- China

- /

- Semiconductors

- /

- SHSE:603688

Jiangsu Pacific Quartz's (SHSE:603688) earnings growth rate lags the 15% CAGR delivered to shareholders

While Jiangsu Pacific Quartz Co., Ltd (SHSE:603688) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 11% in the last quarter. On the bright side the returns have been quite good over the last half decade. Its return of 77% has certainly bested the market return! Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 41% decline over the last twelve months.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Jiangsu Pacific Quartz

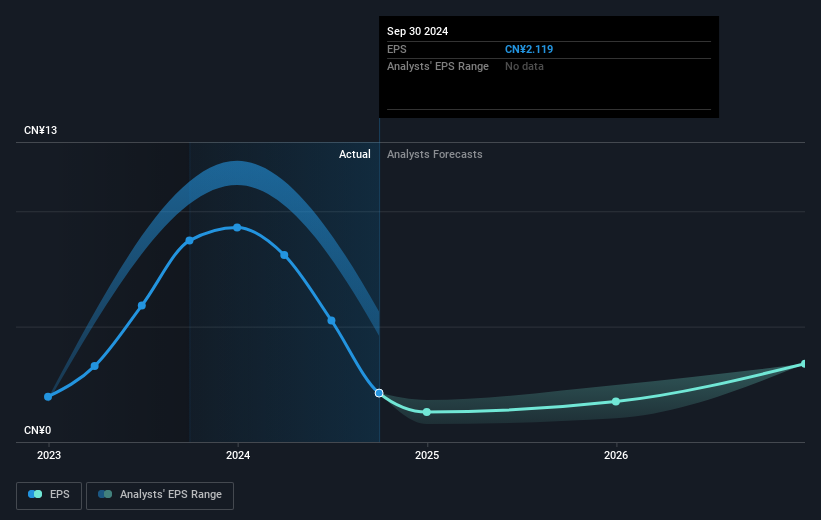

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Jiangsu Pacific Quartz managed to grow its earnings per share at 47% a year. This EPS growth is higher than the 12% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Jiangsu Pacific Quartz has grown profits over the years, but the future is more important for shareholders. This free interactive report on Jiangsu Pacific Quartz's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Jiangsu Pacific Quartz's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Jiangsu Pacific Quartz's TSR of 101% over the last 5 years is better than the share price return.

A Different Perspective

Jiangsu Pacific Quartz shareholders are down 36% for the year, but the market itself is up 21%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 15% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on Jiangsu Pacific Quartz you might want to consider these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603688

Jiangsu Pacific Quartz

Engages in the research and development, manufacture, marketing, and sale of quartz materials in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives