CSPC Innovation Pharmaceutical Co., Ltd.'s (SZSE:300765) 27% Share Price Plunge Could Signal Some Risk

The CSPC Innovation Pharmaceutical Co., Ltd. (SZSE:300765) share price has fared very poorly over the last month, falling by a substantial 27%. The good news is that in the last year, the stock has shone bright like a diamond, gaining 120%.

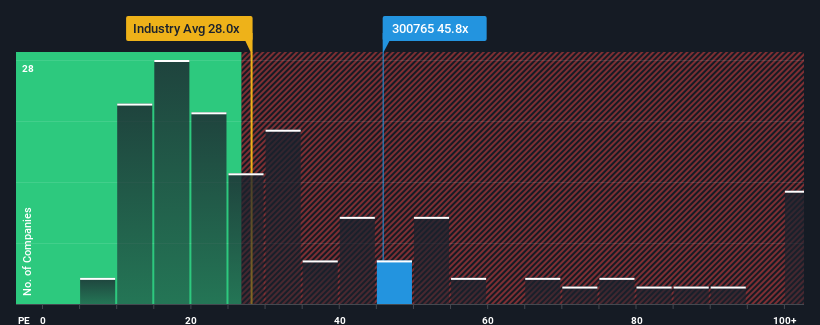

Even after such a large drop in price, CSPC Innovation Pharmaceutical's price-to-earnings (or "P/E") ratio of 45.8x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 28x and even P/E's below 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

CSPC Innovation Pharmaceutical hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for CSPC Innovation Pharmaceutical

Is There Enough Growth For CSPC Innovation Pharmaceutical?

In order to justify its P/E ratio, CSPC Innovation Pharmaceutical would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 7.3% decrease to the company's bottom line. Even so, admirably EPS has lifted 90% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 23% per annum as estimated by the four analysts watching the company. With the market predicted to deliver 25% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that CSPC Innovation Pharmaceutical is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On CSPC Innovation Pharmaceutical's P/E

Even after such a strong price drop, CSPC Innovation Pharmaceutical's P/E still exceeds the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of CSPC Innovation Pharmaceutical's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware CSPC Innovation Pharmaceutical is showing 2 warning signs in our investment analysis, and 1 of those is concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300765

CSPC Innovation Pharmaceutical

Engages in the research and development, production, and sales of biopharmaceuticals, APIs, and functional foods in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives