- China

- /

- General Merchandise and Department Stores

- /

- SZSE:002640

3 Promising Penny Stocks With Market Caps Over US$400M

Reviewed by Simply Wall St

As global markets react to rising U.S. Treasury yields, the S&P 500 has seen a downturn after weeks of gains, while growth stocks continue to outperform value stocks. In this context, penny stocks—though often considered niche investments—remain relevant for those seeking potential growth opportunities in smaller or newer companies. By focusing on penny stocks with strong financial health, investors can uncover promising candidates that offer a mix of affordability and long-term potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$495.14M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.32 | THB1.88B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.765 | £473.73M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.125 | £806.26M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.12 | £426.67M | ★★★★☆☆ |

Click here to see the full list of 5,796 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ming Yuan Cloud Group Holdings Limited is an investment holding company that offers software solutions for property developers in China, with a market cap of HK$4.78 billion.

Operations: The company's revenue is derived from Cloud Services, generating CN¥1.32 billion, and On-premise Software and Services, contributing CN¥281.71 million.

Market Cap: HK$4.78B

Ming Yuan Cloud Group Holdings, with a market cap of HK$4.78 billion, is navigating the challenges typical of its sector. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a strong cash position with short-term assets significantly exceeding liabilities and no debt burden. The company reported revenues of CN¥720.11 million for the first half of 2024 but posted a net loss of CN¥115.37 million, showing improvement from previous periods. Recent board changes include appointing Ms. Wen Hongmei as an independent director, potentially bringing fresh financial expertise to the company’s leadership team amidst ongoing volatility in its share price.

- Take a closer look at Ming Yuan Cloud Group Holdings' potential here in our financial health report.

- Review our growth performance report to gain insights into Ming Yuan Cloud Group Holdings' future.

Lanzhou Lishang Guochao Industrial GroupLtd (SHSE:600738)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lanzhou Lishang Guochao Industrial Group Co., Ltd operates department stores in China and internationally, with a market capitalization of CN¥3.14 billion.

Operations: Lanzhou Lishang Guochao Industrial Group Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥3.14B

Lanzhou Lishang Guochao Industrial Group has shown a mixed financial picture, with earnings for the nine months ending September 30, 2024, reporting net income of CN¥107.48 million despite sales declining to CN¥516.2 million from the previous year. The company's debt management appears prudent, with a satisfactory net debt to equity ratio of 22.9% and interest payments well covered by EBIT at 50.3x coverage. However, short-term assets do not cover liabilities, indicating potential liquidity concerns. Earnings growth over the past year was significant at 166.5%, surpassing industry averages and highlighting improved profitability metrics like profit margins rising to 16%.

- Click here to discover the nuances of Lanzhou Lishang Guochao Industrial GroupLtd with our detailed analytical financial health report.

- Gain insights into Lanzhou Lishang Guochao Industrial GroupLtd's future direction by reviewing our growth report.

Global Top E-Commerce (SZSE:002640)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Global Top E-Commerce Co., Ltd. operates in the cross-border e-commerce sector across several countries including the United States, Canada, and major European markets, with a market cap of CN¥4.81 billion.

Operations: There are no reported revenue segments for Global Top E-Commerce Co., Ltd.

Market Cap: CN¥4.81B

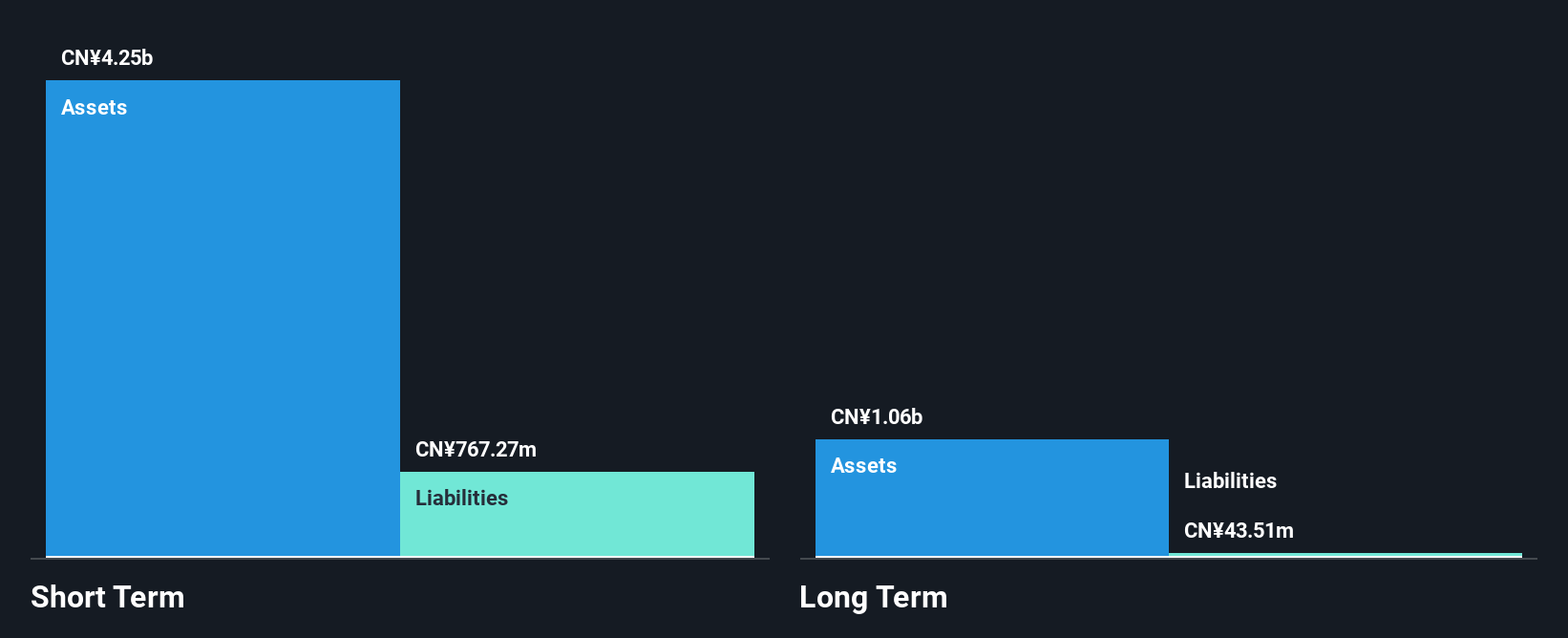

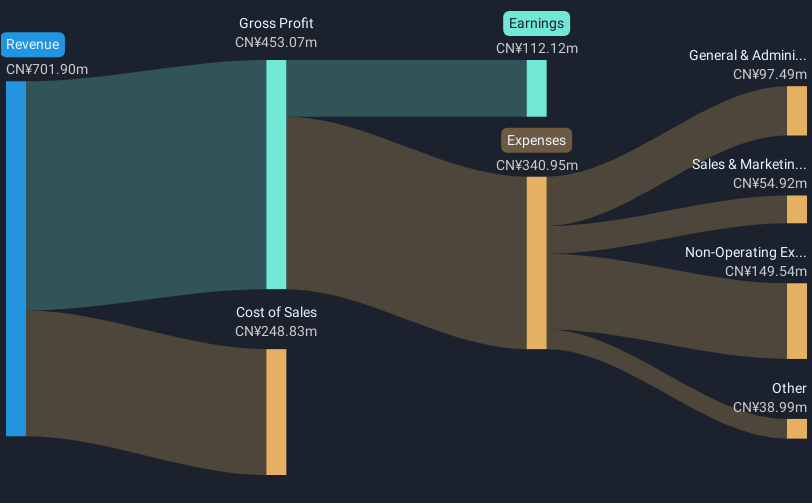

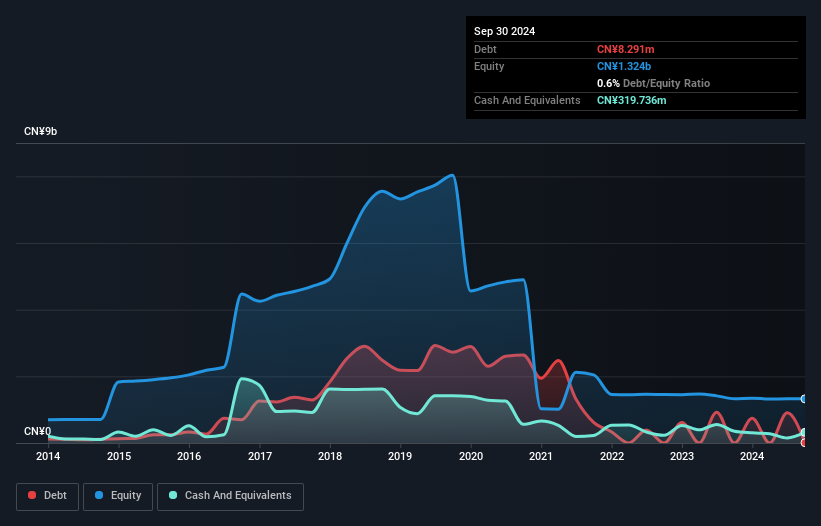

Global Top E-Commerce Co., Ltd. has faced challenges with declining sales, reporting CN¥4.2 billion for the nine months ending September 30, 2024, down from CN¥5 billion a year earlier. Despite this, the company maintains a strong financial position with short-term assets of CN¥2.1 billion exceeding both short and long-term liabilities. It has demonstrated prudent cash management, possessing more cash than total debt and maintaining a positive free cash flow sufficient for over three years of runway. Recent share buybacks totaling CN¥15.1 million indicate efforts to bolster investor confidence amidst ongoing volatility in its stock price.

- Unlock comprehensive insights into our analysis of Global Top E-Commerce stock in this financial health report.

- Understand Global Top E-Commerce's track record by examining our performance history report.

Key Takeaways

- Click through to start exploring the rest of the 5,793 Penny Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002640

Global Top E-Commerce

Engages in the cross-border e-commerce business in the People’s Republic of China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives