- Hong Kong

- /

- Transportation

- /

- SEHK:525

Discover 3 Top Penny Stocks With Market Caps Over US$900M

Reviewed by Simply Wall St

Global markets have experienced a tumultuous week, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating sharply. Amidst this backdrop of fluctuating earnings and economic signals, investors are increasingly looking toward less conventional opportunities for potential growth. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing prospects for those willing to explore beyond the mainstream. Despite being a somewhat outdated term, penny stocks remain relevant as they can present significant growth opportunities when backed by strong financials and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR351.85M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$514.18M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.795 | MYR126.45M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR295.43M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.00 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

Click here to see the full list of 5,801 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Guangshen Railway (SEHK:525)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangshen Railway Company Limited operates railway passenger and freight transportation services in the People's Republic of China with a market cap of HK$24.04 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥27.05 billion.

Market Cap: HK$24.04B

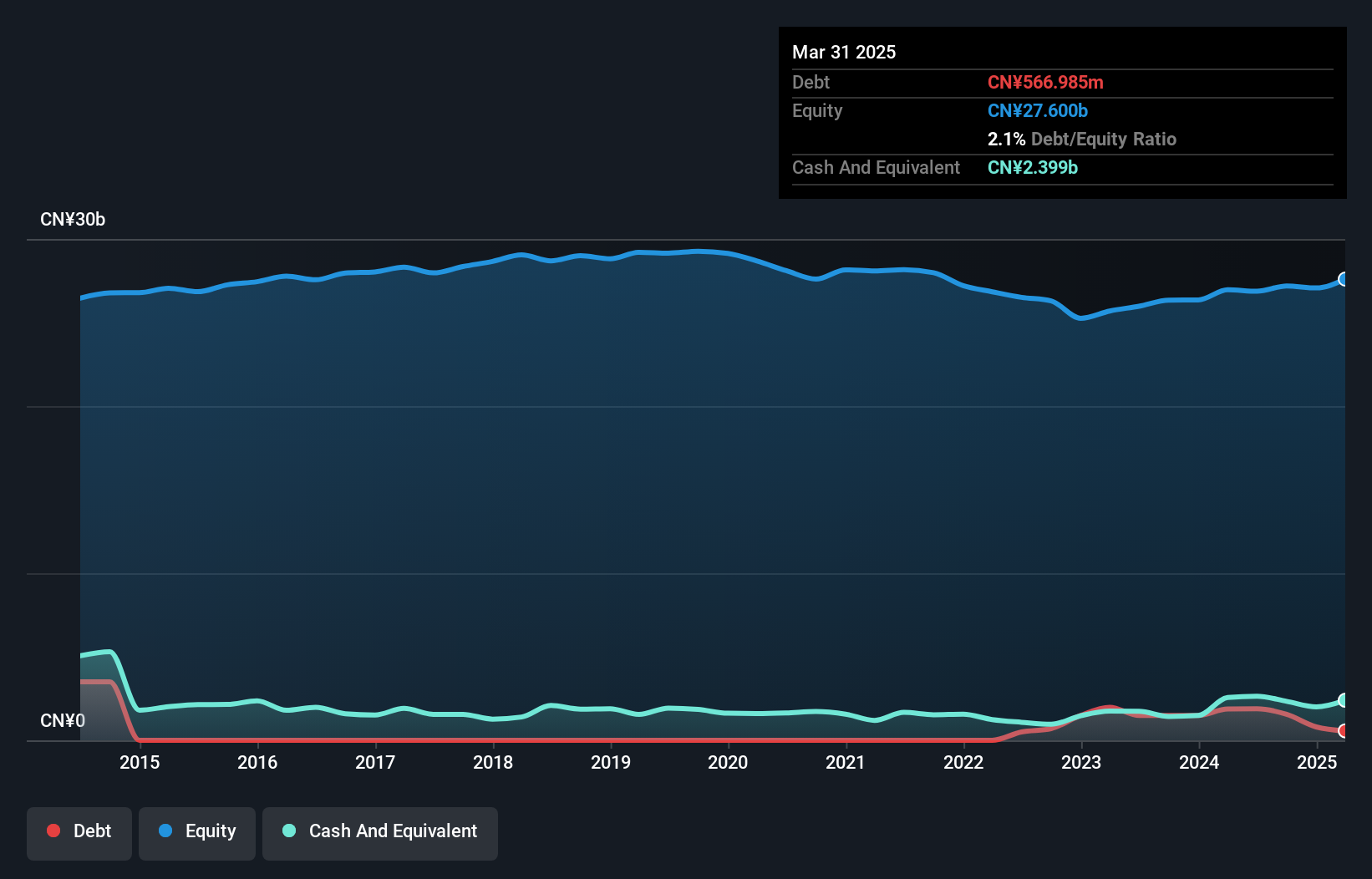

Guangshen Railway Company Limited has shown significant earnings growth, with a very large increase of 6743.2% over the past year, outperforming the transportation industry. The company's financial health is supported by its short-term assets exceeding both short and long-term liabilities, and its debt being well covered by operating cash flow. Recent strategic alliances, such as the cooperative development project with Zhixin Real Estate, indicate potential for future growth through diversification. However, investors should note that while the company trades below estimated fair value and has stable weekly volatility, it maintains a low return on equity and an unstable dividend track record.

- Click here and access our complete financial health analysis report to understand the dynamics of Guangshen Railway.

- Gain insights into Guangshen Railway's outlook and expected performance with our report on the company's earnings estimates.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Overseas Grand Oceans Group Limited is an investment holding company that focuses on investing in, developing, and leasing real estate properties in the People’s Republic of China and Hong Kong, with a market cap of approximately HK$7.40 billion.

Operations: The company generates its revenue primarily from Property Investment and Development, which accounts for CN¥50.70 billion, followed by Property Leasing at CN¥279.66 million.

Market Cap: HK$7.4B

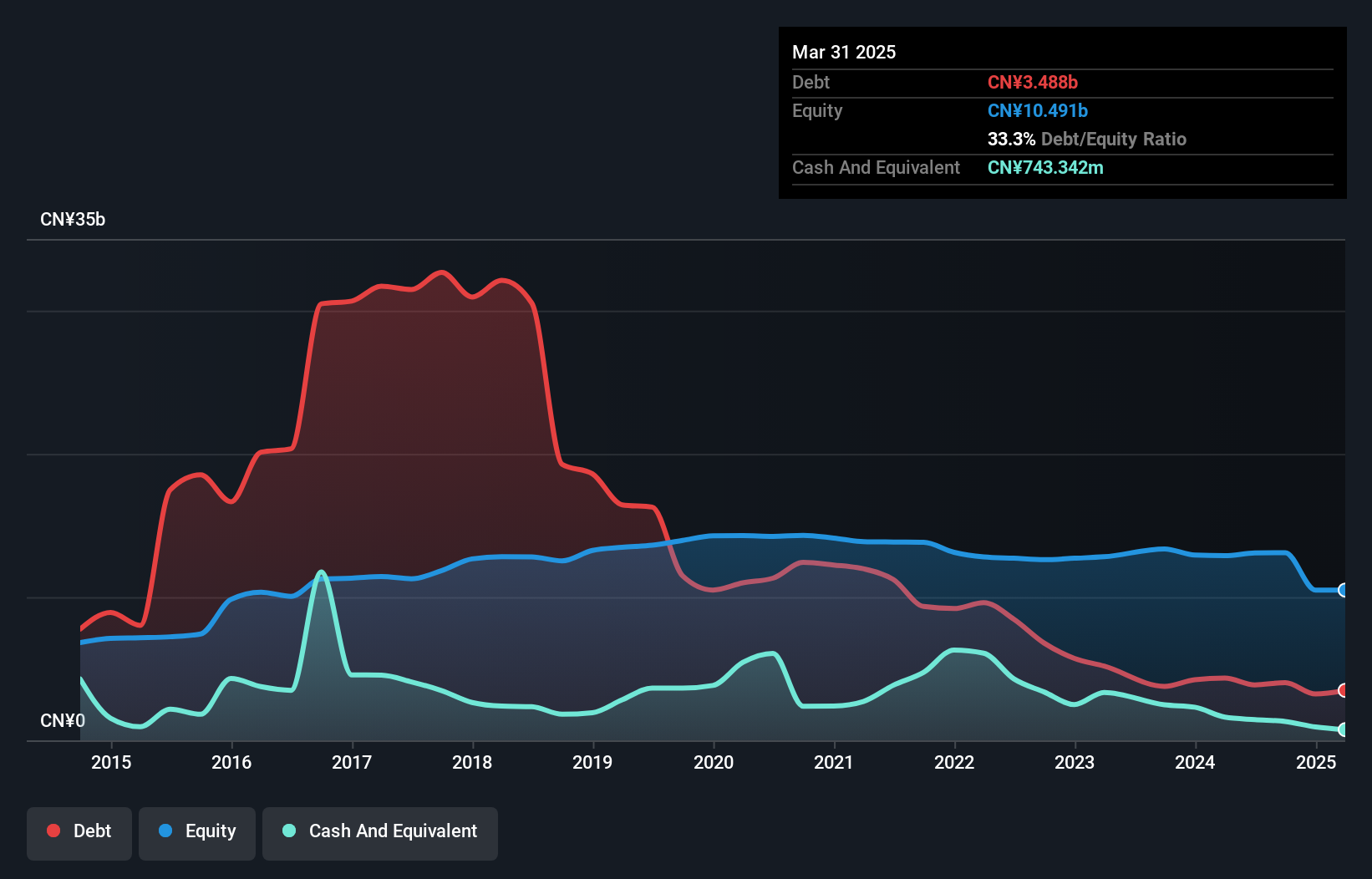

China Overseas Grand Oceans Group Limited faces challenges with negative earnings growth and a low return on equity of 2.4%. Despite this, the company maintains a strong financial position with short-term assets of CN¥131.6 billion surpassing both short and long-term liabilities. While its debt-to-equity ratio has improved to 112.5% over five years, net debt remains high at 46.1%. The stock's price-to-earnings ratio of 4.9x suggests it trades below the Hong Kong market average, presenting potential value opportunities despite an unstable dividend history and recent profit margin declines impacted by one-off losses amounting to CN¥1.5 billion.

- Jump into the full analysis health report here for a deeper understanding of China Overseas Grand Oceans Group.

- Review our growth performance report to gain insights into China Overseas Grand Oceans Group's future.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China and has a market cap of CN¥8.53 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥8.53B

Greattown Holdings Ltd. is navigating a challenging period with a significant decline in sales and net income over the past year, reporting CN¥3.81 billion in sales for the first nine months of 2024 compared to CN¥10.23 billion previously. Despite being unprofitable, it maintains a satisfactory net debt-to-equity ratio of 9.6%, indicating manageable debt levels relative to equity. The company benefits from strong liquidity as its short-term assets of CN¥14.8 billion exceed both short and long-term liabilities significantly, providing some financial stability amidst earnings volatility and negative return on equity challenges at -1.45%.

- Click to explore a detailed breakdown of our findings in Greattown Holdings' financial health report.

- Evaluate Greattown Holdings' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Discover the full array of 5,801 Penny Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:525

Guangshen Railway

Engages in the railway passenger and freight transportation businesses in the People’s Republic of China.

Solid track record with excellent balance sheet.