- China

- /

- Life Sciences

- /

- SZSE:301257

Little Excitement Around SMO ClinPlus CO.,LTD.'s (SZSE:301257) Earnings As Shares Take 37% Pounding

SMO ClinPlus CO.,LTD. (SZSE:301257) shareholders that were waiting for something to happen have been dealt a blow with a 37% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 50% loss during that time.

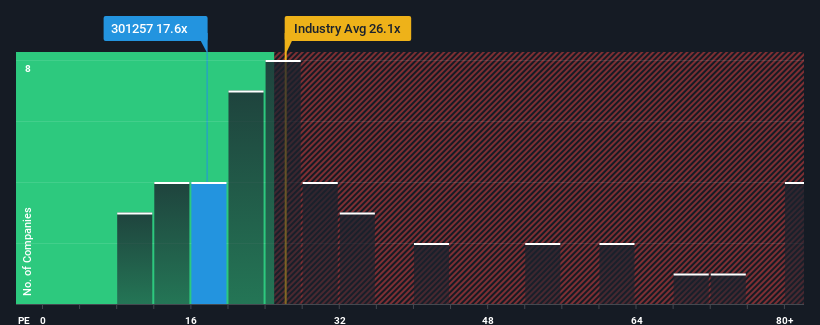

After such a large drop in price, SMO ClinPlusLTD may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 17.6x, since almost half of all companies in China have P/E ratios greater than 31x and even P/E's higher than 57x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for SMO ClinPlusLTD as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for SMO ClinPlusLTD

How Is SMO ClinPlusLTD's Growth Trending?

SMO ClinPlusLTD's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 42% last year. Pleasingly, EPS has also lifted 64% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 17% per annum over the next three years. With the market predicted to deliver 25% growth per year, the company is positioned for a weaker earnings result.

With this information, we can see why SMO ClinPlusLTD is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

SMO ClinPlusLTD's P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of SMO ClinPlusLTD's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for SMO ClinPlusLTD (1 can't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on SMO ClinPlusLTD, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301257

SMO ClinPlusLTD

Provides site management services in research development in pharmaceuticals, medical devices, and health-related products in China.

Flawless balance sheet low.

Market Insights

Community Narratives