- China

- /

- Real Estate

- /

- SHSE:603506

Changjiang Publishing & MediaLtd And Two More Top Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, China's market has shown signs of cooling, with recent data indicating a slow in industrial profits and increased foreign selling. In such an environment, dividend stocks like Changjiang Publishing & Media Ltd may appeal to investors looking for potential stability and consistent returns amidst broader market volatility. In assessing what makes a good dividend stock under the current market conditions, factors such as the sustainability of dividends, company fundamentals, and sector resilience become particularly pertinent.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Lao Feng Xiang (SHSE:600612) | 3.20% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.68% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.64% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.62% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.95% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.66% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.20% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.52% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.57% | ★★★★★★ |

Click here to see the full list of 232 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

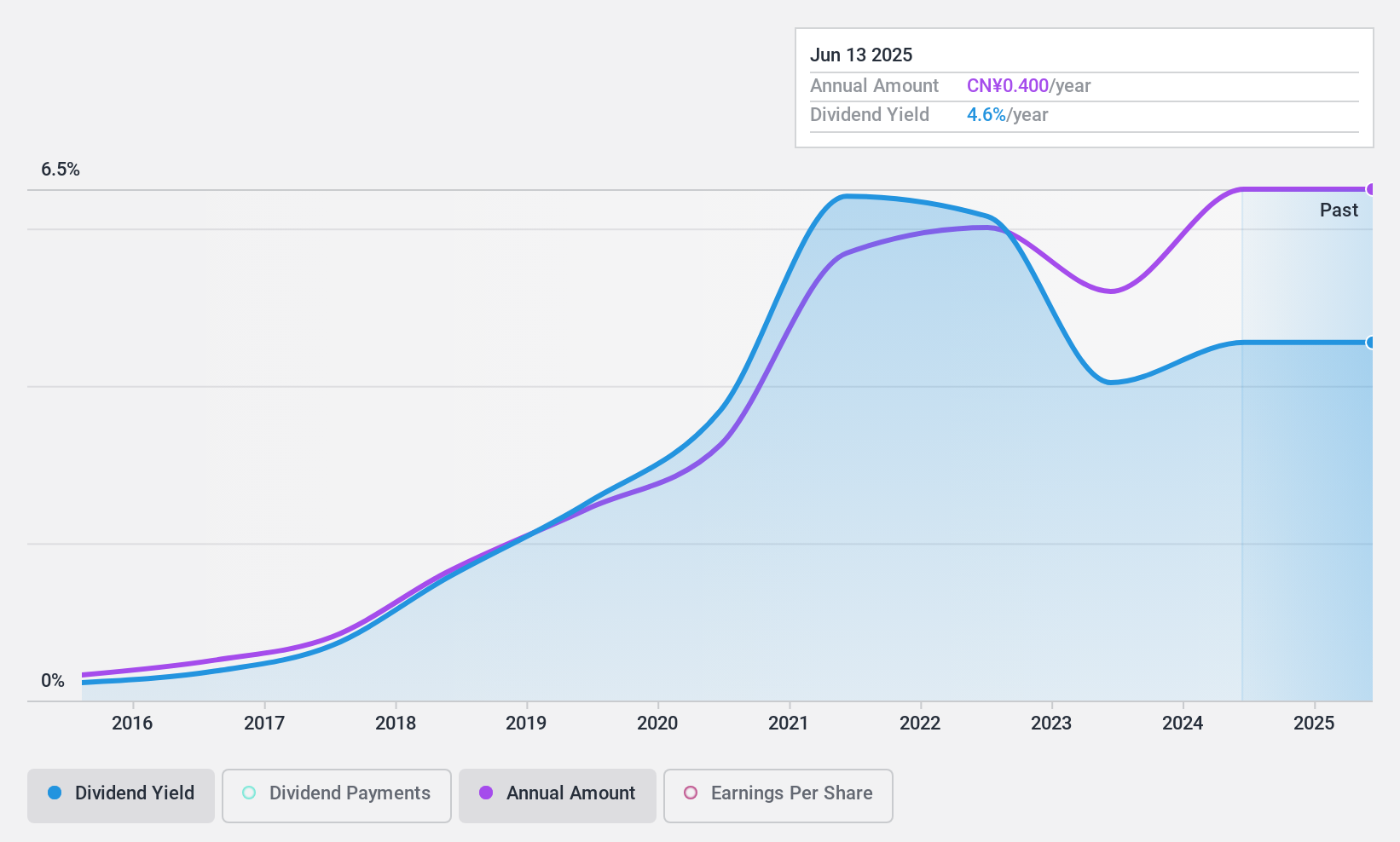

Changjiang Publishing & MediaLtd (SHSE:600757)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Changjiang Publishing & Media Co., Ltd is a media publishing company based in China, with a market capitalization of approximately CN¥10.11 billion.

Operations: Changjiang Publishing & Media Co., Ltd generates revenue primarily through its media publishing operations in China.

Dividend Yield: 4.8%

Changjiang Publishing & Media Co., Ltd. offers a dividend yield of 4.8%, ranking in the top 25% in the Chinese market. The firm's dividends are well-supported with a payout ratio of 54.1% and a cash payout ratio of 69.5%. Although dividends have increased over the past nine years, its track record remains relatively short and unstable, suggesting potential concerns about long-term sustainability despite current coverage by earnings and cash flows. Recent financial reports indicate a dip in quarterly revenue and net income compared to the previous year, which could influence future dividend reliability.

- Navigate through the intricacies of Changjiang Publishing & MediaLtd with our comprehensive dividend report here.

- The analysis detailed in our Changjiang Publishing & MediaLtd valuation report hints at an deflated share price compared to its estimated value.

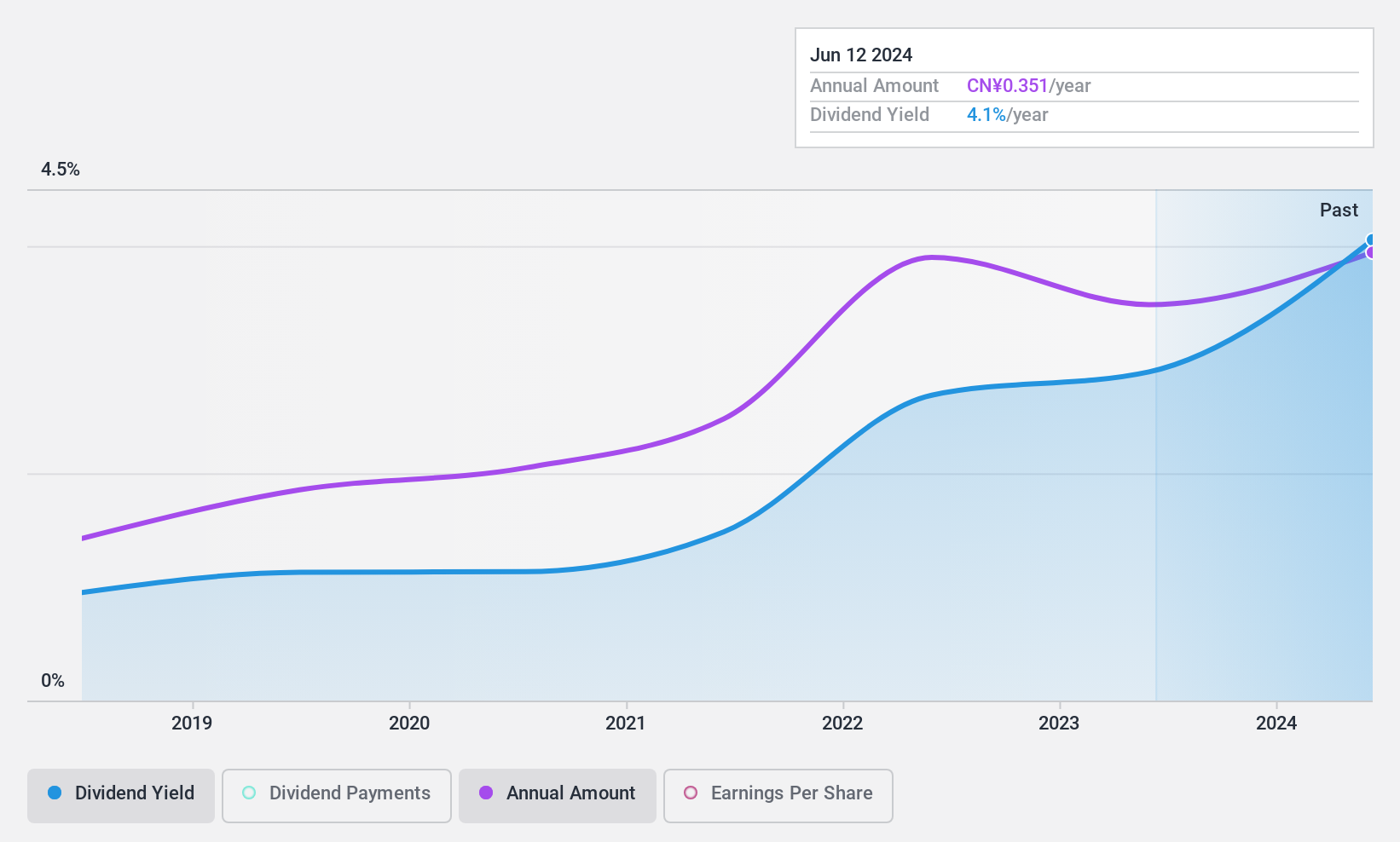

Nacity Property Service GroupLtd (SHSE:603506)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nacity Property Service Group Ltd, operating in China, provides real estate property management services with a market capitalization of approximately CN¥1.64 billion.

Operations: Nacity Property Service Group Ltd generates its revenue primarily from real estate property management services in China.

Dividend Yield: 4%

Nacity Property Service Group Ltd. reported a decrease in quarterly revenue and net income for Q1 2024, with sales dropping to CNY 441.95 million from CNY 465.09 million year-over-year, and net income falling to CNY 20.83 million from CNY 40.33 million. Despite this, the company maintains a dividend payout ratio of 38.9% and a cash payout ratio of 83.9%, suggesting dividends are covered by earnings and cash flows respectively; however, it has only been paying dividends for six years, indicating potential concerns about the sustainability of its dividend policy in the long term especially given its recent financial performance dip.

- Click here to discover the nuances of Nacity Property Service GroupLtd with our detailed analytical dividend report.

- Our expertly prepared valuation report Nacity Property Service GroupLtd implies its share price may be lower than expected.

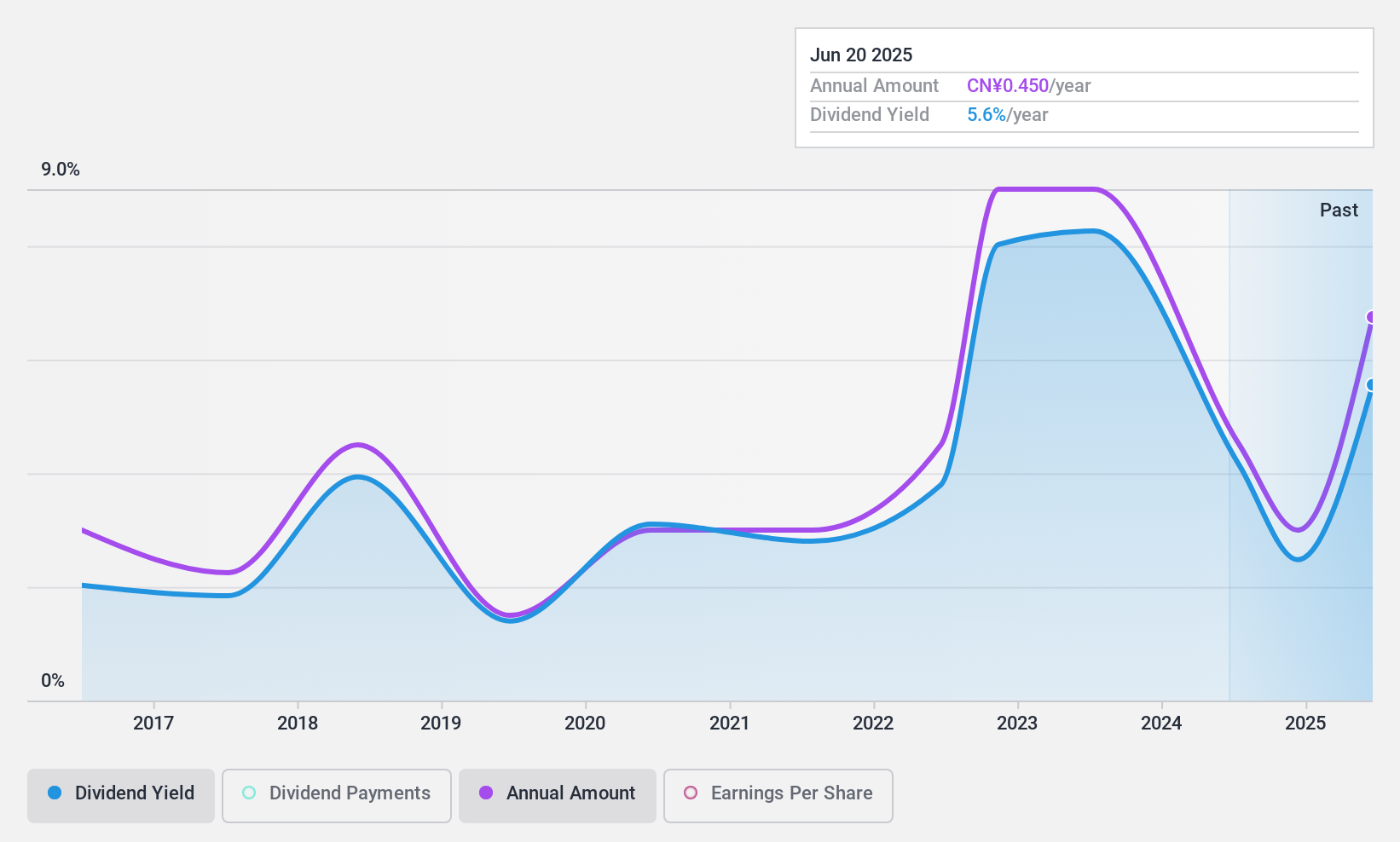

Shaanxi Provincial Natural GasLtd (SZSE:002267)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shaanxi Provincial Natural Gas Co., Ltd. is a company based in China that focuses on the planning, construction, operation, management, and distribution of natural gas in Shaanxi Province, with a market capitalization of approximately CN¥8.95 billion.

Operations: Shaanxi Provincial Natural Gas Co., Ltd. primarily generates revenue through the distribution of natural gas within Shaanxi Province, China.

Dividend Yield: 3.7%

Shaanxi Provincial Natural Gas Co., Ltd. reported a significant revenue increase in Q1 2024 to CNY 3.31 billion, up from CNY 2.71 billion year-over-year, with net income also rising to CNY 488.83 million from CNY 419 million. Despite this growth, the company's dividend sustainability is questionable due to a high cash payout ratio of 271.3% and historical volatility in dividend payments over the past decade. However, its recent approval of a cash dividend suggests ongoing commitment to shareholder returns amidst these challenges.

- Click to explore a detailed breakdown of our findings in Shaanxi Provincial Natural GasLtd's dividend report.

- Upon reviewing our latest valuation report, Shaanxi Provincial Natural GasLtd's share price might be too optimistic.

Taking Advantage

- Delve into our full catalog of 232 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nacity Property Service GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603506

Nacity Property Service GroupLtd

Offers real estate property management services in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion