As global markets continue their upward trajectory, buoyed by optimism around trade policies and advancements in artificial intelligence, investors are increasingly looking for opportunities that align with these trends. Penny stocks, often perceived as relics of a bygone era, still offer significant potential when backed by strong financials and sound fundamentals. These smaller or newer companies can present unique growth opportunities at lower price points, making them attractive options for those seeking to uncover hidden value in the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £791.31M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,716 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★★☆

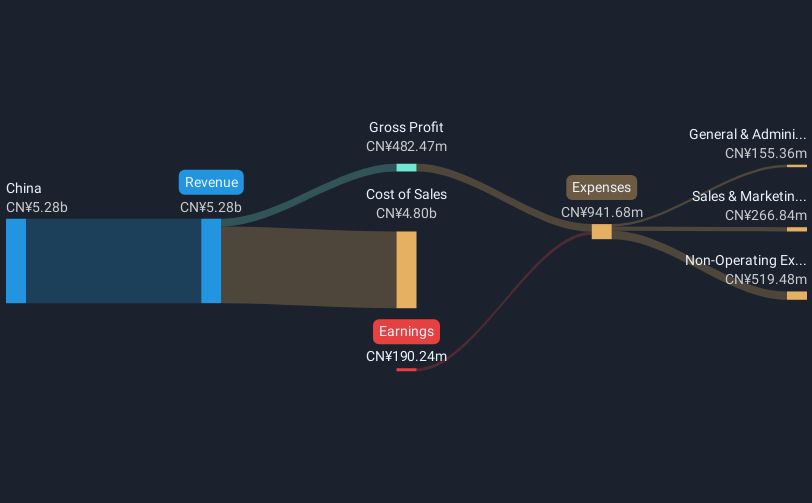

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China with a market capitalization of CN¥6.84 billion.

Operations: The company generates revenue of CN¥5.28 billion from its operations within China.

Market Cap: CN¥6.84B

Greattown Holdings Ltd. operates in the Chinese real estate sector with a market capitalization of CN¥6.84 billion and generates revenue of CN¥5.28 billion. Despite its size, the company remains unprofitable with increasing losses over the past five years at a rate of 31% annually. However, Greattown has managed to reduce its debt to equity ratio from 82.3% to 30.8%, indicating improved financial management, and maintains satisfactory net debt levels at 20.7%. Short-term assets exceed both short-term and long-term liabilities significantly, suggesting strong liquidity despite ongoing profitability challenges.

- Unlock comprehensive insights into our analysis of Greattown Holdings stock in this financial health report.

- Review our historical performance report to gain insights into Greattown Holdings' track record.

Innovation New Material Technology (SHSE:600361)

Simply Wall St Financial Health Rating: ★★★★☆☆

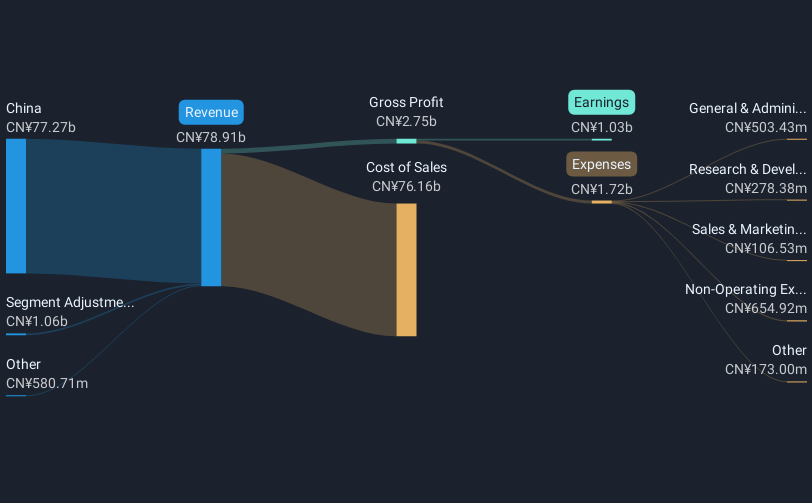

Overview: Innovation New Material Technology Co., Ltd. operates in the field of advanced materials and has a market cap of approximately CN¥15.40 billion.

Operations: The company's revenue is primarily derived from its Commodity Retail Business, which generated CN¥78.91 billion.

Market Cap: CN¥15.4B

Innovation New Material Technology Co., Ltd. presents a mixed picture for investors interested in advanced materials. The company, with a market cap of CN¥15.40 billion, trades at an attractive price-to-earnings ratio of 15x compared to the broader Chinese market. Despite high net debt to equity at 45.1%, its interest payments are well covered by EBIT, and short-term assets exceed liabilities significantly, indicating solid liquidity. However, negative operating cash flow raises concerns about debt coverage and financial stability despite stable earnings growth and no shareholder dilution over the past year. Recent events include an upcoming extraordinary shareholders meeting on December 30, 2024.

- Navigate through the intricacies of Innovation New Material Technology with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Innovation New Material Technology's future.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Financial Health Rating: ★★★★★★

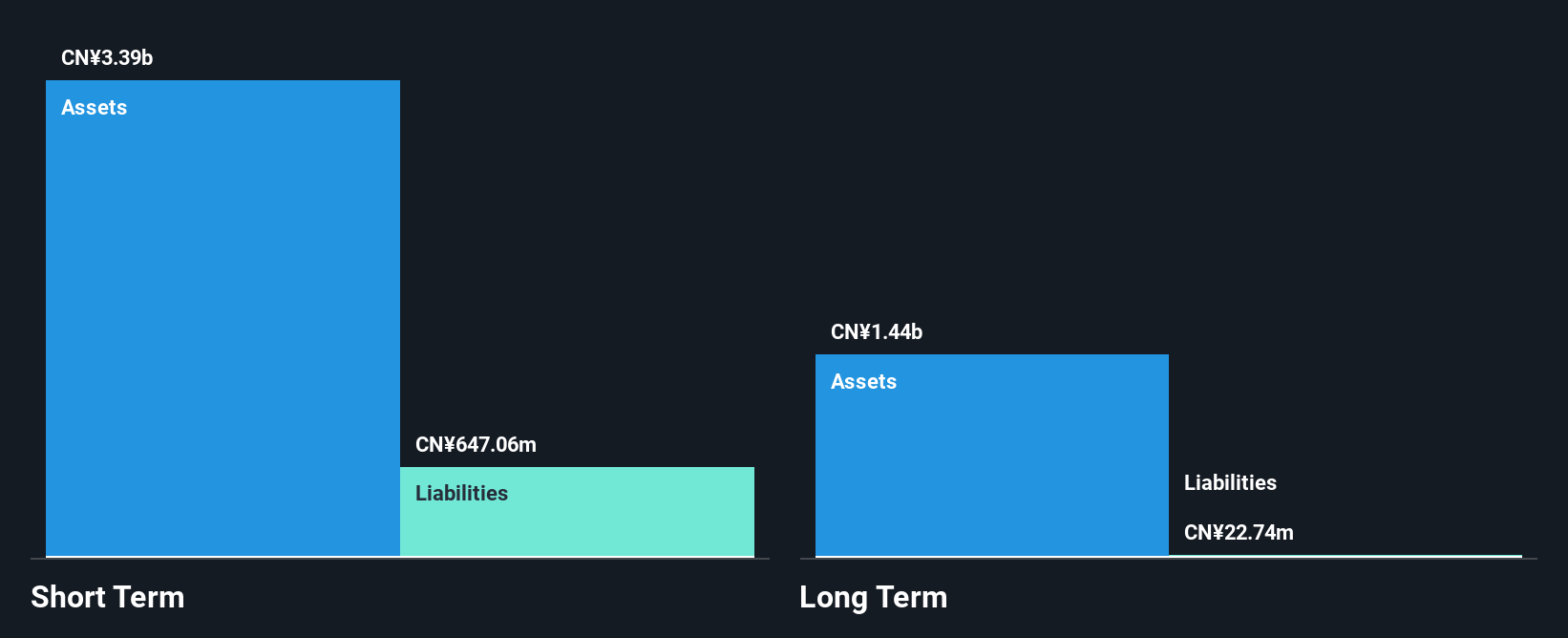

Overview: NanJi E-Commerce Co., LTD operates in China, offering brand authorization, retail, and mobile Internet marketing services with a market cap of CN¥11.66 billion.

Operations: The company generates CN¥3.03 billion in revenue from its operations within China.

Market Cap: CN¥11.66B

NanJi E-Commerce Co., LTD, with a market cap of CN¥11.66 billion, has recently turned profitable, though its earnings have been impacted by a significant one-off gain of CN¥45.7 million. Despite becoming debt-free and having short-term assets exceeding both short and long-term liabilities, the company's earnings have declined by 51.5% annually over the past five years. The dividend yield of 1.62% is not well covered by current earnings or free cash flow, raising sustainability concerns. While management and board tenure suggest experience, the stock's high volatility and low return on equity present potential risks for investors in this segment.

- Dive into the specifics of NanJi E-Commerce here with our thorough balance sheet health report.

- Gain insights into NanJi E-Commerce's past trends and performance with our report on the company's historical track record.

Next Steps

- Embark on your investment journey to our 5,716 Penny Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJi E-Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002127

NanJi E-Commerce

Provides brand authorization, retail, and mobile Internet marketing services in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives