- China

- /

- Communications

- /

- SHSE:600105

High Growth Tech Stocks In Asia To Watch March 2025

Reviewed by Simply Wall St

As global markets face heightened volatility with U.S. consumer confidence dropping and tech stocks experiencing significant declines, the Asian markets are drawing attention for their potential in the high-growth tech sector. In this climate, identifying promising stocks involves looking for companies that demonstrate resilience to economic pressures and have strong innovation pipelines, making them well-positioned to navigate current uncertainties and capitalize on long-term growth opportunities.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| PharmaResearch | 23.41% | 26.41% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Bioneer | 26.13% | 104.84% | ★★★★★★ |

| giftee | 20.11% | 69.33% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Jiangsu Etern (SHSE:600105)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Etern Company Limited operates in the communication cable industry with a market capitalization of CN¥8.83 billion.

Operations: The company generates revenue primarily from its involvement in the communication cable industry. With a market capitalization of CN¥8.83 billion, it focuses on producing and selling various types of cables, contributing significantly to its financial performance.

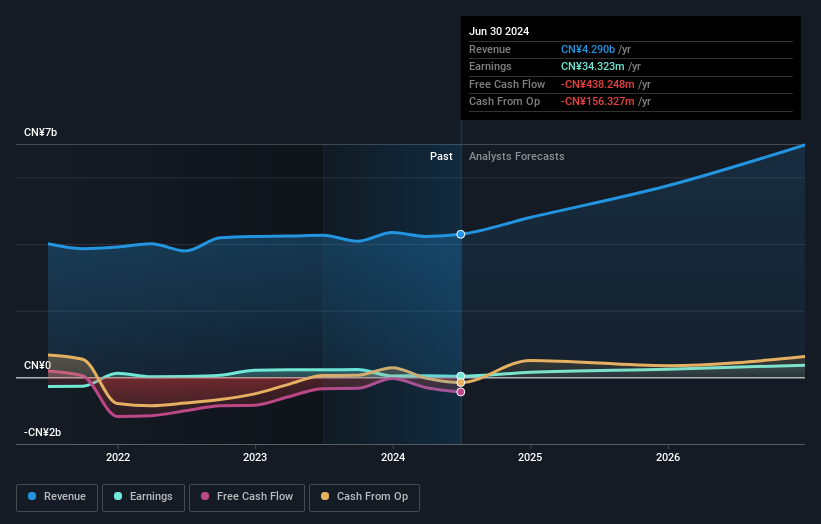

Jiangsu Etern, navigating through the competitive tech landscape in Asia, showcases a robust trajectory with an anticipated revenue surge at 20.5% annually. Despite facing a challenging past year with earnings contracting by 93.8%, the company is poised for a significant rebound, with earnings expected to climb by 71.7% per year. This turnaround is partly fueled by strategic R&D investments, which are critical as they align with industry demands for innovative solutions in communications technology. Moreover, Jiangsu Etern's recent financials were impacted by a one-off gain of CN¥31.6M, underscoring the need to scrutinize underlying performance metrics closely. As it stands against industry averages and market expectations, the firm’s future prospects hinge on maintaining this aggressive growth momentum while enhancing its profit margins from last year's low of 0.3%.

- Unlock comprehensive insights into our analysis of Jiangsu Etern stock in this health report.

Evaluate Jiangsu Etern's historical performance by accessing our past performance report.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health informatization industry in China with a market capitalization of CN¥10.63 billion.

Operations: The company focuses on providing software and services for the medical and health informatization sector in China.

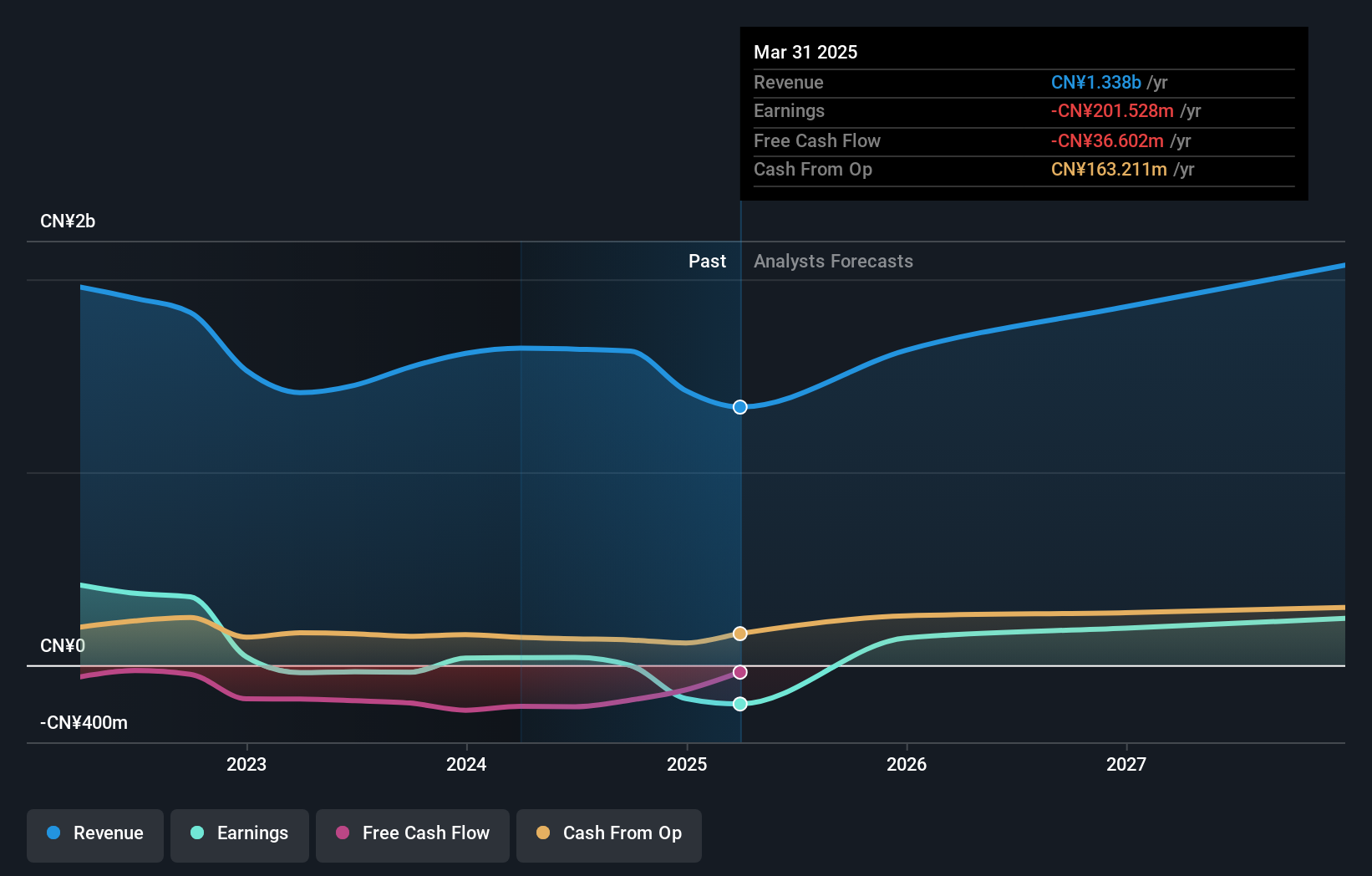

B-SOFTLtd, amidst the vibrant tech scene in Asia, is demonstrating notable growth with a projected annual revenue increase of 16.5%. This figure positions it slightly above the CN market average growth of 13.2%. The company's earnings are also expected to rise impressively by 66.6% annually, signaling strong future profitability. Particularly compelling is B-SOFTLtd's commitment to innovation as evidenced by its R&D expenditures, crucial for maintaining competitive edge in the rapidly evolving software sector. While currently unprofitable, these strategic investments are set to propel B-SOFTLtd into profitability within three years, aligning with broader market expectations for substantial profit growth across the industry.

- Click here and access our complete health analysis report to understand the dynamics of B-SOFTLtd.

Understand B-SOFTLtd's track record by examining our Past report.

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Acrobiosystems Co., Ltd. specializes in developing and manufacturing recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies as well as scientific research institutions, with a market cap of CN¥6.83 billion.

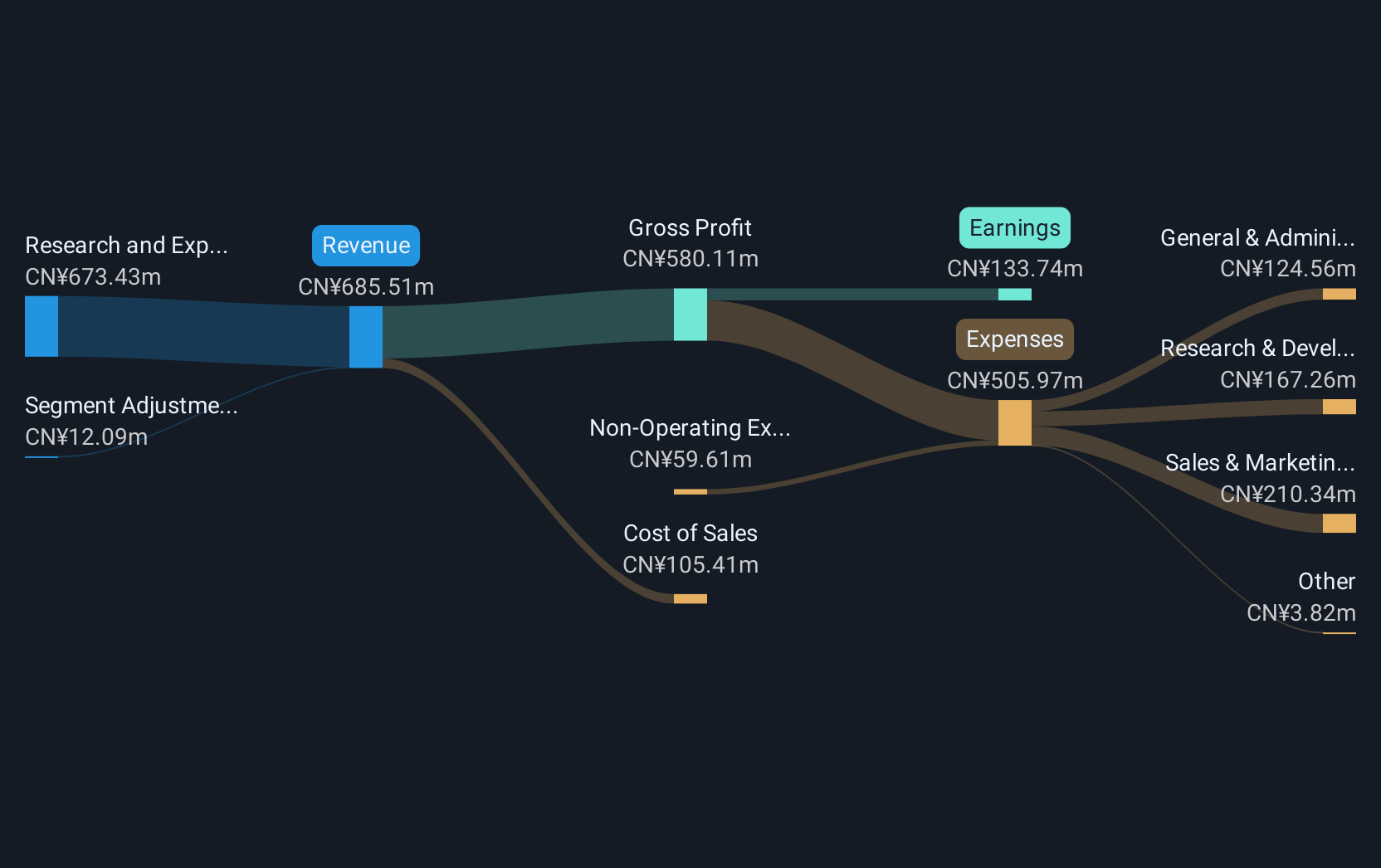

Operations: Acrobiosystems Co., Ltd. generates revenue primarily from its research and experimental development segment, which accounts for CN¥583.70 million.

AcrobiosystemsLtd, amid Asia's dynamic tech landscape, is poised for robust growth with its revenue expected to climb by 18.9% annually, outpacing the CN market average of 13.2%. This surge is bolstered by a significant projected annual earnings increase of 29.5%, reflecting strong operational efficiency and market positioning. The company has also demonstrated a commitment to shareholder value through recent activities including a consistent dividend payout and strategic share repurchases totaling CNY 6 million. Despite challenges like a dip in profit margins from 31.1% to 18.3%, Acrobiosystems continues to invest in future growth, evident from its R&D focus which remains integral to sustaining its competitive edge in the high-stakes biotech sector.

- Click here to discover the nuances of AcrobiosystemsLtd with our detailed analytical health report.

Gain insights into AcrobiosystemsLtd's past trends and performance with our Past report.

Next Steps

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 518 more companies for you to explore.Click here to unveil our expertly curated list of 521 Asian High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600105

High growth potential slight.