- China

- /

- Real Estate

- /

- SHSE:601512

China-Singapore Suzhou Industrial Park Development Group (SHSE:601512) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that China-Singapore Suzhou Industrial Park Development Group Co., Ltd. (SHSE:601512) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for China-Singapore Suzhou Industrial Park Development Group

What Is China-Singapore Suzhou Industrial Park Development Group's Debt?

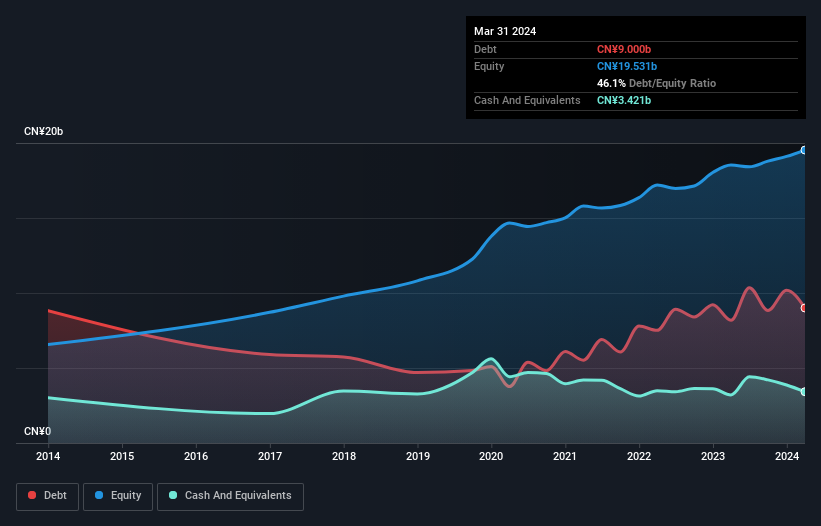

The image below, which you can click on for greater detail, shows that at March 2024 China-Singapore Suzhou Industrial Park Development Group had debt of CN¥9.00b, up from CN¥8.18b in one year. However, it also had CN¥3.42b in cash, and so its net debt is CN¥5.58b.

How Healthy Is China-Singapore Suzhou Industrial Park Development Group's Balance Sheet?

According to the last reported balance sheet, China-Singapore Suzhou Industrial Park Development Group had liabilities of CN¥7.79b due within 12 months, and liabilities of CN¥7.80b due beyond 12 months. On the other hand, it had cash of CN¥3.42b and CN¥2.77b worth of receivables due within a year. So it has liabilities totalling CN¥9.40b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of CN¥11.1b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

China-Singapore Suzhou Industrial Park Development Group has a debt to EBITDA ratio of 2.9, which signals significant debt, but is still pretty reasonable for most types of business. However, its interest coverage of 1k is very high, suggesting that the interest expense on the debt is currently quite low. Importantly, China-Singapore Suzhou Industrial Park Development Group's EBIT fell a jaw-dropping 27% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if China-Singapore Suzhou Industrial Park Development Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, China-Singapore Suzhou Industrial Park Development Group created free cash flow amounting to 6.2% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

We'd go so far as to say China-Singapore Suzhou Industrial Park Development Group's EBIT growth rate was disappointing. But at least it's pretty decent at covering its interest expense with its EBIT; that's encouraging. We're quite clear that we consider China-Singapore Suzhou Industrial Park Development Group to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for China-Singapore Suzhou Industrial Park Development Group (1 is a bit unpleasant) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601512

China-Singapore Suzhou Industrial Park Development Group

China-Singapore Suzhou Industrial Park Development Group Co., Ltd.

Adequate balance sheet and fair value.