- China

- /

- Life Sciences

- /

- SZSE:300813

Zhejiang Tailin BioEngineering Co.,Ltd's (SZSE:300813) Shares Climb 32% But Its Business Is Yet to Catch Up

Zhejiang Tailin BioEngineering Co.,Ltd (SZSE:300813) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 50% over that time.

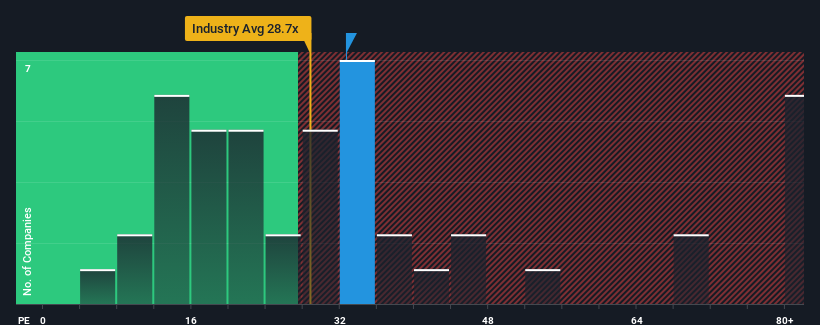

Even after such a large jump in price, it's still not a stretch to say that Zhejiang Tailin BioEngineeringLtd's price-to-earnings (or "P/E") ratio of 32.7x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

As an illustration, earnings have deteriorated at Zhejiang Tailin BioEngineeringLtd over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Zhejiang Tailin BioEngineeringLtd

Is There Some Growth For Zhejiang Tailin BioEngineeringLtd?

There's an inherent assumption that a company should be matching the market for P/E ratios like Zhejiang Tailin BioEngineeringLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 17% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 41% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Zhejiang Tailin BioEngineeringLtd is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Zhejiang Tailin BioEngineeringLtd's P/E

Zhejiang Tailin BioEngineeringLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Zhejiang Tailin BioEngineeringLtd currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Zhejiang Tailin BioEngineeringLtd.

Of course, you might also be able to find a better stock than Zhejiang Tailin BioEngineeringLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Tailin BioEngineeringLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300813

Zhejiang Tailin BioEngineeringLtd

Offers life science system solutions in China.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives