- China

- /

- Specialty Stores

- /

- SZSE:002024

Asian Value Stocks That Might Be Trading Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets navigate the complexities of shifting interest rates and economic uncertainties, Asia's financial landscape presents intriguing opportunities for investors seeking value. In this environment, identifying stocks that may be trading below their estimated worth requires a keen understanding of market fundamentals and an eye for potential growth amidst prevailing challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tianqi Lithium (SZSE:002466) | CN¥51.64 | CN¥101.91 | 49.3% |

| Taiwan Union Technology (TPEX:6274) | NT$443.00 | NT$867.93 | 49% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.20 | HK$16.17 | 49.3% |

| NEXON Games (KOSDAQ:A225570) | ₩12510.00 | ₩24473.30 | 48.9% |

| Mobvista (SEHK:1860) | HK$15.70 | HK$30.71 | 48.9% |

| Meitu (SEHK:1357) | HK$7.50 | HK$14.65 | 48.8% |

| KIYO LearningLtd (TSE:7353) | ¥700.00 | ¥1383.95 | 49.4% |

| H.U. Group Holdings (TSE:4544) | ¥3319.00 | ¥6592.59 | 49.7% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩449500.00 | ₩891938.16 | 49.6% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥264.26 | CN¥515.52 | 48.7% |

Let's dive into some prime choices out of the screener.

Binjiang Service Group (SEHK:3316)

Overview: Binjiang Service Group Co. Ltd. offers property management and related services in the People's Republic of China, with a market cap of HK$6.97 billion.

Operations: The company generates revenue through three main segments: Property Management Services (CN¥2.19 billion), Value-added Services (CN¥1.26 billion), and Value-added Services to Non-property Owners (CN¥528.80 million).

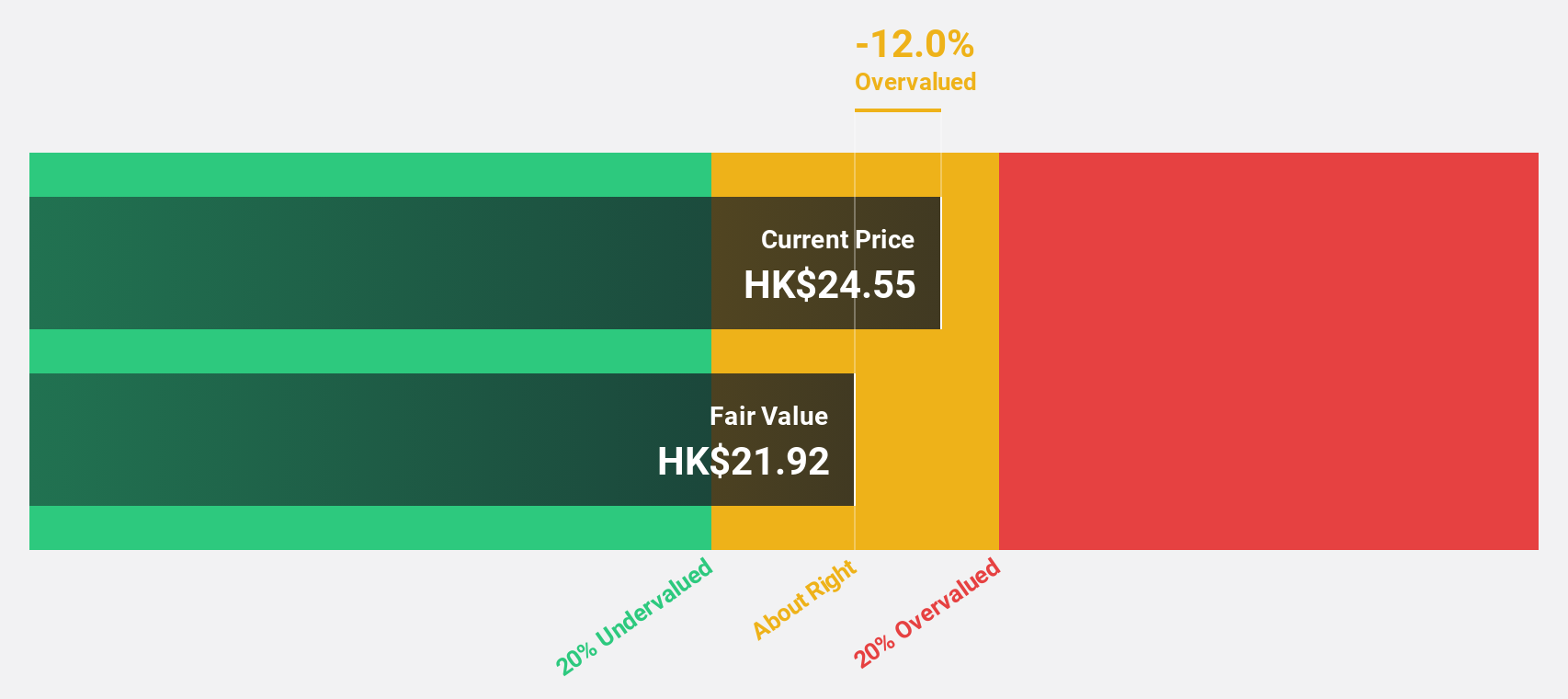

Estimated Discount To Fair Value: 26.7%

Binjiang Service Group is trading at HK$25.2, significantly below its estimated fair value of HK$34.37, making it potentially undervalued based on cash flows. Analysts agree on a potential price rise of 30.5%. Despite an unstable dividend record, the company's Return on Equity is forecast to reach 37.2% in three years. Revenue and earnings are expected to grow faster than the Hong Kong market, although not at a significant rate above 20% annually.

- Our earnings growth report unveils the potential for significant increases in Binjiang Service Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Binjiang Service Group.

Xiaocaiyuan International Holding (SEHK:999)

Overview: Xiaocaiyuan International Holding Ltd. is an investment holding company that operates in the restaurant business in the People's Republic of China, with a market capitalization of approximately HK$11.28 billion.

Operations: The company generates revenue primarily from its restaurant operations, amounting to CN¥3.23 billion, and its delivery business, contributing CN¥2.13 billion.

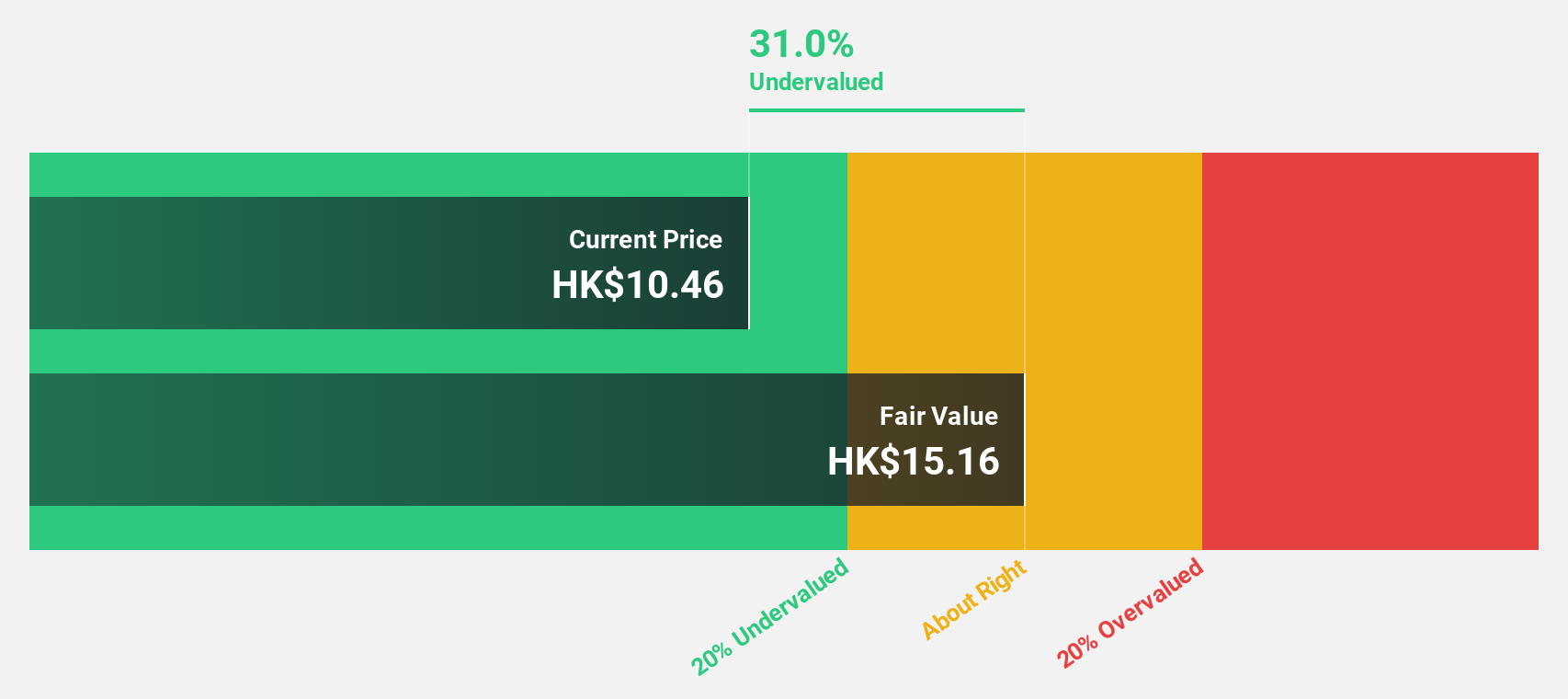

Estimated Discount To Fair Value: 36%

Xiaocaiyuan International Holding is trading at HK$9.59, well below its estimated fair value of HK$14.98, indicating potential undervaluation based on cash flows. Analysts forecast a 43.8% price increase and expect earnings to grow by 24.5% annually, surpassing the Hong Kong market's growth rate of 12.2%. Revenue is projected to expand by 18.9% per year, while Return on Equity is anticipated to reach a robust 31.3% in three years.

- According our earnings growth report, there's an indication that Xiaocaiyuan International Holding might be ready to expand.

- Click here to discover the nuances of Xiaocaiyuan International Holding with our detailed financial health report.

Suning.com (SZSE:002024)

Overview: Suning.com Co., Ltd. operates as a retail business in China with a market cap of approximately CN¥16.02 billion.

Operations: Suning.com Co., Ltd. generates revenue through its retail operations in China.

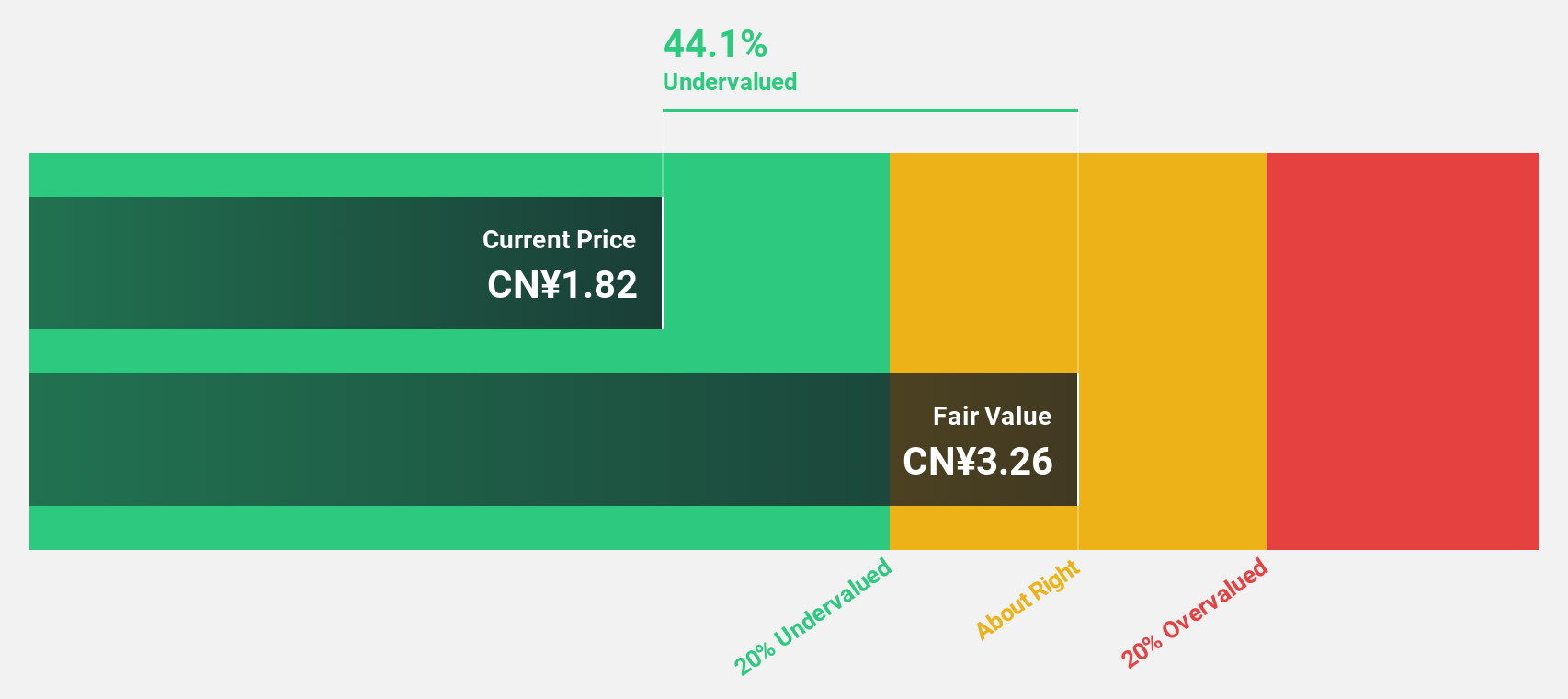

Estimated Discount To Fair Value: 46.6%

Suning.com is trading at CN¥1.74, significantly below its fair value estimate of CN¥3.26, highlighting potential undervaluation based on cash flows. Despite becoming profitable this year, earnings growth is forecast to outpace the Chinese market with a 63% annual increase over the next three years. However, recent earnings show net income declined to CN¥73.33 million from CN¥599.22 million a year ago, and debt remains poorly covered by operating cash flow.

- Our growth report here indicates Suning.com may be poised for an improving outlook.

- Dive into the specifics of Suning.com here with our thorough financial health report.

Seize The Opportunity

- Embark on your investment journey to our 276 Undervalued Asian Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002024

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)