- China

- /

- Specialty Stores

- /

- SHSE:603900

Leysen Jewellery Inc.'s (SHSE:603900) 39% Price Boost Is Out Of Tune With Revenues

Leysen Jewellery Inc. (SHSE:603900) shareholders are no doubt pleased to see that the share price has bounced 39% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.7% in the last twelve months.

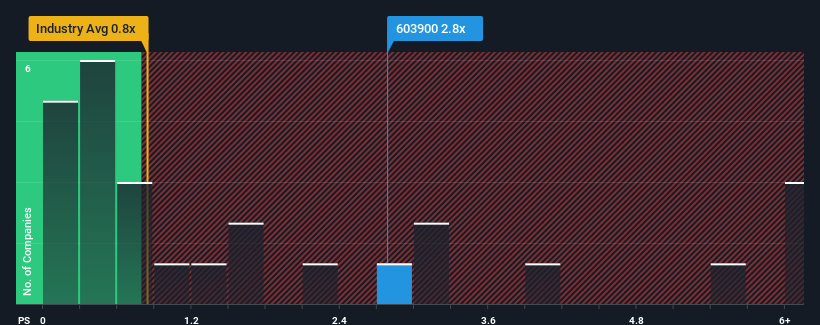

Since its price has surged higher, you could be forgiven for thinking Leysen Jewellery is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.8x, considering almost half the companies in China's Specialty Retail industry have P/S ratios below 0.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Leysen Jewellery

What Does Leysen Jewellery's Recent Performance Look Like?

For example, consider that Leysen Jewellery's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Leysen Jewellery's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Leysen Jewellery would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. As a result, revenue from three years ago have also fallen 50% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 18% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Leysen Jewellery's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Leysen Jewellery's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Leysen Jewellery revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Plus, you should also learn about these 3 warning signs we've spotted with Leysen Jewellery.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Leysen Jewellery, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603900

Leysen Jewellery

Engages in the design, development, and retail of diamond jewelry products in China.

Mediocre balance sheet low.