- China

- /

- Semiconductors

- /

- SHSE:688018

Espressif Systems (Shanghai) Co., Ltd. (SHSE:688018) Stock Rockets 36% As Investors Are Less Pessimistic Than Expected

Espressif Systems (Shanghai) Co., Ltd. (SHSE:688018) shares have continued their recent momentum with a 36% gain in the last month alone. The annual gain comes to 137% following the latest surge, making investors sit up and take notice.

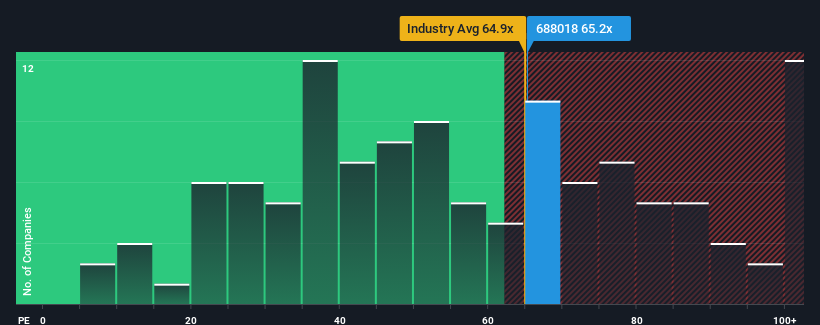

After such a large jump in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 37x, you may consider Espressif Systems (Shanghai) as a stock to avoid entirely with its 65.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Espressif Systems (Shanghai) has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Espressif Systems (Shanghai)

Is There Enough Growth For Espressif Systems (Shanghai)?

The only time you'd be truly comfortable seeing a P/E as steep as Espressif Systems (Shanghai)'s is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 244% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 79% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 15% as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

With this information, we find it concerning that Espressif Systems (Shanghai) is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Shares in Espressif Systems (Shanghai) have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Espressif Systems (Shanghai)'s analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 1 warning sign for Espressif Systems (Shanghai) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Espressif Systems (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688018

Espressif Systems (Shanghai)

A fabless semiconductor company, develops and sells cutting-edge and low-power wireless communication chipsets in China and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026