- China

- /

- Real Estate

- /

- SZSE:002344

Haining China Leather MarketLtd (SZSE:002344) investors are up 7.3% in the past week, but earnings have declined over the last year

It might be of some concern to shareholders to see the Haining China Leather Market Co.,Ltd (SZSE:002344) share price down 22% in the last month. But that doesn't change the reality that over twelve months the stock has done really well. To wit, it had solidly beat the market, up 29%.

Since the stock has added CN¥449m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Haining China Leather MarketLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Haining China Leather MarketLtd actually saw its earnings per share drop 29%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 0.8% dividend yield is doing much to support the share price. Unfortunately Haining China Leather MarketLtd's fell 8.4% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

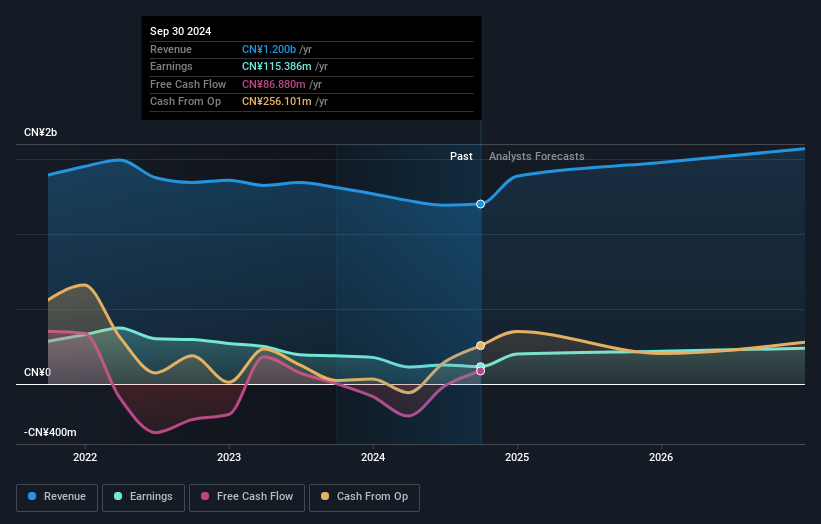

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Haining China Leather MarketLtd

A Different Perspective

We're pleased to report that Haining China Leather MarketLtd shareholders have received a total shareholder return of 30% over one year. Of course, that includes the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Haining China Leather MarketLtd .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Haining China Leather MarketLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002344

Haining China Leather MarketLtd

Engages in the development, leasing, and service of the professional leather market in China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives