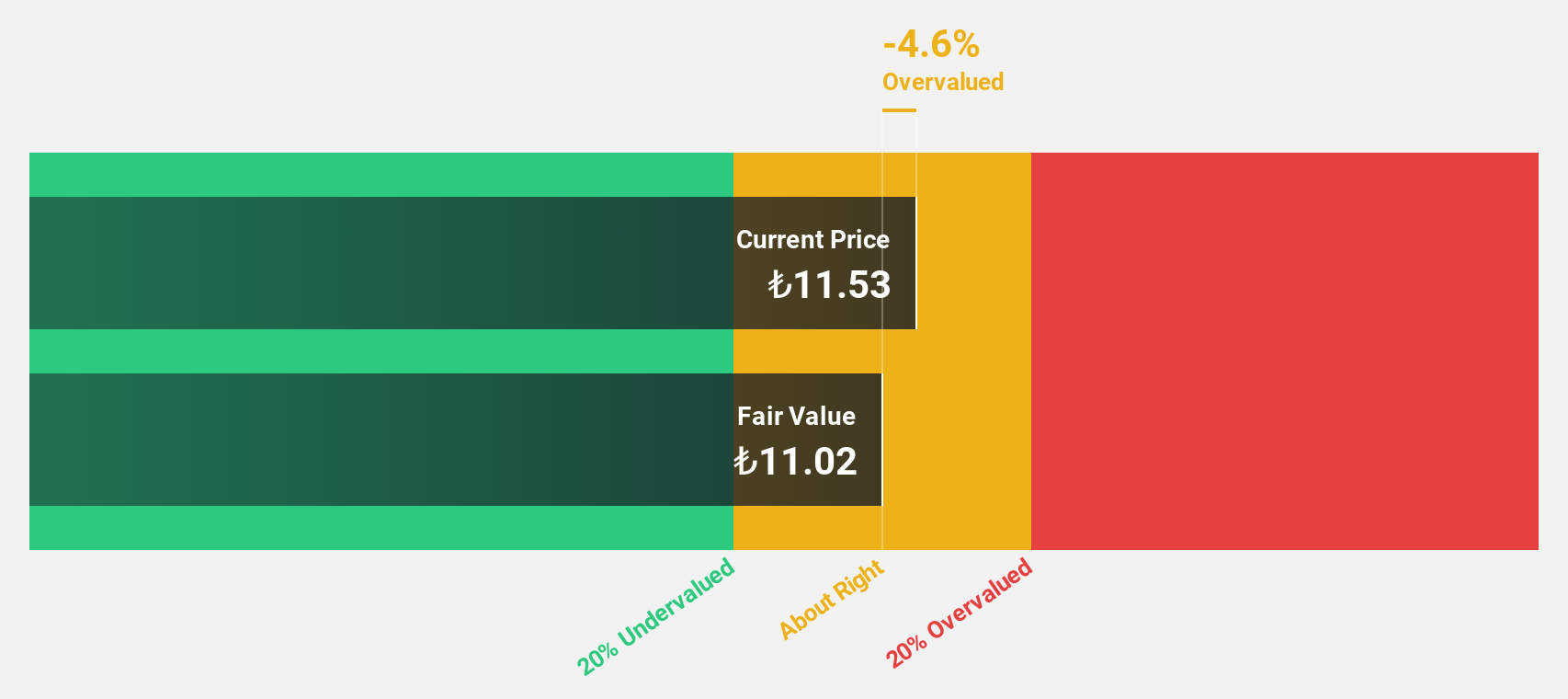

Estimated Discount To Fair Value: 25.7%

Türkiye Is Bankasi is trading at TRY12.05, significantly below its estimated fair value of TRY16.21, suggesting it is undervalued based on cash flows. Analysts anticipate a 48.7% rise in stock price, supported by strong earnings growth forecasts of 35% annually over the next three years, outpacing the Turkish market average. Despite a high level of non-performing loans at 2.2%, its return on equity is projected to reach 31.4%, indicating robust future profitability potential.

- Our comprehensive growth report raises the possibility that Türkiye Is Bankasi is poised for substantial financial growth.

- Navigate through the intricacies of Türkiye Is Bankasi with our comprehensive financial health report here.

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers a range of banking products and services both in Turkey and internationally, with a market cap of TRY211.35 billion.

Operations: The company generates revenue from several segments, including Retail Banking (Incl. Private Banking and Wealth Management) at TRY77.46 billion, Commercial and SME Banking at TRY52.24 billion, Corporate Banking at TRY13.70 billion, Other Domestic Operations at TRY11.36 billion, Treasury, Asset Liability Management and Other at TRY4.47 billion, and Other Foreign Operations at TRY4.50 billion.

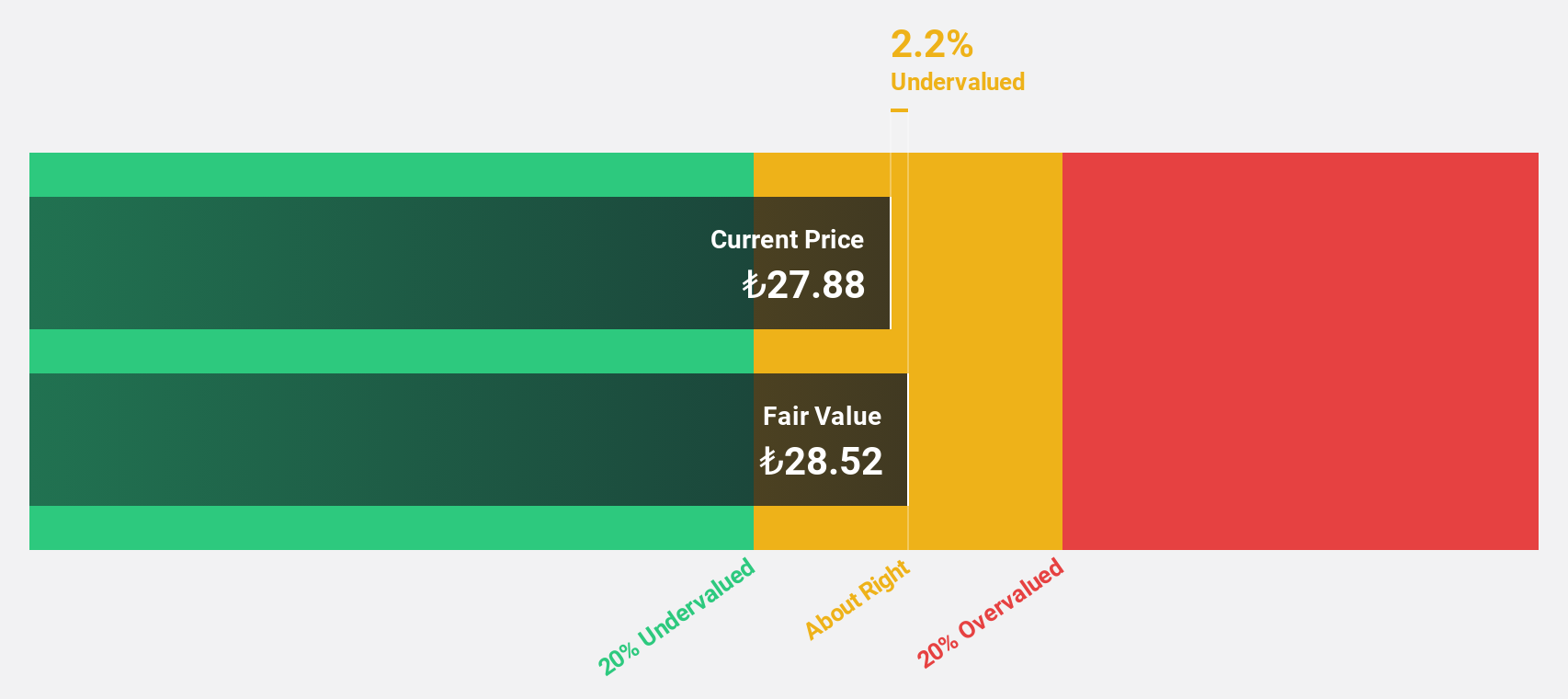

Estimated Discount To Fair Value: 34.9%

Yapi ve Kredi Bankasi, trading at TRY25.02, is undervalued relative to its fair value of TRY38.45. Analysts project a 55.4% stock price increase with revenue growth expected to outpace the Turkish market at 35.8% annually, despite earnings growing slower than the market average. The bank's return on equity is forecasted to reach a robust 34.8%, though it faces challenges with a high bad loans ratio of 2.6%.

- Insights from our recent growth report point to a promising forecast for Yapi ve Kredi Bankasi's business outlook.

- Dive into the specifics of Yapi ve Kredi Bankasi here with our thorough financial health report.

Hwatsing Technology (SHSE:688120)

Overview: Hwatsing Technology Co., Ltd. is a Chinese company that manufactures semiconductor equipment products and has a market cap of approximately CN¥43.76 billion.

Operations: Hwatsing Technology Co., Ltd. generates its revenue primarily from the manufacturing and sale of semiconductor equipment products in China.

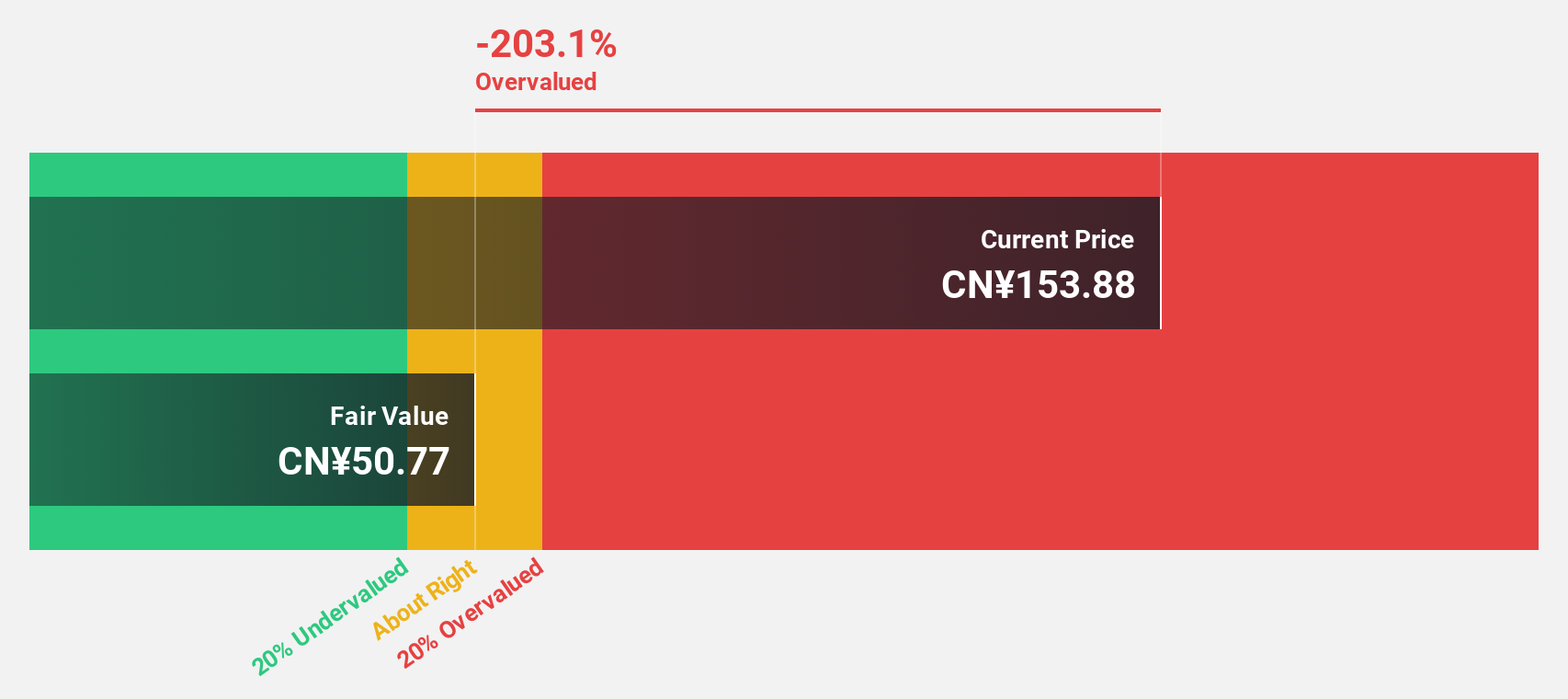

Estimated Discount To Fair Value: 19.8%

Hwatsing Technology, trading at CNY 185, is undervalued compared to its fair value of CNY 230.79. The company reported sales of CNY 2.45 billion for the nine months ended September 2024, up from CNY 1.84 billion a year ago, with net income rising to CNY 720.7 million from CNY 563.93 million. Despite high share price volatility recently, earnings are projected to grow significantly at over 26% annually, outpacing the Chinese market average growth rate.

- In light of our recent growth report, it seems possible that Hwatsing Technology's financial performance will exceed current levels.

- Get an in-depth perspective on Hwatsing Technology's balance sheet by reading our health report here.

Summing It All Up

- Delve into our full catalog of 959 Undervalued Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Türkiye Is Bankasi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ISCTR

Türkiye Is Bankasi

Provides various banking products and services in Turkey.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives