- China

- /

- Specialty Stores

- /

- SHSE:605599

3 Global Dividend Stocks To Consider With Up To 4.8% Yield

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, investors are increasingly seeking stability in dividend stocks, which can offer a reliable income stream amidst market volatility. In such uncertain times, selecting dividend stocks with robust yields and strong fundamentals can be an effective strategy for those looking to balance risk and reward.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Torigoe (TSE:2009) | 4.12% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.84% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.94% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.31% | ★★★★★★ |

| Banque Cantonale de Genève (SWX:BCGE) | 26.53% | ★★★★★★ |

Click here to see the full list of 1377 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Shanghai Shuixing Home Textile (SHSE:603365)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Shuixing Home Textile Co., Ltd. is engaged in the research, development, design, production, and sale of household textiles in China with a market cap of CN¥4.38 billion.

Operations: Shanghai Shuixing Home Textile Co., Ltd. generates its revenue primarily through its textile manufacturing segment, which accounted for CN¥4.31 billion.

Dividend Yield: 4.9%

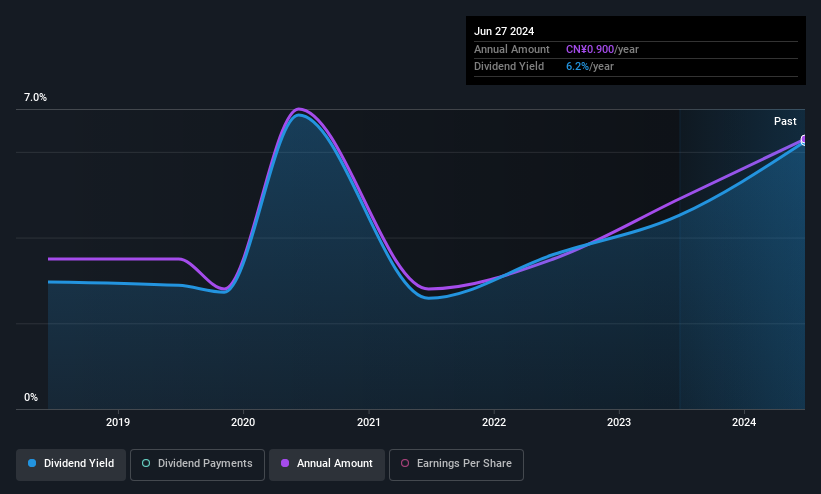

Shanghai Shuixing Home Textile's dividend yield of 4.87% ranks in the top quartile of the CN market, supported by a payout ratio of 65.3%, indicating coverage by earnings. However, its dividend history is marked by volatility and only spans seven years. The company's price-to-earnings ratio of 13.2x suggests good value relative to the broader market at 45x, but its recent earnings growth remains modest with net income slightly declining year-over-year to CNY 141.15 million for H1 2025.

- Click here to discover the nuances of Shanghai Shuixing Home Textile with our detailed analytical dividend report.

- Our valuation report unveils the possibility Shanghai Shuixing Home Textile's shares may be trading at a discount.

Beijing Caishikou Department StoreLtd (SHSE:605599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Caishikou Department Store Co., Ltd. operates as a retail company and has a market cap of CN¥11.52 billion.

Operations: Beijing Caishikou Department Store Co., Ltd. generates revenue primarily through its Gold and Jewellery Sale segment, amounting to CN¥24.49 billion.

Dividend Yield: 4.7%

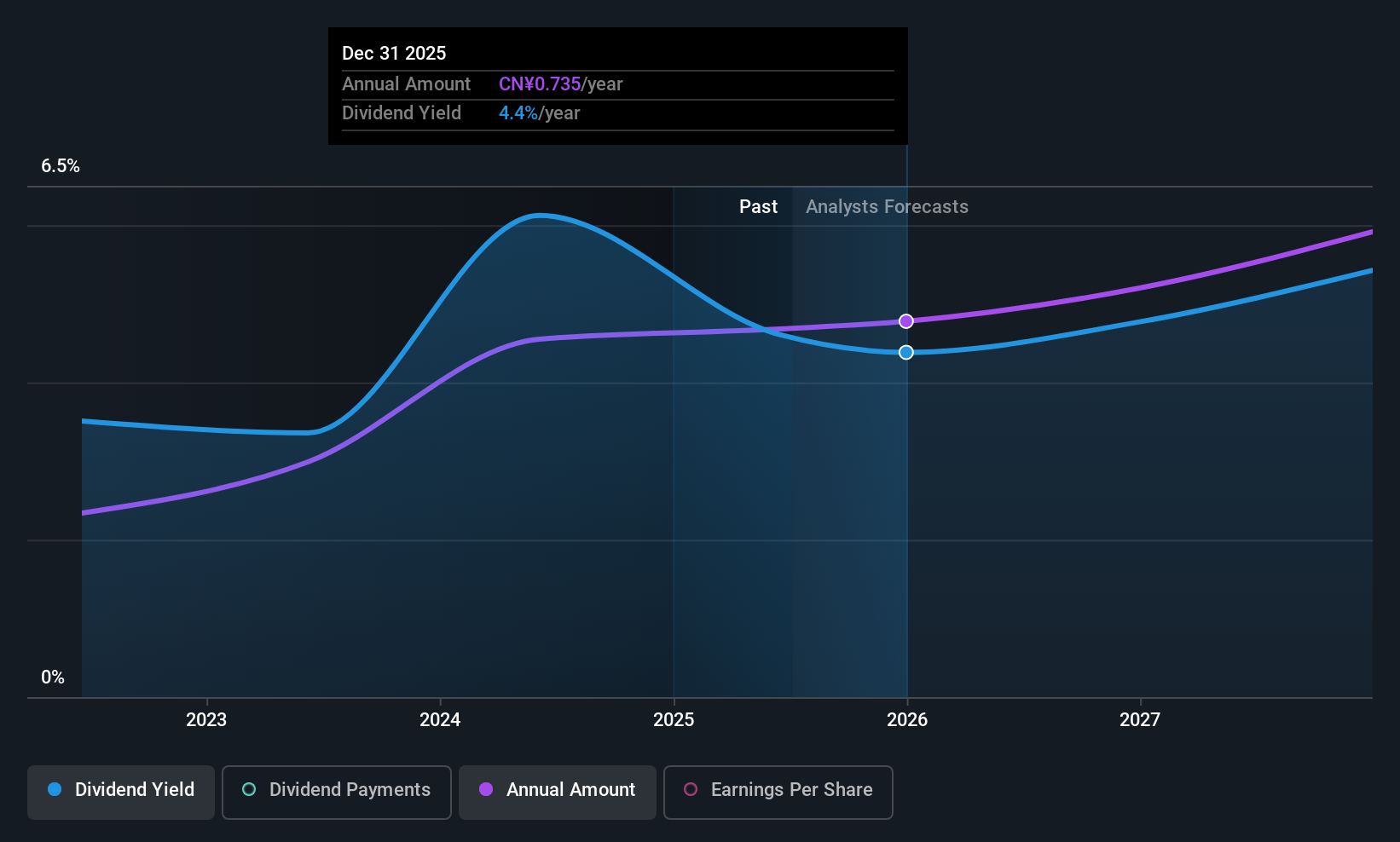

Beijing Caishikou Department Store's dividend yield of 4.74% is among the top 25% in the CN market, supported by a payout ratio of 72%, indicating coverage by earnings. The company's dividends are also backed by cash flows with a cash payout ratio of 79.9%. Despite only four years of dividend payments, stability has been maintained. Recent earnings growth and trading below estimated fair value suggest potential for investors seeking income and value opportunities.

- Take a closer look at Beijing Caishikou Department StoreLtd's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Beijing Caishikou Department StoreLtd is priced lower than what may be justified by its financials.

Rix (TSE:7525)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rix Corporation manufactures and sells machinery equipment and industrial materials in Japan, with a market cap of ¥26.64 billion.

Operations: Rix Corporation's revenue is derived from several segments, including Automobile (¥11.43 billion), Environment (¥2.84 billion), Rubber/Tire (¥4.20 billion), Machine Tools (¥2.33 billion), Paper and Pulp (¥940.21 million), Steel and Iron (¥15.76 billion), High-Performance Material (¥2.46 billion), and Electronics and Semiconductor (¥7.49 billion).

Dividend Yield: 4%

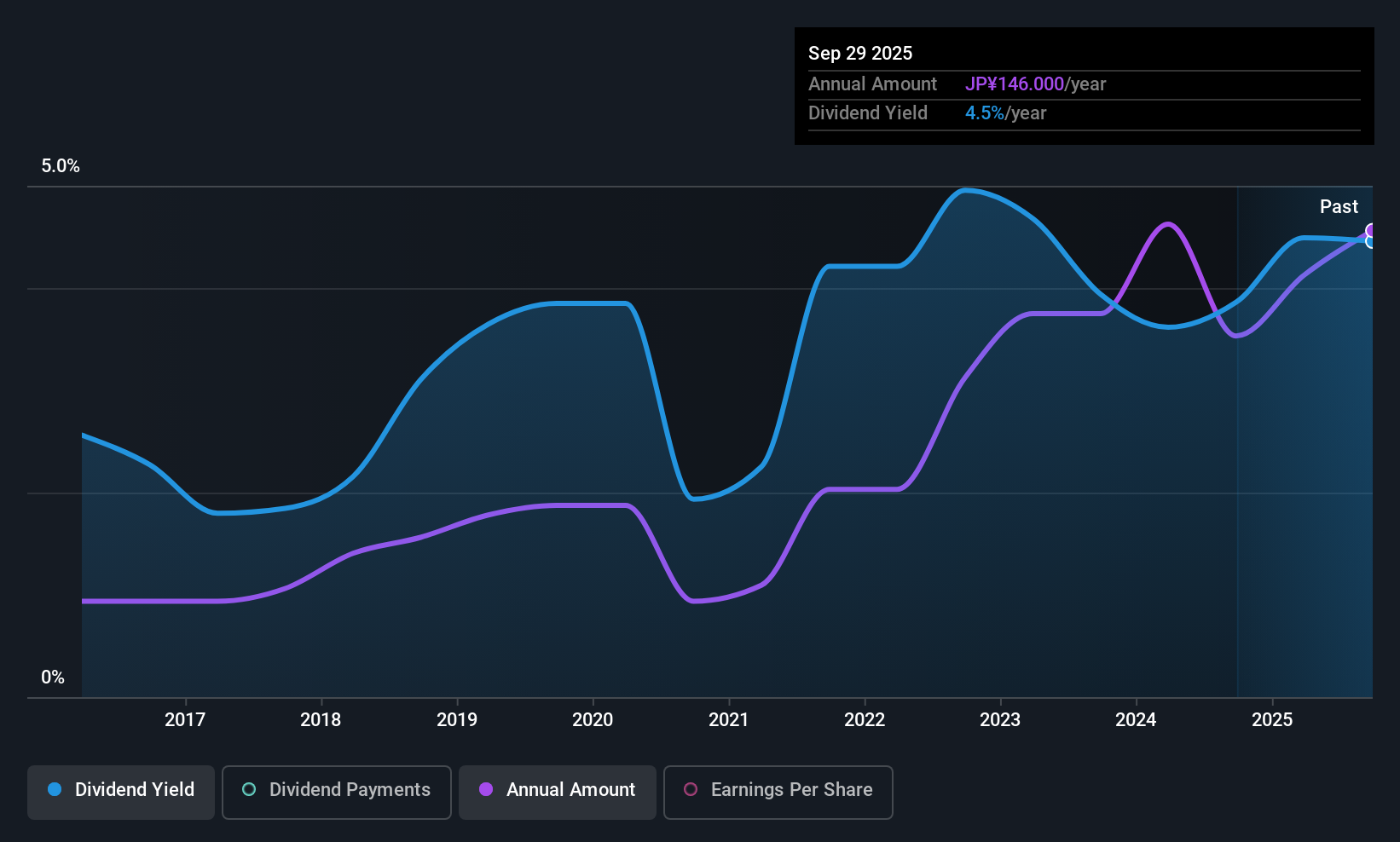

Rix Corporation's dividend yield of 3.98% places it in the top 25% of JP market payers, though its high cash payout ratio of 106.5% indicates dividends are not covered by free cash flow. Despite a low earnings payout ratio of 41.2%, suggesting coverage by profits, dividends have been volatile and unreliable over the past decade. Recent earnings showed a slight decline with net income at JPY 502.84 million for Q1, reflecting potential challenges for sustaining growth in dividends.

- Navigate through the intricacies of Rix with our comprehensive dividend report here.

- According our valuation report, there's an indication that Rix's share price might be on the cheaper side.

Seize The Opportunity

- Take a closer look at our Top Global Dividend Stocks list of 1377 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Caishikou Department StoreLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605599

Beijing Caishikou Department StoreLtd

Beijing Caishikou Department Store Co.,Ltd.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives