- China

- /

- Electrical

- /

- SZSE:300913

Top Asian Growth Companies With High Insider Ownership In May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, Asian economies are also experiencing shifts that present unique opportunities for investors. In this environment, growth companies with high insider ownership can offer compelling prospects, as they often benefit from strong alignment between management and shareholder interests, which can be particularly advantageous during periods of market uncertainty.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.0% |

| WinWay Technology (TWSE:6515) | 22.1% | 21.4% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.8% |

| giftee (TSE:4449) | 34.5% | 67.1% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's dive into some prime choices out of the screener.

Shenghe Resources Holding (SHSE:600392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenghe Resources Holding Co., Ltd is involved in the research, development, production, and supply of rare earth and related products both in China and internationally, with a market cap of CN¥20.74 billion.

Operations: Shenghe Resources Holding Co., Ltd generates its revenue primarily through the research, development, production, and supply of rare earth and related products across domestic and international markets.

Insider Ownership: 13.5%

Revenue Growth Forecast: 27.9% p.a.

Shenghe Resources Holding has demonstrated substantial growth, with earnings surging by a very large amount over the past year. Forecasts suggest continued robust revenue and earnings growth, outpacing the Chinese market. However, its dividend yield of 1.01% is not well covered by free cash flows, and recent financial results have been influenced by significant one-off items. Despite a lower price-to-earnings ratio than the market average, its return on equity is expected to remain modest at 10.1%.

- Click here to discover the nuances of Shenghe Resources Holding with our detailed analytical future growth report.

- Our expertly prepared valuation report Shenghe Resources Holding implies its share price may be too high.

Jiangsu Pacific Quartz (SHSE:603688)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Pacific Quartz Co., Ltd. focuses on the research, development, manufacture, marketing, and sale of quartz materials in China with a market capitalization of CN¥18.23 billion.

Operations: The company's revenue segments include the production and sale of quartz materials in China.

Insider Ownership: 31.6%

Revenue Growth Forecast: 44.2% p.a.

Jiangsu Pacific Quartz's recent earnings report showed a decline in sales and net income, with first-quarter sales at CNY 253.84 million and net income at CNY 52.75 million. Despite this, the company is expected to experience significant revenue growth of 44.2% annually, surpassing the Chinese market average of 12.6%. Earnings are also forecasted to grow significantly at 60.5% per year over the next three years, outpacing market expectations despite current profit margin compression from last year's figures.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangsu Pacific Quartz.

- Our valuation report here indicates Jiangsu Pacific Quartz may be overvalued.

Zhejiang Zhaolong Interconnect TechnologyLtd (SZSE:300913)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Zhaolong Interconnect Technology Co., Ltd. operates in the technology sector with a market capitalization of CN¥12.72 billion.

Operations: The company's revenue from the digital communication cable industry is CN¥1.91 billion.

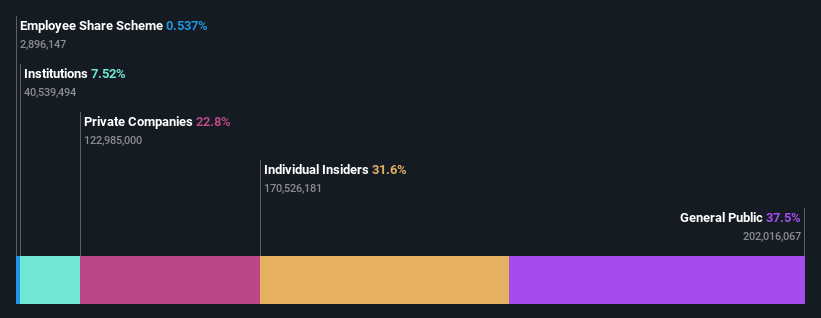

Insider Ownership: 24.3%

Revenue Growth Forecast: 21% p.a.

Zhejiang Zhaolong Interconnect Technology reported strong first-quarter results, with sales rising to CNY 448.13 million and net income increasing to CNY 32.59 million. Despite a highly volatile share price recently, the company's revenue is forecasted to grow at 21% annually, outpacing the Chinese market's average growth rate of 12.6%. Earnings are also expected to grow significantly at 24.42% per year over the next three years, indicating robust growth potential despite low forecasted return on equity.

- Get an in-depth perspective on Zhejiang Zhaolong Interconnect TechnologyLtd's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Zhejiang Zhaolong Interconnect TechnologyLtd's current price could be inflated.

Taking Advantage

- Click through to start exploring the rest of the 620 Fast Growing Asian Companies With High Insider Ownership now.

- Ready For A Different Approach? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Zhejiang Zhaolong Interconnect TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Zhaolong Interconnect TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300913

Zhejiang Zhaolong Interconnect TechnologyLtd

Zhejiang Zhaolong Interconnect Technology Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives