More Unpleasant Surprises Could Be In Store For Tuoxin Pharmaceutical Group Co.,Ltd.'s (SZSE:301089) Shares After Tumbling 28%

The Tuoxin Pharmaceutical Group Co.,Ltd. (SZSE:301089) share price has fared very poorly over the last month, falling by a substantial 28%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

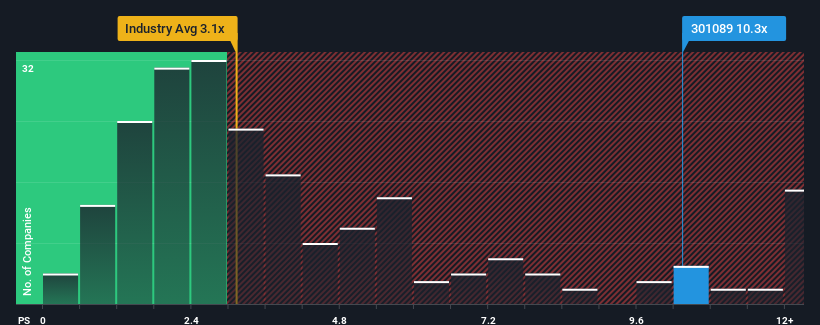

In spite of the heavy fall in price, given around half the companies in China's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3.1x, you may still consider Tuoxin Pharmaceutical GroupLtd as a stock to avoid entirely with its 10.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Tuoxin Pharmaceutical GroupLtd

How Tuoxin Pharmaceutical GroupLtd Has Been Performing

For example, consider that Tuoxin Pharmaceutical GroupLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tuoxin Pharmaceutical GroupLtd's earnings, revenue and cash flow.How Is Tuoxin Pharmaceutical GroupLtd's Revenue Growth Trending?

Tuoxin Pharmaceutical GroupLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 67%. This means it has also seen a slide in revenue over the longer-term as revenue is down 29% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 18% shows it's an unpleasant look.

With this in mind, we find it worrying that Tuoxin Pharmaceutical GroupLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Tuoxin Pharmaceutical GroupLtd's P/S

A significant share price dive has done very little to deflate Tuoxin Pharmaceutical GroupLtd's very lofty P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Tuoxin Pharmaceutical GroupLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tuoxin Pharmaceutical GroupLtd (1 is a bit concerning!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Tuoxin Pharmaceutical GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tuoxin Pharmaceutical GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301089

Tuoxin Pharmaceutical GroupLtd

Engages in the research, development, production, and sale of chemical synthesis, biological fermentation nucleoside (acid) APIs, and pharmaceutical intermediates in China and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives