- China

- /

- Real Estate

- /

- SHSE:600223

Can Mixed Fundamentals Have A Negative Impact on Lushang Freda Pharmaceutical Co.,Ltd. (SHSE:600223) Current Share Price Momentum?

Most readers would already be aware that Lushang Freda PharmaceuticalLtd's (SHSE:600223) stock increased significantly by 5.0% over the past week. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. Particularly, we will be paying attention to Lushang Freda PharmaceuticalLtd's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Lushang Freda PharmaceuticalLtd

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Lushang Freda PharmaceuticalLtd is:

5.8% = CN¥274m ÷ CN¥4.8b (Based on the trailing twelve months to September 2024).

The 'return' refers to a company's earnings over the last year. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.06 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Lushang Freda PharmaceuticalLtd's Earnings Growth And 5.8% ROE

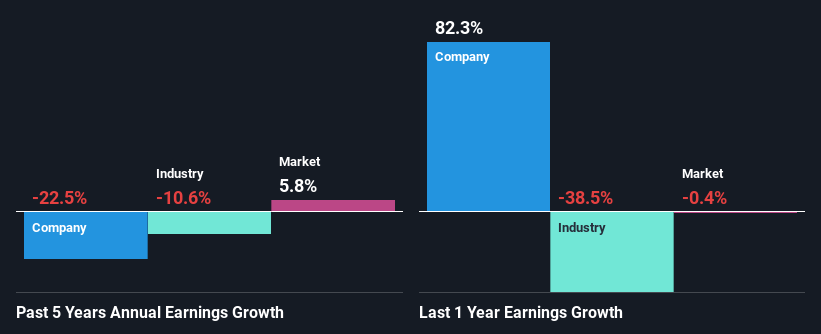

On the face of it, Lushang Freda PharmaceuticalLtd's ROE is not much to talk about. However, the fact that the its ROE is quite higher to the industry average of 3.2% doesn't go unnoticed by us. However, Lushang Freda PharmaceuticalLtd's five year net income decline rate was 22%. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. Hence, this goes some way in explaining the shrinking earnings.

As a next step, we compared Lushang Freda PharmaceuticalLtd's performance with the industry and found thatLushang Freda PharmaceuticalLtd's performance is depressing even when compared with the industry, which has shrunk its earnings at a rate of 11% in the same period, which is a slower than the company.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Lushang Freda PharmaceuticalLtd's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Lushang Freda PharmaceuticalLtd Using Its Retained Earnings Effectively?

Lushang Freda PharmaceuticalLtd has a high three-year median payout ratio of 62% (that is, it is retaining 38% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent.

Additionally, Lushang Freda PharmaceuticalLtd has paid dividends over a period of six years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 42% over the next three years. As a result, the expected drop in Lushang Freda PharmaceuticalLtd's payout ratio explains the anticipated rise in the company's future ROE to 8.9%, over the same period.

Summary

On the whole, we feel that the performance shown by Lushang Freda PharmaceuticalLtd can be open to many interpretations. Specifically, the low earnings growth is a bit concerning, especially given that the company has a respectable rate of return. Investors may have benefitted, had the company been reinvesting more of its earnings. As discussed earlier, the company is retaining a small portion of its profits. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600223

Lushang Freda PharmaceuticalLtd

Engages in the production and sales of pharmaceuticals, raw materials, and additives in China.

Flawless balance sheet with reasonable growth potential.