Earnings Tell The Story For CSPC Innovation Pharmaceutical Co., Ltd. (SZSE:300765) As Its Stock Soars 27%

The CSPC Innovation Pharmaceutical Co., Ltd. (SZSE:300765) share price has done very well over the last month, posting an excellent gain of 27%. The last 30 days bring the annual gain to a very sharp 90%.

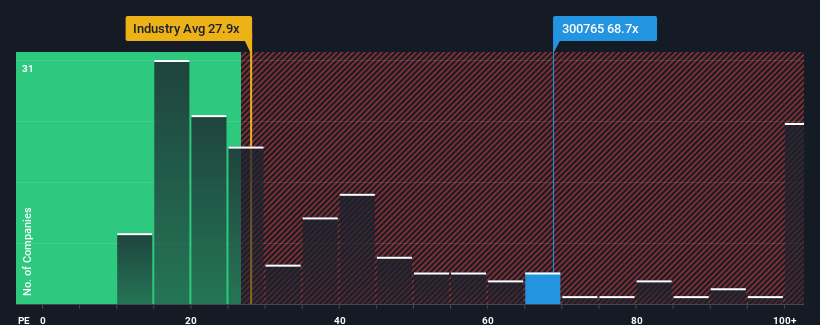

Since its price has surged higher, CSPC Innovation Pharmaceutical's price-to-earnings (or "P/E") ratio of 68.7x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

The recently shrinking earnings for CSPC Innovation Pharmaceutical have been in line with the market. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for CSPC Innovation Pharmaceutical

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like CSPC Innovation Pharmaceutical's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. However, a few strong years before that means that it was still able to grow EPS by an impressive 87% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 30% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

In light of this, it's understandable that CSPC Innovation Pharmaceutical's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From CSPC Innovation Pharmaceutical's P/E?

Shares in CSPC Innovation Pharmaceutical have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that CSPC Innovation Pharmaceutical maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with CSPC Innovation Pharmaceutical (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300765

CSPC Innovation Pharmaceutical

Engages in the research and development, production, and sales of biopharmaceuticals, APIs, and functional foods in China and internationally.

High growth potential with mediocre balance sheet.