- China

- /

- Retail Distributors

- /

- SHSE:600128

Weak Statutory Earnings May Not Tell The Whole Story For Soho Holly (SHSE:600128)

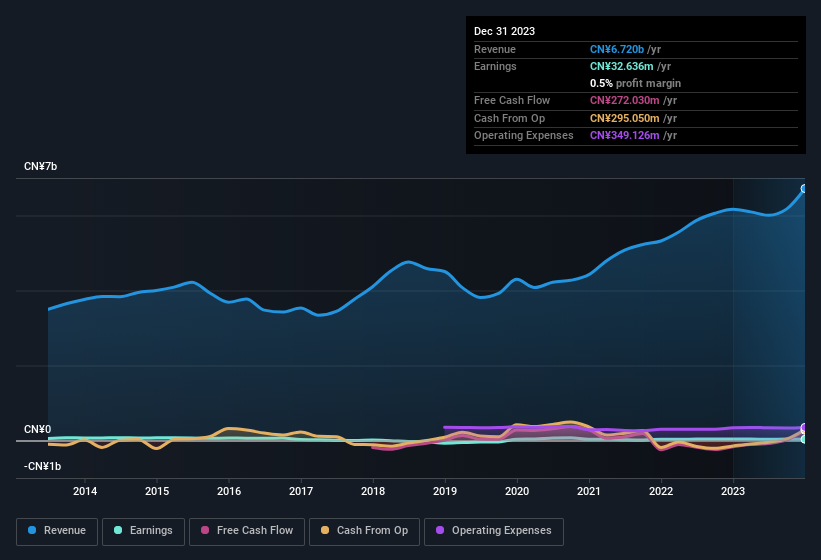

Following the release of a lackluster earnings report from Soho Holly Corporation (SHSE:600128) the stock price made a strong positive move. Our analysis suggests that there are some positive factors lying below the troubling profit numbers which investors are finding comfort in.

Check out our latest analysis for Soho Holly

Examining Cashflow Against Soho Holly's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Soho Holly has an accrual ratio of -0.12 for the year to December 2023. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. Indeed, in the last twelve months it reported free cash flow of CN¥272m, well over the CN¥32.6m it reported in profit. Given that Soho Holly had negative free cash flow in the prior corresponding period, the trailing twelve month resul of CN¥272m would seem to be a step in the right direction. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Soho Holly.

How Do Unusual Items Influence Profit?

While the accrual ratio might bode well, we also note that Soho Holly's profit was boosted by unusual items worth CN¥7.6m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Soho Holly had a rather significant contribution from unusual items relative to its profit to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Soho Holly's Profit Performance

In conclusion, Soho Holly's accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Based on these factors, we think it's very unlikely that Soho Holly's statutory profits make it seem much weaker than it is. So while earnings quality is important, it's equally important to consider the risks facing Soho Holly at this point in time. Every company has risks, and we've spotted 1 warning sign for Soho Holly you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600128

Soho Holly

Manufactures and trades in various products in Mainland China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives