- China

- /

- Life Sciences

- /

- SZSE:301230

High Insider Ownership Growth Companies On Chinese Exchanges June 2024

Reviewed by Simply Wall St

Amidst a backdrop of mixed economic signals from China, where industrial production has shown weaker growth and new home prices continue their decline, investors are closely watching shifts in market dynamics. In such an environment, growth companies with high insider ownership on Chinese exchanges could offer unique insights into corporate confidence and potential resilience.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

Here we highlight a subset of our preferred stocks from the screener.

Guobang Pharma (SHSE:605507)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guobang Pharma Ltd. specializes in the research, development, production, and sale of pharmaceutical and veterinary products, with a market capitalization of approximately CN¥9.64 billion.

Operations: The company generates revenue through the pharmaceutical and veterinary sectors.

Insider Ownership: 12.7%

Guobang Pharma, a growth-oriented firm in China with high insider ownership, shows promising financial dynamics despite some challenges. Recent earnings reveal a slight decline in revenue to CNY 1.34 billion from CNY 1.41 billion year-over-year, though net income increased marginally to CNY 198.73 million. Analysts forecast robust earnings growth at an annual rate of 22.51%, outpacing the broader Chinese market's average, although the company's Return on Equity is expected to remain low at 11.8% in three years' time.

- Click here to discover the nuances of Guobang Pharma with our detailed analytical future growth report.

- Our valuation report here indicates Guobang Pharma may be undervalued.

Kunshan GuoLi Electronic Technology (SHSE:688103)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kunshan GuoLi Electronic Technology Co., Ltd. operates in the electronics sector with a market capitalization of approximately CN¥3.20 billion.

Operations: The company generates revenue primarily through the research, development, production, and sales of vacuum devices, totaling CN¥707.64 million.

Insider Ownership: 32%

Kunshan GuoLi Electronic Technology, despite recent challenges including being dropped from the S&P Global BMI Index, shows potential in growth metrics. The company reported a decrease in net income to CNY 4.16 million from CNY 11.43 million year-over-year but is expected to see significant earnings growth at an annual rate of 70.7%, well above the Chinese market average of 22.5%. However, its current dividend yield of 0.69% is poorly covered by cash flows, reflecting some financial strain.

- Click to explore a detailed breakdown of our findings in Kunshan GuoLi Electronic Technology's earnings growth report.

- The analysis detailed in our Kunshan GuoLi Electronic Technology valuation report hints at an inflated share price compared to its estimated value.

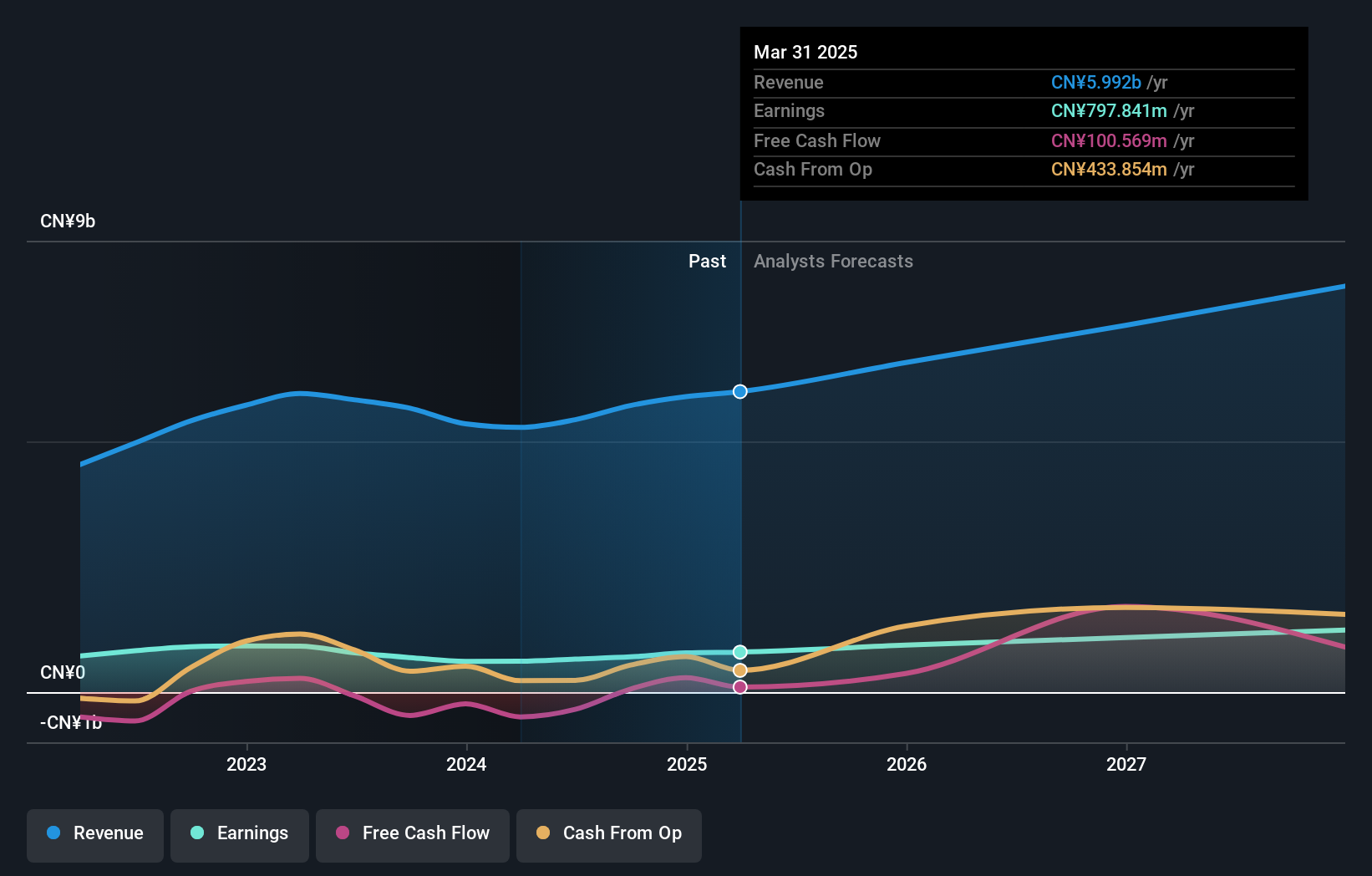

PharmaResources (Shanghai) (SZSE:301230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PharmaResources (Shanghai) Co., Ltd. provides CRO, CDMO, and CMO services for drug discovery in China, with a market capitalization of approximately CN¥3.47 billion.

Operations: The company generates revenue through its services in contract research (CRO), contract development and manufacturing (CDMO), and contract manufacturing (CMO) within the pharmaceutical sector.

Insider Ownership: 13.9%

PharmaResources (Shanghai) has shown a mixed financial performance with recent quarterly earnings reflecting a significant drop in net income to CNY 3.67 million from CNY 15.28 million year-over-year, despite steady revenue growth. The company's annual earnings are forecasted to grow at an impressive rate of 35.08% per year, outpacing the Chinese market average. However, its profit margins have declined and its share price has been highly volatile over the past three months, indicating potential risks for investors seeking stability.

- Click here and access our complete growth analysis report to understand the dynamics of PharmaResources (Shanghai).

- Our comprehensive valuation report raises the possibility that PharmaResources (Shanghai) is priced higher than what may be justified by its financials.

Summing It All Up

- Explore the 364 names from our Fast Growing Chinese Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade PharmaResources (Shanghai), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301230

PharmaResources (Shanghai)

Operates as a CRO, CDMO, and CMO service provider of drug discovery in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives