- China

- /

- Real Estate

- /

- SHSE:600773

These 4 Measures Indicate That Tibet Urban Development and InvestmentLTD (SHSE:600773) Is Using Debt In A Risky Way

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Tibet Urban Development and Investment Co.,LTD (SHSE:600773) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Tibet Urban Development and InvestmentLTD

What Is Tibet Urban Development and InvestmentLTD's Net Debt?

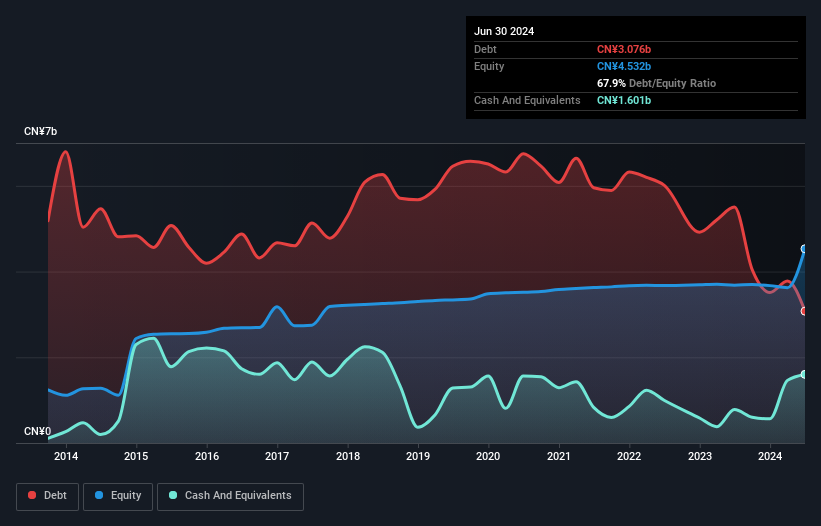

As you can see below, Tibet Urban Development and InvestmentLTD had CN¥3.08b of debt at June 2024, down from CN¥5.50b a year prior. However, because it has a cash reserve of CN¥1.60b, its net debt is less, at about CN¥1.47b.

A Look At Tibet Urban Development and InvestmentLTD's Liabilities

We can see from the most recent balance sheet that Tibet Urban Development and InvestmentLTD had liabilities of CN¥6.13b falling due within a year, and liabilities of CN¥4.33b due beyond that. Offsetting this, it had CN¥1.60b in cash and CN¥98.7m in receivables that were due within 12 months. So its liabilities total CN¥8.76b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of CN¥10.2b, so it does suggest shareholders should keep an eye on Tibet Urban Development and InvestmentLTD's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Tibet Urban Development and InvestmentLTD shareholders face the double whammy of a high net debt to EBITDA ratio (8.3), and fairly weak interest coverage, since EBIT is just 0.59 times the interest expense. The debt burden here is substantial. Worse, Tibet Urban Development and InvestmentLTD's EBIT was down 66% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Tibet Urban Development and InvestmentLTD will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Tibet Urban Development and InvestmentLTD burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Tibet Urban Development and InvestmentLTD's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. After considering the datapoints discussed, we think Tibet Urban Development and InvestmentLTD has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Tibet Urban Development and InvestmentLTD (of which 1 makes us a bit uncomfortable!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tibet Urban Development and InvestmentLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600773

Tibet Urban Development and InvestmentLTD

Develops, operates, manages, and sells real estate properties in China.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives