- China

- /

- Specialty Stores

- /

- SHSE:603900

Subdued Growth No Barrier To Leysen Jewellery Inc. (SHSE:603900) With Shares Advancing 38%

Leysen Jewellery Inc. (SHSE:603900) shares have had a really impressive month, gaining 38% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

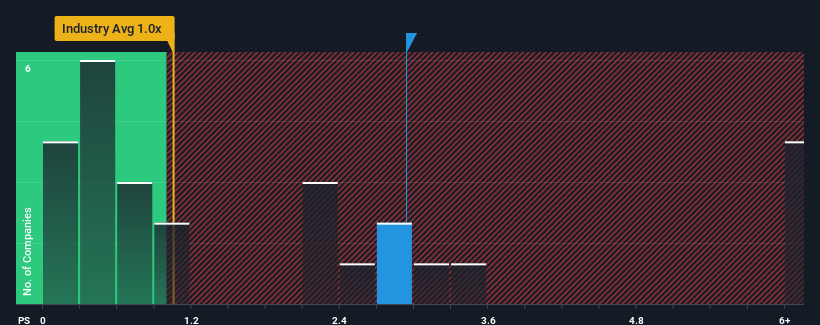

Following the firm bounce in price, you could be forgiven for thinking Leysen Jewellery is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.9x, considering almost half the companies in China's Specialty Retail industry have P/S ratios below 1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Leysen Jewellery

What Does Leysen Jewellery's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Leysen Jewellery over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Leysen Jewellery will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Leysen Jewellery's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. This means it has also seen a slide in revenue over the longer-term as revenue is down 40% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 18% shows it's an unpleasant look.

With this in mind, we find it worrying that Leysen Jewellery's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Leysen Jewellery's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Leysen Jewellery currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Leysen Jewellery you should know about.

If these risks are making you reconsider your opinion on Leysen Jewellery, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603900

Leysen Jewellery

Engages in the design, development, and retail of diamond jewelry products in China.

Mediocre balance sheet very low.

Market Insights

Community Narratives