- China

- /

- Life Sciences

- /

- SZSE:301257

Beyond Lackluster Earnings: Potential Concerns For SMO ClinPlusLTD's (SZSE:301257) Shareholders

SMO ClinPlus CO.,LTD.'s (SZSE:301257) lackluster earnings announcement last week disappointed investors. We think there is more to the story than simply soft profit numbers. Our analysis shows that there are some other factors of concern.

View our latest analysis for SMO ClinPlusLTD

Examining Cashflow Against SMO ClinPlusLTD's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

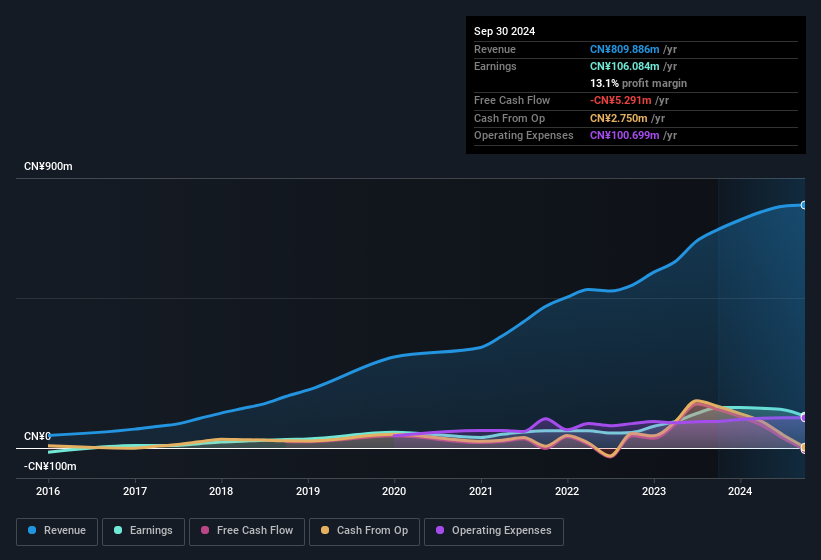

For the year to September 2024, SMO ClinPlusLTD had an accrual ratio of 0.53. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of CN¥5.3m despite its profit of CN¥106.1m, mentioned above. It's worth noting that SMO ClinPlusLTD generated positive FCF of CN¥128m a year ago, so at least they've done it in the past. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that SMO ClinPlusLTD's profit was boosted by unusual items worth CN¥17m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On SMO ClinPlusLTD's Profit Performance

Summing up, SMO ClinPlusLTD received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. For the reasons mentioned above, we think that a perfunctory glance at SMO ClinPlusLTD's statutory profits might make it look better than it really is on an underlying level. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Case in point: We've spotted 2 warning signs for SMO ClinPlusLTD you should be mindful of and 1 of these is concerning.

Our examination of SMO ClinPlusLTD has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301257

SMO ClinPlusLTD

Provides site management services in research development in pharmaceuticals, medical devices, and health-related products in China.

Flawless balance sheet low.

Market Insights

Community Narratives